EUR / USD

On June 15, the EUR / USD pair gained about 70 bps, and thus, started the construction of the intended wavelength to b 4 to C to B. If so, then lowering the tool quotes resumes with the goals, levels arranged approximately 100.0% and 76.4% Fibonacci within wave with a 4 to C to B. The structure of an upward trend still uncertain, thus after the completion of construction of correctional wave I expect the construction of wave 5 to C to B.

Fundamental component:

On Monday, there were practically no economic reports and news in the European Union and America. The news background remains moderate and does not change in recent days. Donald Trump, who considers himself knowledgeable in the economy, recently questioned the Fed’s forecasts for inflation, unemployment, and GDP. Trump said, “He also sees numbers, but much more optimistic, and the Fed too often makes mistakes.” This statement, however, does not help the restoration of demand on the US dollar.

Meanwhile, there are few reasons for excessive optimism in the European Union. Last month, Angela Merkel, Emmanuel Macron, and other EU politicians proposed various options for creating the Recovery Fund, where the money will be distributed on the terms of grants and interest-free loans to all the most affected EU countries. However, over the past few months, 27 countries have failed to agree on where to get this money as well as its distribution.

Amidst all these, the statistics of the European Union and the USA continue to fall, and it cannot be said that some of the countries feel better after the crisis. In addition to this, is the issue between China and Hong Kong. It should be noted that not only the United States took up arms against Beijing because of the possible adoption of the law “on national security”, which, in fact, will put an end to the autonomy of Hong Kong. The European Union, Great Britain, Canada, and Australia also opposed the violation of the rights of Hong Kongers and the autonomy of the district by the Chinese authorities.

General conclusions and recommendations:

The EUR / USD pair is supposedly continuing to build the upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated marks 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each new upward signal from the MACD indicator. At this time, the instrument is at the stage of constructing the correctional wave 4 in C to B, so the instrument may decline for some time.

GBP / USD

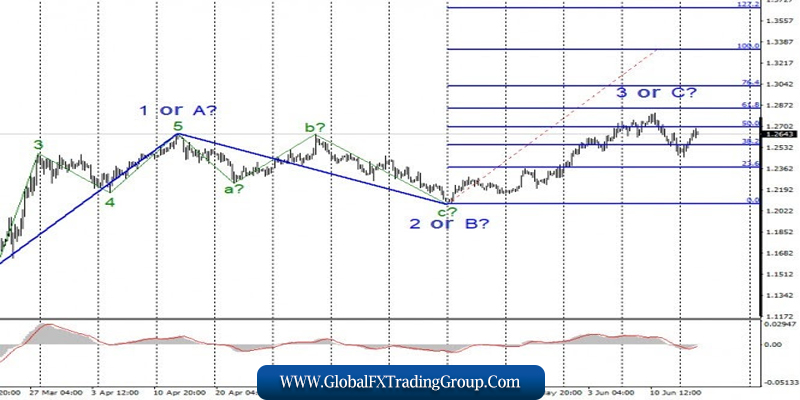

On June 15, the GBP / USD pair gained about 65 base points. Thus, at the current moment, the construction of the internal correctional wave of 3 or C is supposedly completed. If this is true, then the quotes of the instrument will continue to increase with targets above the 28th figure. At the same time, the news background may begin to put pressure on the British and cause a drop in demand for this currency, which may lead to the completion of the construction of the upward trend.

Fundamental component:

In the UK, no important information was released on Monday. However, earlier today, they released data on the unemployment rate for April which is about 3.9%, the number of applications for unemployment benefits for May with 528 thousand, and the change in average wages of 1%. It is worth noting that all reports, except unemployment, turned out to be significantly worse than expected.

However, the markets seemed unbothered by this data as the sales of the pound sterling turned out quite contrary. There was also information from Boris Johnson that London and Brussels could sign a deal as early as next month, but no specific information was received on this subject.

General conclusions and recommendations:

The GBP/USD tool continues to build an upward trend. Thus, purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend continuing to buy the pound sterling for each upward signal from the MACD indicator. At the same time be on the lookout, as the instrument may unexpectedly complete the construction of the upward trend section.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom