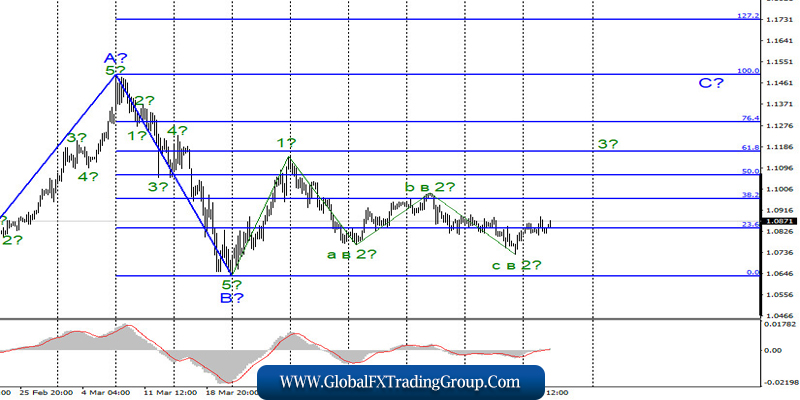

EUR / USD

On April 28, the EUR/USD pair lost only a few basis points. Thus, a small change had no impact on the current wave counting, involving the construction of a new upward wave 3 in C. If the current wave marking is correct, then the increase in quotes will continue with targets located near the 11the figure above. On the other hand, a successful attempt to break through the minimum wave C in 2 points will indicate that the markets are not ready to further purchase the instrument and will require adjustments and additions.

Fundamental component:

There was no news background again for the EUR/USD pair on Tuesday. Markets discuss upcoming events at the beginning of the new week, such as reports on GDP in the eurozone and America, as well as meetings of the ECB and the Fed. The opinions of markets vary. Some believe that the meetings of the central banks of the eurozone and the United States will be “passing” and no new information will come from them.

They also believe that Central banks will not make any important decisions and change the parameters of monetary policies, while others believe that the Fed and the ECB will provide information on periods of economic recovery, as well as further incentives, which are also very important aspects. In addition, the markets are now clearly depressed by the forecasts for GDP for the first and second quarter in the United States. According to official forecasts, we should expect a decline of 4-5% in the first quarter. In the second quarter, the US economy may fall by another 25-35%. And it can only show recovery in the third and fourth quarter.

But only if quarantine will be lifted in the coming months, as well as in the absence of new outbreaks of the pandemic. Nevertheless, there is still a bit of good news. Both the US and the EU countries are preparing to weaken quarantine measures and announce the passage of “peaks” of the disease, however, new patients continue to be identified and admitted to hospitals, which does not allow declaring victory over the COVID-2019 pandemic. There is also little news from doctors now.

Most of them oppose the lifting of quarantine measures and continue to claim that the vaccine should be expected no earlier than the fall of 2020, when, according to the same doctors, the second wave of the pandemic is quite possible.

General conclusions and recommendations:

The euro/dollar pair has supposedly begun to build the rising wave 3 in C. Thus, I now recommend buying the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. I also recommend placing Stop Loss protective orders below the wave minimum at 2.

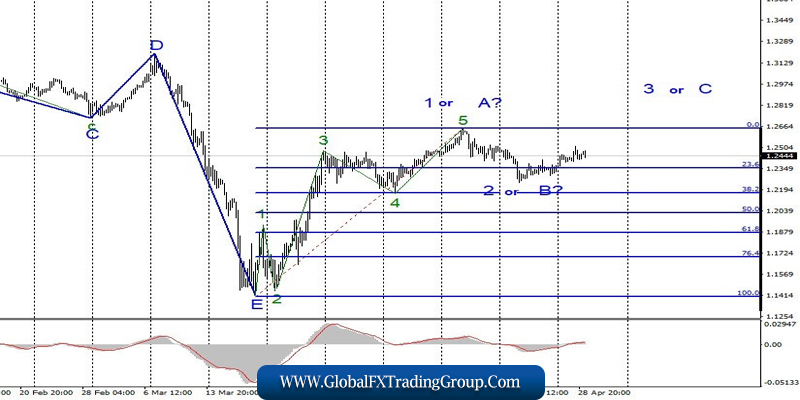

GBP / USD

On April 28, the GBP/USD pair gained several basis points, so the wave markings did not suffer any changes. The estimated wave 2 or B can still take on a three-wave form, but at the same time it may already be completed. This is the main difficulty of the current markup. The signal of the MACD indicator “down” can indicate that a new descending wave consisting of 2 or B. On the other hand, a successful attempt to break the maximum of wave 1 or A will indicate the readiness of the markets to further increase the instrument.

Fundamental component:

There was no news background for the GBP/USD pair on April 28, either. But there will be some news in the UK today. Markets will be forced to focus on the same information from America, so the movements of the euro/dollar and pound/dollar instruments may be similar.

Unlike his American counterpart Donald Trump, Boris Johnson is not in a rush to lift quarantine in the UK and warns residents that quitting quarantine too quickly can cause a second outbreak of coronavirus. According to the British Prime Minister, the priority now is to consolidate the success of countering the pandemic from isolation.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with targets located around 22 and 21 figures, based on the construction of correction wave 2 or B on the new MACD signal down, or waiting for the completion of this wave, then buy at the beginning of upward wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom