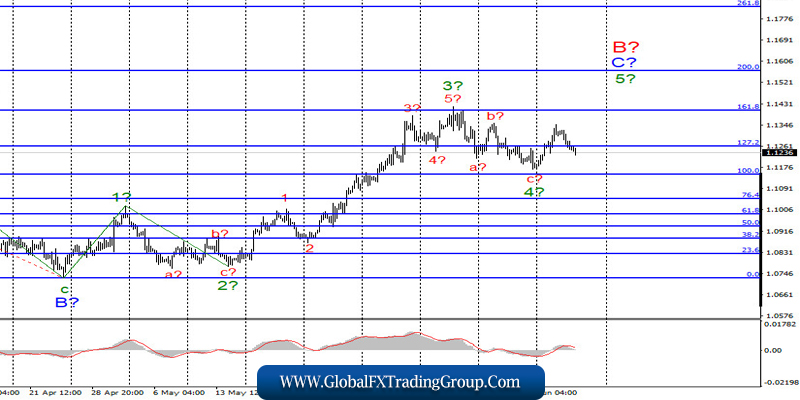

EUR / USD

On June 24, the EUR/USD pair lost about 55 basis points and thus started building a new downward wave. However, this wave can belong to the wave 4 in C in B or be the second, corrective in the composition of the wave 5 in C in B. Thus, we can say that the current wave markup is a bit confusing. I’m currently leaning towards the option of building waves 5 to C to B. Thus, I expect a new increase in quotes of the instrument in the near future.

Fundamental component:

There were no interesting economic reports in the European Union and the US on Wednesday. But recently, more and more experts are paying attention to the growing numbers of new cases of coronavirus. This primarily concerns America, where everything is quarantined, from the president, who demonstratively does not want to wear a mask, to ordinary Americans who, instead of staying at home, have been organizing mass protests and rallies for more than a month, often accompanied by riots and others illegal actions.

Of course, there are those Americans who protect their health, but even if they are 50 percent of the total, this will not allow them to contain the second wave of the pandemic. There is a high number of new infections in America. The numbers are almost at their peak. However, I am sure that even if the numbers are higher than March and April, there will be no second “lockdown”.

At least not with Donald Trump. Trump is focusing on the elections, so he will do everything possible to restore the economy and increase his popularity among voters. Moreover, closing the economy now for the second time will mean a new collapse of economic indicators. Then, for sure, tTump’s support in the election will be not enough. The same applies to Europe.

The European Union cannot accept a new package of assistance to the economy, which is called the recovery Fund. The second “lockdown” in such conditions is the “final nail in the coffin lid.” In addition, do not forget that all countries are constantly fighting on the world stage for leadership, power, influence and market share. Therefore, no one can afford to sit in quarantine while the neighbor is actively trading and active, despite the pandemic.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located near the calculated levels of 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each signal “up” MACD. An unsuccessful attempt to break through any target level may mean the completion of the entire wave C in B.

GBP / USD

On June 24, the GBP/USD pair lost about 100 basis points and, therefore, cast doubt on the further increase in quotes within the wave 5 in 3 or C. the The current wave markup has not yet been violated, but the expected wave 4 may become more complicated, and with it the entire wave markup. At the same time, I don’t see any reason to panic yet. The descending wave can end today, after which the extended wave 5 in 3 or C will begin to build.

Fundamental component:

There was no interesting news and events in the UK on Wednesday, as in the EU, as in the USA. Today, markets will actively monitor statistics from America, where several important economic reports will be released at once. I recommend paying the most attention to GDP for the first quarter, however, the report on orders for durable goods is also considered important. Weak data from America may reduce demand for the US currency, which will lead to the resumption of growth of both instruments in accordance with their wave markings.

General conclusions and recommendations:

The pound/dollar pair supposedly continues to build the rising wave 3 or C. Thus, the purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend buying the pound for each MACD signal “up”, calculated on the construction of a rising wave 5 to 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom