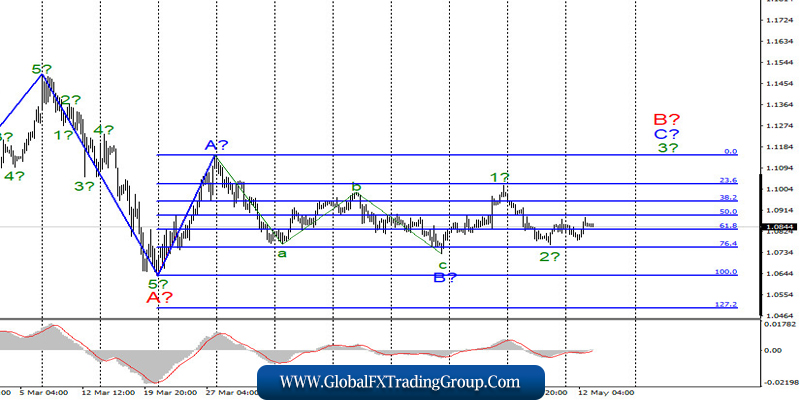

EUR / USD

On May 12, the EUR / USD pair gained about 40 base points, but this was enough for the instrument to begin to move quotes from previously reached lows. Thus, the alleged wave 2 in C in B is still considered complete. If this is true, then the increase in quotes will continue within the framework of wave 3 with targets located about 11 of the figure and above. At the same time, the wave pattern of the instrument may require making adjustments or additions, since the euro quotes are growing very reluctantly.

Fundamental component:

The news on Monday and Tuesday is forcing markets to become wary again, and perhaps even prepare for a new panic. The fact is that the conflict between the US and China over the coronavirus pandemic continues to grow. Let me remind you that Washington immediately makes several complaints to Beijing regarding the spread of the COVID-19 virus around the world.

The White House believes that Beijing deliberately misinformed the whole world about the scale of the pandemic and too late in announcing the new virus in the media as well as in informing the WHO. Moreover, Washington does not exclude the laboratory origin of the virus and its not entirely random release. Thus, Donald Trump believes that China should be punished for its negligence and is preparing a new package of sanctions that could spark a new trade war between the countries.

Yesterday, US Senator Lindsey Graham introduced a bill on liability for COVID-19, which would impose sanctions on China if it does not provide a full report on what happened in a laboratory in Wuhan. The senator believes that China lied and continues to lie to the whole world about the coronavirus. At the same time, it is reported that China itself does not mind terminating the trade deal since we believe that during the crisis caused by the virus, some points of the agreement are not feasible.

America is not going to resume negotiations on a trade agreement and change any of its items to be more favorable to China. Thus, the transaction can be terminated, and new fees and penalties can be introduced by both parties to the dispute.

General conclusions and recommendations:

The Euro-Dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located, as before, at around 1.1148, which equates to Fibonacci 0.0%, or near the peak of wave A. A successful attempt to break through the minimum of wave B will require corrections and additions to the current wave marking.

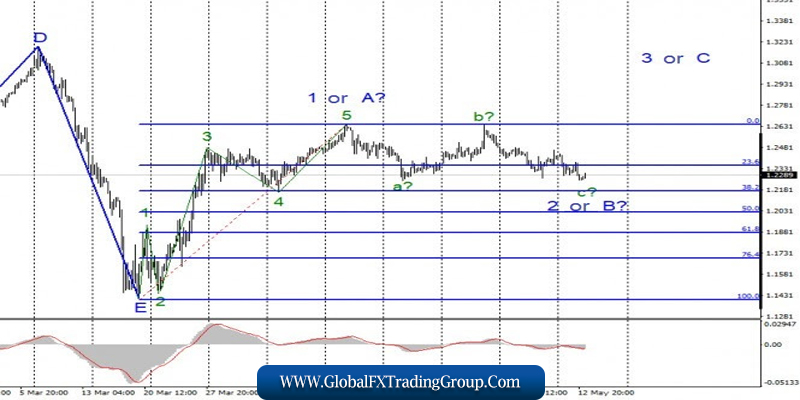

GBP / USD

The GBP / USD pair on May 12 lost another 80 basis points. The MACD indicator did not give a new upward signal yesterday, and the instrument made a successful attempt to break through the previous low. Thus, the alleged wave c in 2 or B resumed its construction with targets located near the 38.2% Fibonacci level. The whole wave 2 or B can take a fairly long horizontal view. However, even in this case, the construction of a rising wave d in its composition is expected.

Fundamental component:

The news background for the GBP / USD pair on May 12 was very weak. However, this morning important data on GDP for the first quarter in the UK has already been released, which inspired a little optimism in buyers of the pound sterling. According to the results of March, GDP fell not as much as the markets expected. Industrial production also turned out to be better than expected.

Thus, in the first half of Wednesday, the pound is even in demand. However, I believe that the market reaction was too weak for such important reports. If the markets have not found the strength to buy the pound on optimistic data, then most likely the decline in the instrument will continue in the near future.

General conclusions and recommendations:

The Pound-Dollar instrument is nearing completion of the construction of the second wave of a new upward trend section. Thus, now I recommend buying the pound with targets located around 26 of the figure, counting on building a wave of 3 or C or d in 2 or B on a new MACD signal “up”. A successful attempt to break the 1.2645 mark will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom