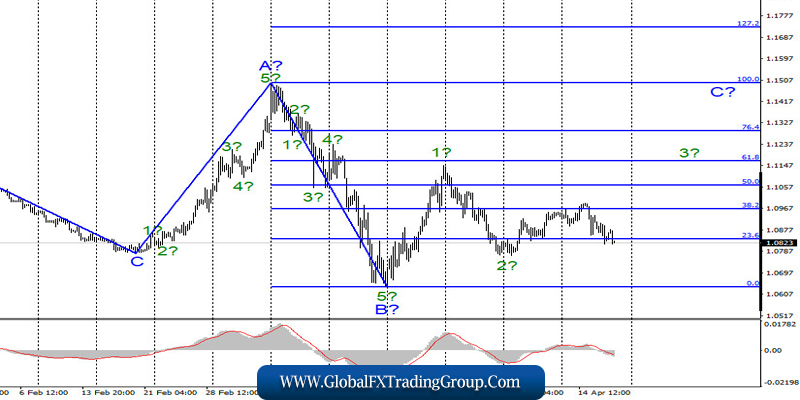

EUR / USD

On April 16, the EUR/USD pair has lost about 70 basis points and thus, significantly complicates the internal wave structure of the expected wave 3 in C. If the current wave marking is correct, then the growth in quotes of the instrument will resume with targets above the 11th figure in the third wave. The entire wave structure, originating on March 20, can take a three-wave form. The quotes, leaving below the minimum of wave 2 in C, will indicate that the instrument is not ready to build the rising wave and will require adjustments and additions to the current markup.

Fundamental component:

There is still little positive news in the currency market. The topic of the epidemic remains the most interesting to all. Despite the fact that there is a slight slowdown in the spread of coronavirus in many countries of the world, I believe that this is not particularly significant for any economy. Firstly, the virus continues to spread in Europe and America. That is, the infection of the population continues, although not at such a high rate as before. It should also be noted that even with fairly strict quarantine measures, the virus still continues to spread.

Thus, nothing can stop it from doing this in the future. People will still leave their homes if only to go to the store or pharmacy. Secondly, the economies of almost all countries of the world remain blocked, and people continue to die from the pandemic. Thus, quarantine measures may be weakened, the growth rate of infection may decrease, but this does not completely solve the problem of coronavirus as a whole. A vaccine and a cure is necessary or else, the disease will constantly attack humanity until it is invented and produced on an industrial scale.

Many doctors believe that coronavirus will be seasonal in nature, like flu or SARS. At the same time, the total number of applications for unemployment benefits has grown to 22 million in the US. Even though Donald Trump wants to weaken quarantine in some states and restart the economy, the number of unemployed in America is still growing.

General conclusions and recommendations:

The euro/dollar pair continues to build the estimated upward wave 3 in C. Thus, I now recommend waiting for the MACD signal up and buying an instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. More so, I recommend placing Stop Loss protective orders below wave 2 minimum.

GBP / USD

On April 16, the GBP/USD pair lost about 65 basis points and supposedly completed the construction of the first wave of a new upward trend section. If this is true, then the decline in quotes will continue in the coming days as part of construction of a wave 2 or B. After the completion of this wave, I expect the instrument’s quotes to resume rising within wave 3 or C. At the same time, panic may return to the currency market, which will complicate the wave patterns of all instruments.

Fundamental component:

The news background for the GBP/USD pair on April 16 was similar. The total number of applications for unemployment benefits in the United States rose to 22 million, but the markets successfully missed this information by themselves and continued to buy the US currency. On the other hand, there are no news or reports from the UK other than those concerning the coronavirus epidemic. As in many other countries, the virus continues to spread in Britain, and here, we are not even talking about the passage of the peak. That is, the growth rate of mortality and morbidity continues to remain high.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with goals that are about 21th figure in the calculation of the construction of the correctional wave or wait for the completion of this wave, then buy at the beginning of an upward wave of 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom