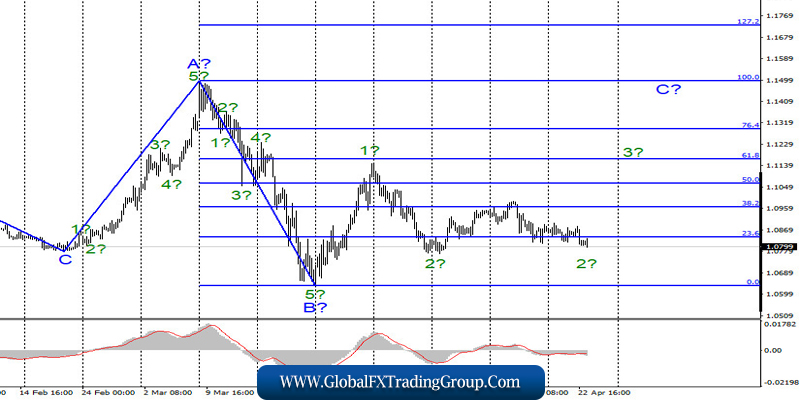

EUR / USD

On April 22, the EUR/USD pair lost about 40 basis points and continues to build the complicated wave 2 at the moment. If this assumption is correct, then the increase in quotes will begin in the near future with goals located around the 11th figures. However, the persistent reluctance of the markets to start buying euros is alarming. Therefore, everything can end with a successful attempt to break through the previous minimum of wave 2 and complicate the entire wave pattern.

Fundamental component:

The news background for the EUR/USD pair is now quite contradictory. Markets are actively discussing today’s summit of the European Union countries, during which a decision should be made on financing the economy, which, like many others, is experiencing serious problems in times of a pandemic.

The main obstacle is the sources of borrowed funds. Some EU countries oppose common European bonds, not wanting to burden their budgets with additional debts, and some EU countries are in favor, because they have suffered a lot from coronavirus and want help from the EU government. In addition to this information, there will also be data on business activity in the EU and the USA today.

According to market expectations, all indexes of business activity in the services and production sectors will decline even more compared to weak March figures. However, there’s nothing to be done about it, since these are the realities of the crisis into which the whole world has been plunged. Thus, the markets will not be surprised at all if business activity subsides today to completely indecent levels.

In the United States, there will also be a report today on applications for unemployment benefits over the past week. Let me remind you that 22 million applications have been recorded over the past 4 weeks. Today, four more may be added to these millions. On the other hand, Donald Trump continues to advocate for weakening quarantine in the country, despite all the warnings of doctors. The war with WHO also began, threats to China are heard, and new disagreements arise.

According to the latest information, Trump is ready to cancel the trade deal with China if he does not adhere to the previously reached agreements. And China seems to be doing just that, based on the emergency clause of the agreement. Moreover, most EU countries and the US itself believe that China is responsible for the spread of the COVID-19 epidemic, and insist on investigating what happened in Wuhan at the end of last year.

General conclusions and recommendations:

The euro/dollar pair continues to build the estimated upward wave C. Thus, I now recommend buying the instrument with a MACD signal up with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. I also recommend placing Stop Loss protective orders under the minimum of wave 2. And wave 2 itself can significantly complicate its internal structure.

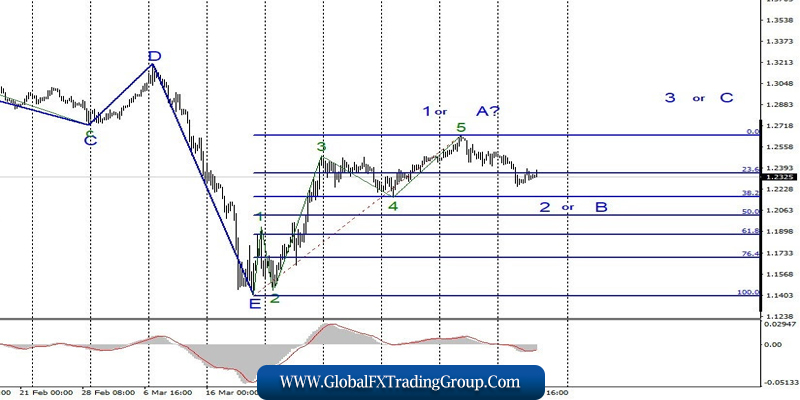

GBP / USD

On April 22, the GBP/USD pair gained about 60 basis points. Thus, in accordance with the current wave marking, the construction of the alleged wave 2 or B continues with targets located near the 38.2% Fibonacci and 50.0% levels. This wave can take a pronounced three-wave form. After the completion of its construction, I expect the resumption of the increase in quotes within the framework of wave 3 or C of the upward trend section. Thus, an unsuccessful attempt to break through the levels of 38.2% or 50.0% will show the willingness of markets to build a new rising wave.

Fundamental component:

The news background for the GBP / USD pair on April 22 was quite weak. The consumer price index in the UK was published, which showed a decrease to 1.5% y / y. Thus, this report was also weaker than market expectations. It is not surprising that the pound has faced a drop in demand in recent days. Moreover, this option coincides with the current wave marking, which involves the construction of a downward wave. In addition, negotiations on Brexit resumed in the UK, which will now be held in video mode.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with goals located around 22 and 21 figures in order to build correctional wave 2 or B, or wait for the completion of this wave, then buy at the beginning of upward wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom