EUR/USD

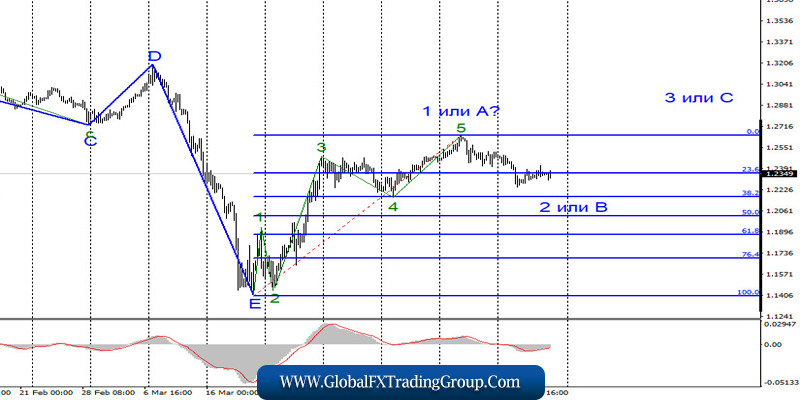

On April 23, the EUR/USD pair lost about 50 basis points. Today, it continues to form the complex wave 2 which later takes the form of three waves. If this assumption is correct, the quotes are expected to rise in the near future with the target at 11th figure within the wave 3. However, the reluctance of the market to start buying the euro is a little alarming. In case new background emerges or a new wave of panic hits the market, we will need to make some adjustments to the current wave pattern.

Fundamental factors:

The news background for the EUR/USD pair is quite controversial today. Yesterday, during the EU summit, its participants failed to reach an agreement on a new stimulus package aimed at supporting the economy. Thus, the demand for the European currency declined slightly in early Friday. But in general, the euro was not hit hard by this news. Now the markets are waiting for an important report on durable goods orders in the US which is likely to be rather disappointing.

Markets may have lowered the demand for the American currency, anticipating the weak statistics. Reports on business activity in the services and production sectors in the EU and the US were also released yesterday. The reports were pessimistic and failed to provide any support both to the dollar and the euro. Another report on initial jobless claims was issued in the US showing that 4.4 million people applied for the unemployment benefits. According to the wave analysis, the euro/dollar pair is expected to rise in the short term.

Besides, the greenback’s rally is unlikely to continue amid the current background. The situation with the coronavirus in the EU and the US does not show any signs of improvement. Despite some statements that the epidemic is slowing down and the quarantine measures are eased, the overall number of cases and deaths from the pandemic continues to rise.

Conclusion and recommendations:

The euro/dollar pair continues to form the estimated upward wave C. Thus, now I recommend buying the instrument with a MACD buy signal with the targets at the levels of 1.1165 and 1.1295 which correspond to the 61.8% and 76.4% Fibonacci levels. I recommend placing Stop Loss orders under the low of the wave 2. The wave 2 has already formed its complex internal structure.

GBP/USD

On April 23, the GBP/USD pair gained just a few basis points. According to the current wave marking, the formation of the wave 2 or B continues with the targets at the 38.2% and 50.0% Fibonacci levels. This wave can take a distinguished three-wave form. After this pattern is completed, I expect the quotes to resume growth within the framework of wave 3 or C of the upward trend section. So far, there are no signs that the formation of the wave will be completed soon.

Fundamental factors:

The news background for the GBP/USD pair on April 23 was rather weak. The British reports on business activity were just as weak as the European and the American ones. This morning, the data on the UK retail sales in March was released. The results turned out to be much worse than in the previous month. The demand for the British pound is rather moderate now but not due to the news. On the other hand, the demand for the currency is even lower in the US. The pair should finally find a direction to move further.

General conclusion and recommendations:

The pound/dollar pair has probably completed the construction of the first wave of a new upward trend. I recommend selling the pound with the targets at 22 and 21 in order to form the correctional wave 2 or B. Otherwise, we can wait until the wave is formed and then open buy positions at the beginning of the upward wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom