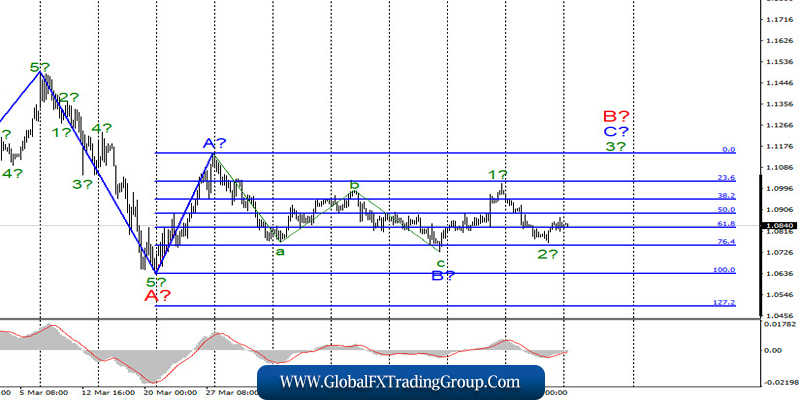

EUR / USD

On May 8, the EUR/USD pair gained several basis points, and the wave pattern remained virtually unchanged. Thus, It is still believed that the alleged wave 2 in B in C has completed its construction. If this is true, then the increase in prices will continue with the targets located near the 11th figure within wave 3 in the B to C. On the other hand, a successful attempt to break through low-wave B will indicate that markets are not ready for further purchases and will complicate the entire wave marking of the instrument.

Fundamental component:

The news background for the EUR/USD pair on Friday was reduced to several reports from the United States, each of them was important in its own way and allowed us to draw certain conclusions. First, the number of workers in the US non-agricultural sector fell by 20.5 million in April. This figure is huge, but the number of applications for unemployment benefits and the ADP report are about the same.

Thus, the collapse of the US currency on these data was not followed. The overall unemployment rate rose in April to 14.7%, which in general also did not disappoint the markets too much. In addition, the level of wages unexpectedly pleased the markets, since it showed an increase of 7.9%. Thus, the news package from the USA was “black”, but with positive notes, albeit small. Mostly, these reports enabled analysts and markets to start wondering again – how long will the recession of the American economy continue and what will be its recovery?

Most experts agree that the recovery will be either “U” -shaped or “V” -shaped. These two options differ from each other only in the period of stagnation. In the first version, it will be long, while very short in the second one. However, at the moment, it cannot be concluded that the recession is complete, which means that the US economy has not yet reached its bottom.

The best indicator for tracking the downward trend in the US economy is the labor market and unemployment. In recent weeks, the number of new applications for unemployment benefits has been declining, although the numbers themselves are still enormous. However, if the quarantine in America begins to ease in may and there is no second wave of the epidemic, the rate of decline in the economy will begin to slow down and, perhaps, in June, it will reach its bottom.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C to B. Thus, I recommend buying the instrument with targets located, as before, around the level of 1.1148, which equates to Fibonacci 0.0%, or the peak of wave A. Moreover, a successful attempt to break through the minimum of wave B will require corrections and additions to the current wave marking.

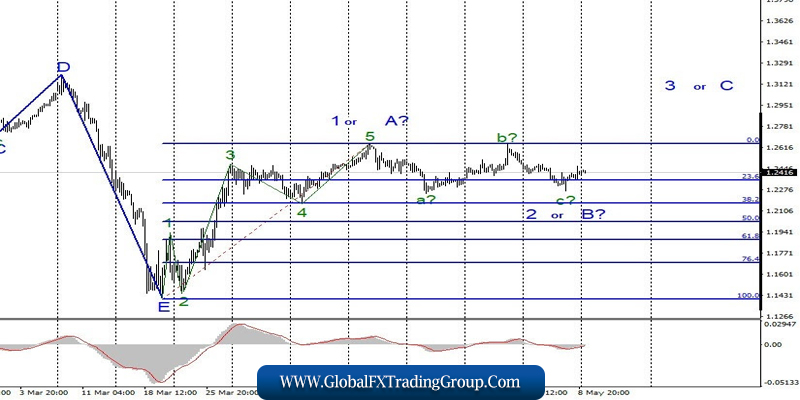

GBP / USD

On May 8, GBP/USD pair added about 45 basis points. The assumed wave C in 2 or B is completed and, if this is true, then the current positions will resume raising quotes with goals located above the peak of wave 1 or A within wave 3 or C. At the same time, wave 2 or b can take a more complex and extended form. Thus, it will be possible to conclude that the markets are ready for new purchases of the British currency only after a successful attempt to break through the peak of wave 1 or A.

Fundamental component:

The news background for the GBP / USD pair on May 8 was weak. There have been no news or economic reports from the UK except during the weekend, wherein Prime Minister Boris Johnson announced a plan according to which the country will start lifting quarantine from May 13. Despite the fact that the number of diseases in the UK continues to grow at a steady pace.

Moreover, Boris Johnson will allow traveling inside the country and going outside an unlimited number of times a day starting from May 13. He also allowed the British to sunbathe and travel to various places. In addition, employees who cannot perform their work remotely can return to work.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with goals located around the 26th figure, calculated on the construction of wave 3 or C or d in 2 or B. On the other hand, a successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom