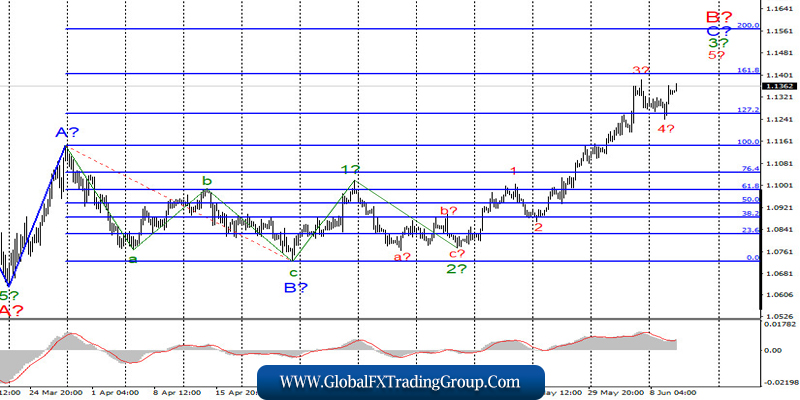

EUR / USD

On June 9, the EUR/USD pair gained about 50 basis points and thus resumed the construction of the upward trend section. This morning, about 30 more points were scored. Thus, the proposed wave 4 in 3 in C to B completed its construction, and the tool began to build wave 5. If this is true, then the quotes will continue to increase with targets located near the 161.8% and 200.0% Fibonacci levels. On the contrary, an unsuccessful attempt to break any of these markers will lead to the eventual completion of construction of a wave 3 in C in B.

Fundamental component:

On Tuesday there was extremely little economic information in the European Union and America again. A report on EU GDP for the first quarter was released, which turned out to be even slightly more optimistic than expected, but the markets did not pay much attention to this event. But recently, the issue of the COVID-19 pandemic in countries such as Russia, the UK, Brazil, and the United States has recently begun to sharply reoccur.

Meanwhile, there was no slowdown in the spread of coronavirus in America according to the Johns Hopkins Institute, while European countries, especially Italy, Spain, France and Germany, practically reduced the number of new cases to zero. Accordingly, it is Europe that has an excellent opportunity to begin rebuilding its economy in the near future. But America continues to work in a massive pandemic, which could not be contained by quarantine or social distance.

And the events of the past two weeks (mass rallies, protests related to the murder of George Floyd), which took place and continue to take place in more than 40 cities and states, clearly did not contribute to stopping the spread of the epidemic. Thus, instead of decreasing incidence rates, they can begin to rise in the United States.

The Johns Hopkins Institute predicts that up to 150 thousand people can die from coronavirus complications in the country before August this year. There has been a strong increase in incidence in 14 states of the United States in recent days. Perhaps, this is one of the reasons for the decline of the US currency in recent weeks.

General conclusions and recommendations:

The euro/dollar pair is supposedly continuing to build the upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated levels 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each new signal “up” MACD. At this time, the instrument supposedly completed the construction of correctional wave 4.

GBP / USD

On June 9, the GBP/USD pair gained just a few basis points. Thus, the current wave marking has not suffered any significant changes. Consequently, the proposed wave 3 or C of the upward trend continues its construction with targets located around 61.8% and 76.4% Fibonacci. The whole wave 3 or C can be very long, especially if the pound finds support for the news background.

Fundamental component:

Nothing interesting happens at the start of a new week in the UK. And the picture will hardly change throughout this week. Only on Friday, there will be some really important reports in the UK that cannot be ignored by the markets. Until this day, markets will only analyze news from America, from where the news flow is also not too stormy. However, the Fed will hold a meeting tonight, a press conference of its representatives, providing economic forecasts. Therefore, markets can become more active in the evening.

General conclusions and recommendations:

The pound/dollar pair supposedly continues to build the rising wave. Thus, purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. Meanwhile, a successful attempt to break the level of 1.2698 (50.0% Fibonacci) indicates the readiness of the markets for further purchases.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom