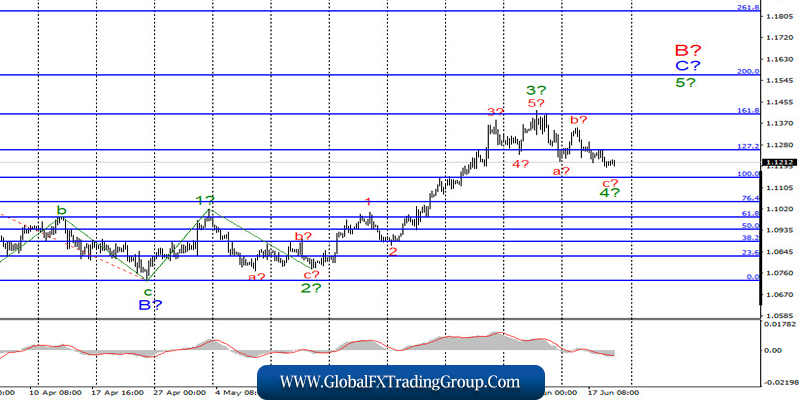

EUR / USD

On June 18, the EUR / USD pair lost about 40 basis points and, thus, continued construction of a prospective wave C 4 to C in B. If this is true, then the decline in quotes will continue with targets located near the level of 100.0% Fibonacci. An unsuccessful attempt to break through this mark will indicate the end of the wave. After completion of wave 4 in C in B, I anticipate the resumption increasing tool quotes with targets located above the level of 161.8% Fibonacci, within wave 5 to C to B.

Fundamental component:

On Thursday, nothing significantly interesting took place in the US and the European Union. However, in general, there are several interesting events that deserve the attention of the markets. The most important event is the EU summit, which is being held today as part of a videoconference, which will discuss budget issues for 2021–2027.

However, it is not the budget itself that interests the markets, but the plan of the European Commission to restore the European economy. Today, the head of the European Parliament, David Sassoli, said that the plan of Ursula von der Leyen is good and can be the starting point for further negotiations. Mr. Sassoli expressed hope that the heads of state of the EU will support the anti-crisis recovery plan. Ursula von der Leyen herself expressed a similar opinion.

However, there are no official results of the summit, It is hard to tell, what will be the likelihood that the northern countries namely, Denmark, Sweden, Austria, and the Netherlands will agree with the proposal of the European Commission. But if they agree, then this will be a breakthrough in the negotiations, and the demand for euro can grow significantly.

I must also note that the situation in the US now remains unstable and dangerous. Rallies and protests continue, and former presidential adviser John Bolton wrote a book in which he reveals many aspects of Donald Trump’s work and exposes it in clearly not the best light. Thus, new political proceedings may begin, and another shadow may be cast on Trump, which may prevent him from winning the presidential election at the end of this year.

General conclusions and recommendations:

The EUR / USD pair is supposedly continuing to build the rising wave C to B. Therefore, I recommend buying the instrument with targets located near the calculated marks 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for a new upward signal from the MACD indicator, which can announce the completion of construction of a wave 4 in C in B.

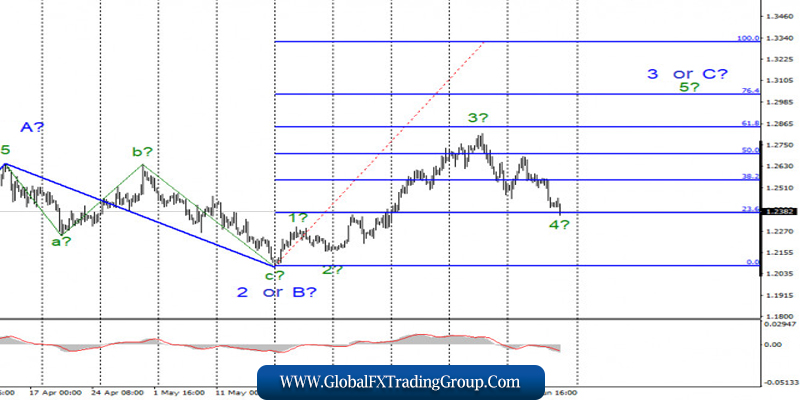

GBP / USD

On June 18, the GBP/USD pair lost another 140 basis points. Thus, at the moment, wave 3 or C complicates its internal structure and continues its construction. If the current wave marking is correct, then the increase in the quotes will resume after the completion of the construction of wave 4 with targets located above the 29th figure. An unsuccessful attempt to break through the 23.6% Fibonacci level will indicate the possible completion of the construction of wave 4 .

Fundamental component:

On Thursday, the UK released the results of the meeting of the Bank of England. The key refinancing rate remained unchanged at 0.1%, and the asset repurchase program was expanded by £ 100 billion. The pound sterling continued to decline along with the greenback because of this news. Also, today its position was further aggravated as markets have further reduced demand for it. Even a retail report in Britain did not help, according to which the decline in May was -13.1%, although markets expected -17.1%.

General conclusions and recommendations:

The GBP/USD tool supposedly continues to build a rising wave. Thus, purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend buying the pound sterling for each upward signal from the MACD indicator, especially in the case of an unsuccessful attempt to break the 1.2372 mark. Otherwise, the entire wave pattern may require adjustments and additions.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom