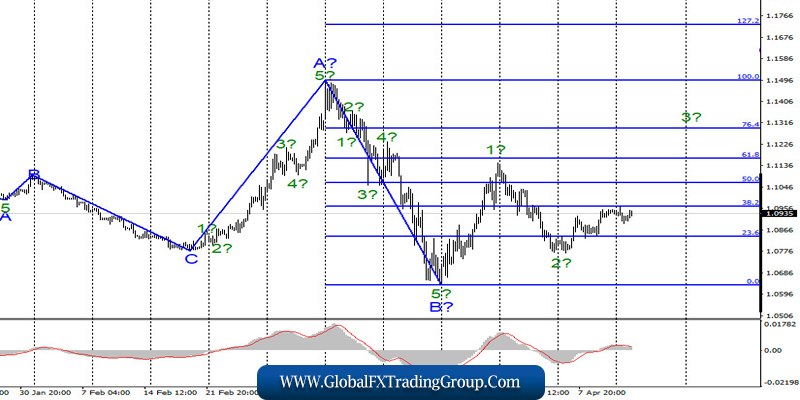

EUR/USD

On April 13, the EUR/USD pair retreated by only 25 basis points. Nevertheless, it remained within the framework of the forming wave 3 or the future wave 3 or C. If this scenario persists, the quotes will continue to rise in any case with targets located near the level of 11 and above, except for unplanned moves. An unsuccessful attempt to break through the 38.2% Fibonacci level sent quotes moving away from the highs reached earlier. This means that the pair will continue the uptrend after a successful attempt to break through this mark.

Fundamental factors:

On Monday, there was no significant news for the EUR/USD pair. No important data was released in the eurozone or the US. Thus, the activity in the markets on this Easter Monday was very low. Still, there were several messages worth noting. First, Donald Trump is planning to ease quarantine restrictions in early May and open the US economy for the international market.

The American president has already mentioned these plans. He believes that the American economy should not be shut down for long. Moreover, Donald Trump thinks that the lockdown will cost the US much more than the losses caused by the pandemic itself. The idea of lifting restrictions first appeared two weeks ago. At that point, US medical officials managed to persuade Trump to extend the lockdown.

Now Trump is again considering easing the restrictions despite the high probability of a new outbreak. So far, the US has the largest number of confirmed cases and deaths from the COVID-19 virus. Moreover, the growth rate of the new cases remains almost unchanged. Meanwhile, French President Emmanuel Macron has extended the lockdown until mid-May.

Thus, the demand for the euro is now slightly higher than for the US dollar. The euro/dollar pair is likely to continue its uptrend today. I don’t expect any economic news today as the trading calendar shows no important events.

Overall conclusion and recommendations:

The euro/dollar pair is still forming the upward C wave and began forming its internal wave 3. Thus, now I would recommend buying the pair with the targets located at the levels of 1.1165 and 1.1295, which correspond to 61.8% and 76.4% Fibonacci level. This will be especially relevant if the pair manages to break through the 1.0963 mark. I recommend placing Stop Loss orders below the lowest point of the wave 2.

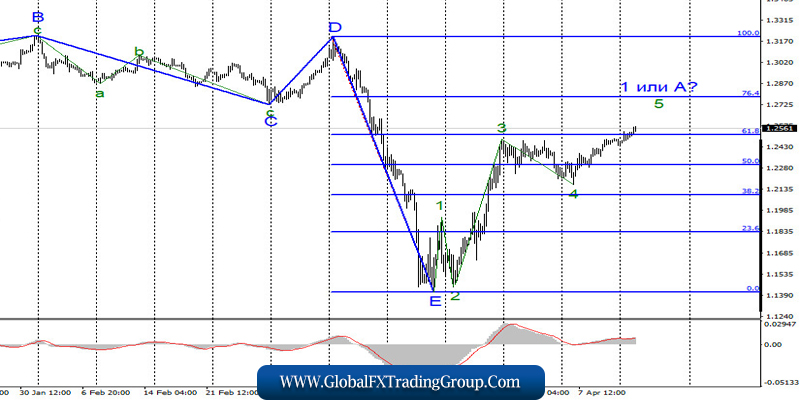

GBP/USD

On April 13, the GBP/USD pair gained about 50 base points and continued to form the rising wave. Starting from March 19, the wave pattern looks rather unusual and I made certain corrections to its outlook. I still think that on March 19, a new upward trend began to form, but now the pair is holding within the framework of the wave 5 to 1 or A. If the trend persists, the quotes will continue to rise for some time, and then the correctional wave 2 or B will start forming.

Fundamental factors:

On April 13, the GBP/USD pair had no significant background. Right now, no important events or news are coming from the UK. The only thing that deserves attention is the recovery of Boris Johnson from the COVID-19 virus. No economic reports are expected from the UK this week. Thus, in the 5 coming days, the markets will mostly focus on 2-3 reports from the US, including reports on industrial production and retail sales.

The situation around coronavirus remains difficult in the US and no less challenging in the UK. There are fewer infected people in Great Britain. However, the country’s population is also smaller. Both countries are just preparing to go through the peak of the epidemic, so the number of cases keeps growing.

Overall conclusion and recommendations:

It seems that the pound/dollar pair continues to form the first wave of a new trend. I would recommend buying the pound with the targets near the estimated level of 1.2776 which corresponds to 76.4% Fibonacci. An unsuccessful attempt to break through this level may complete the formation of the wave 1 or A.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom