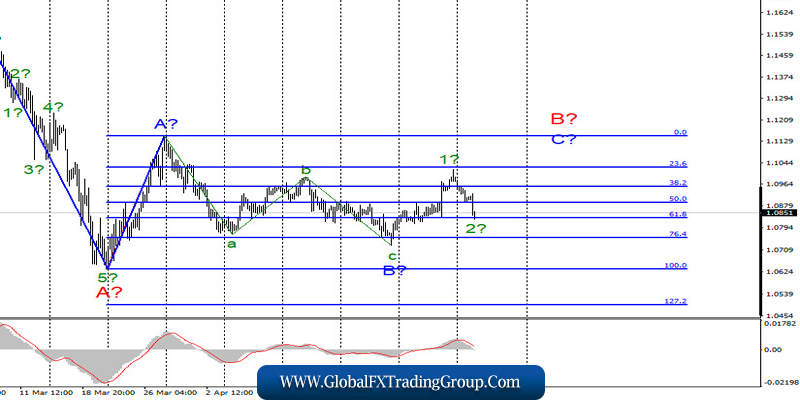

EUR / USD

On May 4, the EUR/USD pair lost about 65 basis points and, thus, began to build a new downward wave. It underwent certain changes since such a development of events did not fit into the previous wave marking. There is no pronounced trend at the moment, so I believe that the instrument is moving using three wave structures. Thus, the instrument is currently in the stage of building an ascending set of waves within the framework of the correction wave B. If this is true, then the wave C in B will take a 5-wave form, which means that the pair will resume increasing from the current levels of the quotes.

Fundamental component:

The news background for the EUR/USD pair on Monday was weak again. There were just a few reports on business activity in the manufacturing sectors of the eurozone countries, as well as a report on manufacturing orders in the United States. All these data turned out to be worse than market expectations, which is absolutely normal for current times. Today, a little later, data on business activity in the service sector will be released in the United States, from which markets also do not expect any positivity.

A much more interesting topic for any instrument and the entire currency market in general is the topic of a possible conflict between America and China. Many experts believe that the increase in dollar quotes in recent days is connected with this, since the demand for risky assets is reduced. Maybe it is so. Although I believe that this topic is of greater importance in the context of the future actions of Beijing and Washington.

If the governments of these countries start a new trade conflict at the time of the pandemic, which is exactly what everything is going to be, if Washington finds evidence of guilt and concealment of information by Beijing, this could cause another blow to the world economy and the economies of the United States and China. This will not change anything even if both parties wait for the pandemic around the world to complete and only then begin to sort things out.

Namely, everything goes to the conflict. Otherwise, it would be unlikely that Donald Trump would speak day after day about the investigation of the US special services regarding the actions of China at the very beginning of the pandemic. It is unlikely that the American president is going to simply threaten China. At the same time, US Treasury Secretary Stephen Mnuchin assured that there was no question of any break in the previous agreement with China. If China adheres to the terms of the deal, then no problems should arise.

General conclusions and recommendations:

The euro/dollar pair is supposedly continuing the upward wave. Thus, I recommend buying an instrument with targets located, as before, at around 1.1148, which equates to 0.0% Fibonacci, or the peak of wave A. A successful attempt to break through the minimum of wave B will lead to the need for additional adjustments to be made current wave counting.

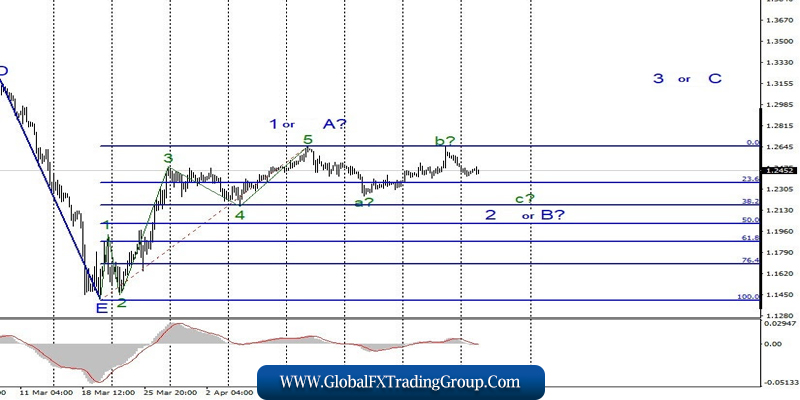

GBP / USD

On May 4, the GBP/USD pair lost 50 basis points and thus, continued to build the expected wave C in 2 or B as part of the upward trend section. The decline in quotes may continue with targets located near the minimum of wave a at 2 or B or slightly lower. After which, I expect the resumption of the increase in quotes within the framework of wave 3 or C with targets above 26th figure. At the same time, all wave marking can take a more complex form before a successful attempt to break through the 0.0% Fibonacci level.

Fundamental component:

There was no news background for the GBP / USD pair on May 4. Today, there are reports on business activity in the service sector and composite PMI in the UK. Ironically, both reports turned out to be better than expected values. Nevertheless, the first was 13.4 points, and the second 13.8. It can be recalled that growth in the industry is observed with a value of business activity above 50 and values below 40 are considered absolutely negative. During today, the demand for both instrument currencies remains flat, without sharp changes.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with targets located around 22 and 21 figures in the calculation of building a corrective wave 2 or B. After the completion of this wave, I recommend buying this instrument with goals located above the 26th figure in the calculation of building a wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom