EUR/USD

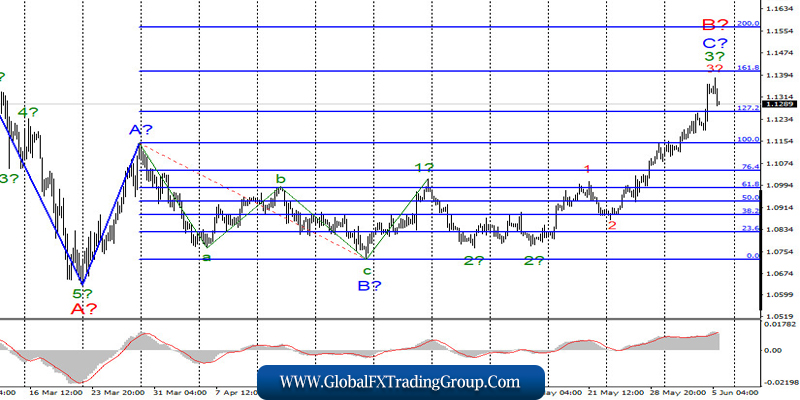

On June 4, the EUR / USD pair gained about 105 bps and thus continued construction supposed wave 3 into 3 to C to B. If this is true, then today’s exit of the quotes from the reached highs may mean the completion of this wave and the transition to the construction of correctional wave 4. Thus, after a fairly long increase in quotes, a rollback from the reached maximums may finally follow. At the same time, the wave marking of the upward trend section does not yet appear to be fully equipped.

Fundamental component:

On Thursday, all markets of the EUR / USD currency pair focused on the results of the ECB meeting. And although there was a fairly large amount of important information, I cannot say that the increase in the instrument was connected precisely with these events. Following the meeting, the European Central Bank expanded its program to counter the economic crisis by 600 billion euros and left key rates unchanged. Christine Lagarde said at a press conference that by the end of 2020, the EU economy will lose about 8.7%. Thus, there was nothing optimistic about the euro yesterday (the report on retail sales in the EU was also weak).

Nevertheless, demand for European currency remained high throughout the day, and at the same time, demand for the pound did not fall. Thus, in general, it is better to conclude that the demand for the US dollar continued to fall, and the outcome of the ECB meeting had nothing to do with it. Today, the picture was about the same. Important reports from the US turned out to be much better than market expectations, but if the euro started to decline, then the pound continued to grow, although, in theory, both pairs should have moved synchronously, as the news was related to both.

The unemployment rate in May quite unexpectedly amounted to 13.3% and decreased compared to April. The data from the Nonfarm showed an additional 2.5 million unemployed, while markets were waiting for a new reduction of 9 million. Given the current state of the US economy, this is great news. Despite this, the US dollar only grew by 30 basis points.

General conclusions and recommendations:

The Euro-Dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated marks of 1.1260 and 1.1406, which equates to 127.2% and 161.8% Fibonacci for each new signal “up” MACD. At this time, the instrument may begin to build correction wave 4.

GBP / USD

On June 4, the GBP / USD pair gained just about 20 base points and about 100 more today, June 5th. Thus, the construction of the upward wave continues, and since the instrument broke the peak of wave b, the chances that wave 2 or B is completed and wave 3 or C continues to be built have increased. If this is true, then after a successful attempt to break through the maximum of wave b, the increase in the quotes will continue with targets located around the 30th figure.

Fundamental component:

In the UK, there was still little to no news for Thursday and Friday. The news and reports in the US have contributed to an even greater increase in demand for the pound and a fall in the dollar, although the reaction could be absolutely the opposite. Even the status on Friday when many take profits, which leads to a pullback, did not help the US dollar. It seems that the markets are seriously concerned about the rallies and protests that swept America and it is not clear when and how these will end.

General conclusions and recommendations:

The Pound / Dollar tool supposedly continues to build a rising wave. However, before a successful attempt to break the 1.2643 mark, I do not recommend buying the pound sterling since a false breakdown is possible. A successful attempt at a breakthrough will show that markets are ready for new purchases as part of building wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom