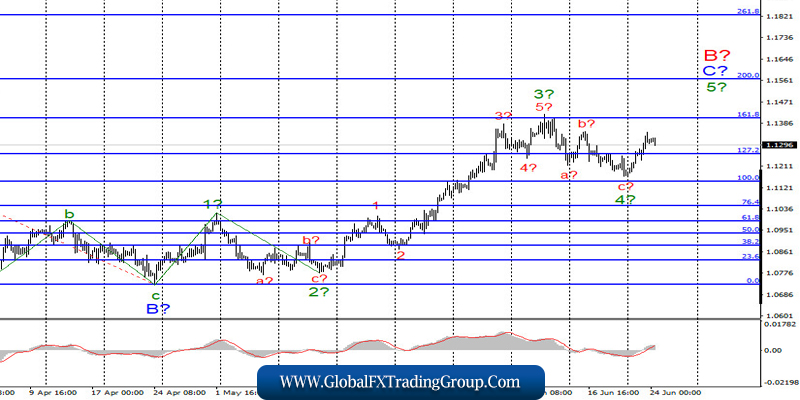

EUR / USD

On June 23, the EUR / USD pair gained about 50 bps and thus continued construction supposed wave 5 to C to B. If this is true, then the increase in prices will continue with the targets located around the level of 161.8% and 200.0% Fibonacci within wave 5 in C in B. Near one of these levels, the whole wave B may end, and the instrument may begin to build a new long-term downward trend section.

Fundamental component:

On Tuesday, several interesting economic reports were published in America and the European Union at once, which could hypothetically increase the demand for any of the currencies. The indices of business activity, one might say, quite unexpectedly, increased significantly compared to May. However, these growths were only recorded in Germany, the European Union, France, and the USA. Thus, according to the logic of things, the euro and the pound should not have risen yesterday, as US indices were no worse than European ones.

However, it was the pound and the euro that was growing again. I believe that recently the coronavirus has again come to the fore. Many experts believe that the second wave of the pandemic will happen very soon after some countries lifted their lockdowns as well as quarantine measures, and weakened preventive measures. The most dangerous thing in this situation is that countries may no longer consider repeated “lockdowns” after having realized that strict quarantine kills the economy very quickly, which may take years to restore.

Meanwhile, countries less affected by the pandemic can go far ahead in the perpetual race for leadership. Thus even if the coronavirus outbreak repeats, this is unlikely to become the basis for new quarantines and “lockdowns”. And if there are no strict restrictions, people will continue to become infected and die, which again will negatively affect the economy of any country. So far, the greatest fears are for America, where not only quarantine is weakened, but also mass rallies and protests are taking place, as well as Trump’s election campaign.

General conclusions and recommendations:

The EUR / USD pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located near the calculated marks 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each upward signal of the MACD indicator. An unsuccessful attempt to break through any target mark may mean the completion of the entire wave C in B.

GBP / USD

On June 23, the GBP / USD pair gained another 50 basis points. Thus, at the moment, wave 4 in 3 or C is considered complete. If this is true, then the increase in tool quotes will continue with the objectives located at least about 29 figures within wave 5 to 3 or C. If the decline in quotes resumes and the low of wave 4 is updated, then all wave marking will require corrections and additions.

Fundamental component:

In the UK, business activity indices in the manufacturing sector (50.1) and in the services sector (47) for June also came out on Tuesday. It should be noted that business activity in the manufacturing sector went above 50.0, thus, production in Britain began to grow. But today no news and reports are expected from either the UK or the United States. Thus, market activity may decline.

General conclusions and recommendations:

The GBP/USD instrument supposedly continues to build the rising wave 3 or C. Thus, the purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend buying the pound sterling for each upward signal of the MACD indicator, calculated on the construction of a rising wave 5 to 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom