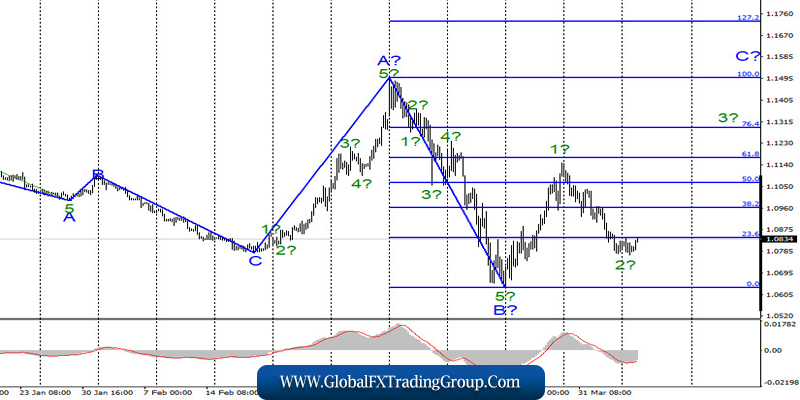

EUR / USD

On April 6, the EUR/USD pair lost about 20 basis points, and thus, continued to build a prospective wave 2 as part of the future C. The instrument is still preparing to complete the construction of wave 2 and the transition to building wave 3. If the current wave marking is correct, then this option is a priority. At the same time, a further decrease in the quotes of the instrument will complicate the current wave pattern and will require additions to it.

Fundamental component:

On Monday, there was no news background for the EUR / USD instrument. No economic news came from the European Union and America. But for the first time in a long time, there was information about successful vaccine development against coronavirus. Messages came from Australia, where scientists found that ivermectin was able to kill the COVID-2019 virus in two days, as well as from Turkey, where scientists invented a vaccine against which antibodies were produced in animals.

In both cases, it is soon planned to test the funds in humans, after which it will become clear whether it will be possible to use these drugs and the vaccine in the fight against coronavirus. In any case, this is positive news. However, the currency market did not react to these successes in the field of medicine. Markets are interested in very specific facts, which affect the global economy and the economy of each individual country. Here, I cannot note any successes for the time being.

Since the COVID-2019 virus continues to infect America and Europe, and most countries of the world remain in quarantine, the economy is now simply worth it. Thus, no positive changes can be noted yet. There will be no important economic reports again in the European Union and America on Tuesday. Nevertheless, I continue to closely monitor the news about the coronavirus, as well as about the development of vaccines against it.

General conclusions and recommendations:

The euro-dollar pair presumably continues to build the rising wave C, which can turn out to be very long. The internal wave structure of this wave can take a 5-wave form. I recommend buying the instrument again in order to build wave 3 inside C after receiving the MACD signal “up” (that is, already) with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% for Fibonacci. I recommend placing Stop L

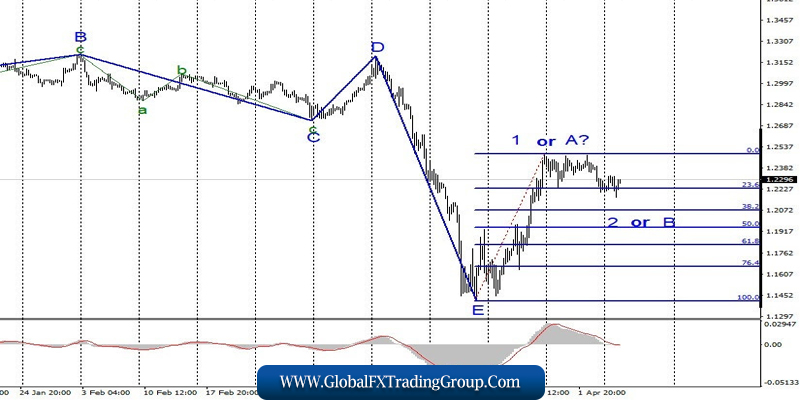

GBP / USD

On April 6, the GBP/USD pair did not lose and did not gain a single point. But there are about 70 points that were scored tonight and in the morning. This increase in quotes does not correspond to the current wave marking, which involves the construction of a correctional wave as part of a new upward trend section. Nevertheless, wave 2 or B can take on a pronounced three-wave form and, thus, resume the decline in quotes in the coming days.

Fundamental component:

The news background for GBP / USD on April 6 was also practically absent. The only news that made the markets excited was the hospitalization of Boris Johnson due to unsuccessful self-isolation as part of the fight against coronavirus. According to circles close to Johnson, the prime minister had a fever that could not be reduced by traditional mean. Moreover, based on the latest information, Johnson is in intensive care and an artificial lung ventilation device is connected to it. All British politicians expressed support for the Prime Minister and wished him a speedy recovery.

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the first rising wave. Thus, now, I recommend selling the pound with the expectation of building wave 2 or B with targets located near the calculated levels of 1.2072 and 1.1944, which corresponds to 38.2% and 50.0% Fibonacci. Two attempts to break through the 23.6% Fibonacci level were unsuccessful, so you need to wait for the third or wait for the completion of building wave 2 or B and enter the market with purchases at the beginning of building wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom