EUR / USD

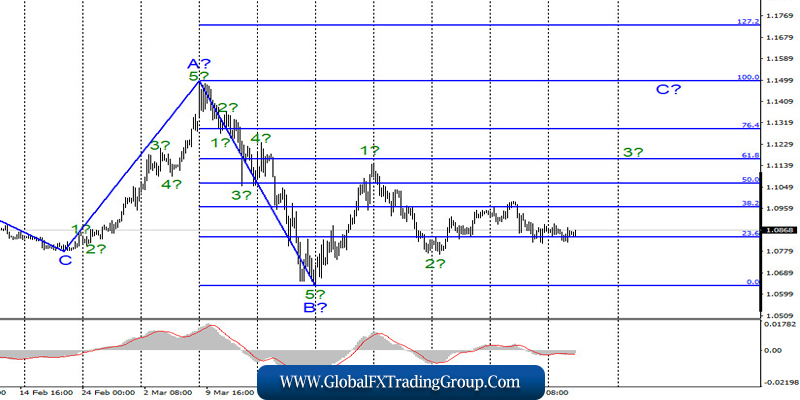

On April 21, the EUR/USD pair did not lose or gain a single point, continuing to trade around the 23.6% Fibonacci level. Thus, the wave marking of the euro/dollar pair has not changed at all over the past day and still involves the construction of an upward wave 3 in C with minimal targets located around the 11th figure. In any case, before the successful attempt to break through the minimum of wave 2, the chances of building an upward wave as part of any part of the trend remain high.

Fundamental component:

There is still little positive news in the currency market. Yesterday, the quotes of North American WTI oil declined again, now in June futures. Thus, the oil market is now in the biggest crisis in its history. According to the latest information, world oil demand fell by 29 million barrels per day. This explains the monstrous glut of oil on the market. This explains the fall of May contracts in the negative price area.

Thus, OPEC urgently needs to take new steps to reduce production and reduce it by at least another 20 million barrels per day. Meanwhile, the global crisis caused by the coronavirus epidemic continues to rage. The number of people infected with the virus worldwide is already nearly 2.6 million. Many governments are preparing to carefully weaken quarantine measures, on the one hand, realizing that the economy urgently needs to be restarted, and on the other hand, fearing new outbreaks of the epidemic. The most eloquent situation is in America, where rallies are held in favor of quarantine removal.

Donald Trump supports these rallies and the idea of resuming the work of the economy. However, he cannot make decisions alone, and most state governors refuse any quarantine concessions. In general, the global economy continues to decline while everything remains the same.

General conclusions and recommendations:

The euro/dollar pair continues to build the estimated 3 upward wave 3 in C. Thus, I now recommend buying the instrument with the MACD signal up with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% for Fibonacci. I also recommend placing Stop Loss protective orders below wave 2 minimum.

GBP / USD

On April 21, the GBP/USD pair lost about 170 basis points. Thus, in accordance with the current wave marking, the construction of the proposed wave 2 or B continues with targets located near the 38.2% and 50.0% Fibonacci levels. After completing the construction of this wave, I expect the continuation of growth in quotes within the framework of wave 3 or C of the upward trend section. Thus, an unsuccessful attempt to break through the levels of 38.2% or 50.0% will show the willingness of markets to build a new upward wave.

Fundamental component:

The news background for the GBP/USD pair on April 21 was quite weak. Reports were issued on the unemployment rate (4.0%, + 0.1% to the previous value), on average wages with and without premiums (+ 2.8% and + 2.9%, respectively) and on applications for benefits for unemployment (total +12,100 applications in March, with market expectations of +172,500) in the UK. Today, the consumer price index came out, which showed a decline to 1.5% y/y.

Thus, most of the reports were weaker than market expectations. It is not surprising that the pound has drop in demand in recent days. Moreover, this option coincides with the current wave marking. In addition, negotiations on Brexit resumed in the UK, which will now be held in video mode.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with goals located around 22 and 21 figures per building correction wave 2 or B, or wait for the completion of this wave, so that buying at the beginning of upward wave 3 or C can be considered later.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom