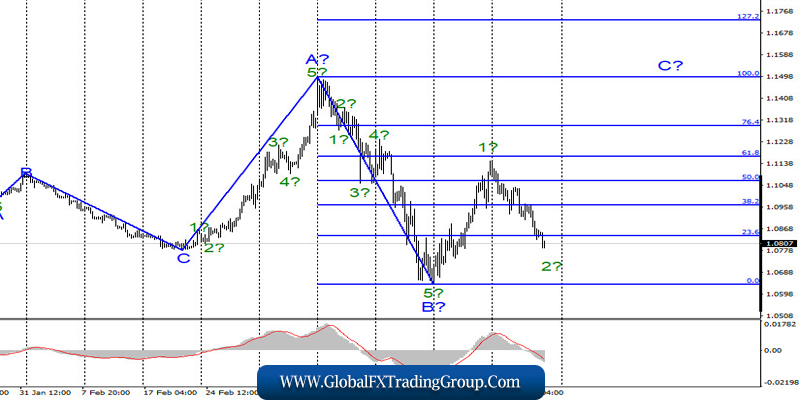

EUR / USD

On April 2, EUR / USD pair lost another 105 basis points, and thus, continued to build a prospective wave 2 as part of the future C. If this is correct, then we may begin raising the instrument within wave 3 in C in the coming days. However, a successful attempt to break through the 23.6% Fibonacci level indicates the readiness of traders for further sales. I also remind you that in the current state of the market, wave marking can become more complicated and require corrections and additions.

Fundamental component:

Yesterday was marked by the release of the second consecutive “crisis” report on applications for unemployment benefits in the United States. However, based on the movement chart of the euro-dollar instrument, it can be noted that the markets were not particularly scared by the total number of 6.5 million Americans who lost their jobs. The US dollar continued to be in demand at yesterday’s trading.

Today, the EUR / USD instrument continues to decline, which confirms the opinion that the markets are not paying attention to statistics now. Nevertheless, America has the most cases of COVID-2019 virus in the world, but this factor also does not scare the markets too much. Today, extremely important reports on unemployment, on Nonfarm, on wages, and also on business activity in the services sector will be released in America.

Let me remind you that unemployment in March should already start to grow from the current 3.5%, Nonfarm should decline for the first time in a long time (like the ADP report), and business activity shows the largest decline in the services sector (and in both the EU and the US). So I don’t expect any positive news from America today.

But at the same time, despite the wave markup and, with a high probability, weak news from the US, markets continue to buy the dollar, just as they did a few weeks earlier. Thus, the amplitude of the instrument begins to grow again, and panic moods – to return to the markets.

General conclusions and recommendations:

The euro-dollar pair presumably continues to build the rising wave C, which can turn out to be very long. The internal wave structure of this wave can take a 5-wave form. I recommend buying the instrument again in order to build wave 3 inside C after receiving the MACD signal “up” with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci.

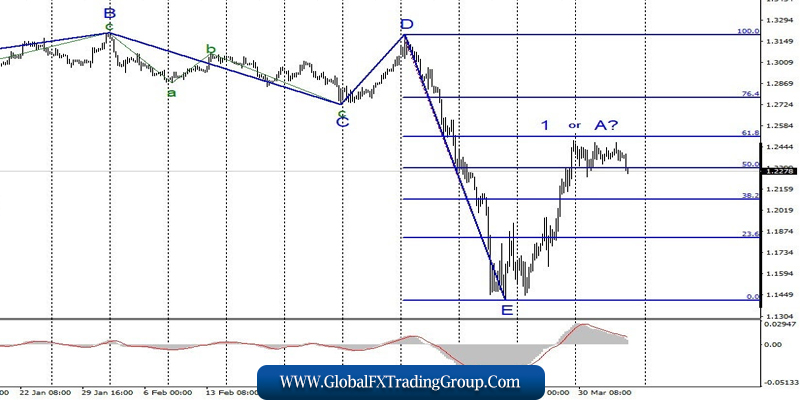

GBP / USD

On April 2, the GBP / USD pair gained about 25 basis points. The amplitude of the movement of the instrument decreased, but today, April 3, the markets come to their senses and begin to trade more actively again. The alleged wave 1 or A of the new upward trend section is supposedly completed. If this is true, then the decline in quotes will continue with targets located near the levels of 38.2% and 23.6% Fibonacci.

Fundamental component:

The news background for the GBP / USD pair on April 2 did not differ too much. The same jobless claims report that markets ignored. Today, Britain released the index of business activity in the services sector, which declined more than expected, 34.5 points in March compared with February (53.2). Thus, in a way, the decline of the pound in the first half of Friday is logical.

Nevertheless, important data in America will come out in the coming hours, which can also be extremely weak. The only question is how weak. Now, wave marking suggests a decline in quotes. I believe that the news background will not interfere with this process.

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the first rising wave. Thus, now, I recommend selling the pound with the expectation of building wave 2 or B with targets located near the calculated levels of 1.2093 and 1.1835, which corresponds to 38.2% and 23.6% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom