EUR/USD

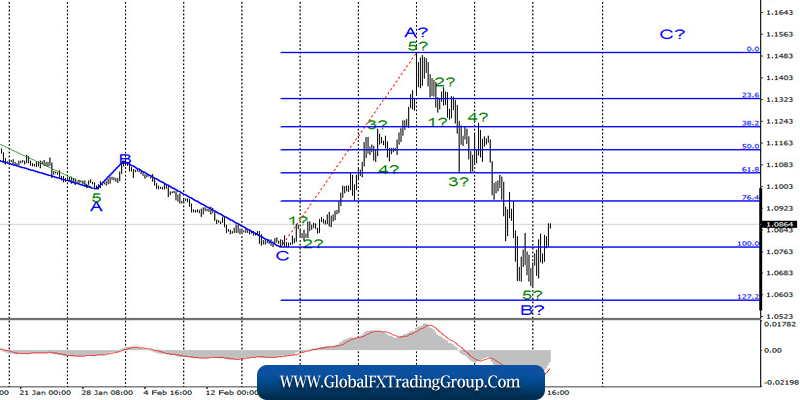

On March 23, the EUR/USD pair gained about 35 more base points, although it reached 1.0830 again during the day. Since the previous local minimum was not updated, I still consider the assumed wave B completed. If this is true, then the tool has moved to build a new upward wave, presumably C, with the potential to increase to the 15th figure. Now such a potential looks rather doubtful, but I would like to remind you that in a state of panic, the market can move in any direction and with terrible force.

Fundamental component:

The news background for the EUR/USD instrument on March 23 was quite strong. Recently, most of the news comes from America, where the Fed and the government are fighting a desperate battle to save the stock market, as well as the entire economy. First, the Fed announced the launch of a quantitative stimulus program, then its expansion and reduction of rates to almost zero, and now it is announcing unlimited purchases of Treasury bonds and various securities.

All this is done to fill the economy with liquidity. However, if in recent weeks the US currency has been rising because the markets considered the dollar to be the most attractive in these harsh times, now many investors are thinking. We thought about the current state of the American economy and what the future holds for it if the Fed has to take such measures to stimulate this very economy. Thus, I believe that the demand for the dollar will now decline.

The panic can’t go on forever. Markets must adapt to the new realities of life until the coronavirus can be defeated. By the way, it should also be recalled that the US government, in turn, wants to provide assistance for several trillion dollars to small businesses, ordinary workers and American citizens. These measures will also help the economy. So far, the US Senate has not approved this amount of aid, but it is unlikely that it will refuse to accept it for a long time.

General conclusions and recommendations:

The euro/dollar pair have presumably completed the construction of a downward wave B. The entire section of the trend, which originates on February 20, takes a horizontal form, and waves A-B-C can be approximately equal in size. For now, the main scenario is to build an ascending wave C. You can buy the instrument carefully with stop-loss orders under the low of wave B.

GBP/USD

The GBP/USD pair lost about 100 basis points on March 23. However, the intended wave E can be completed. If this is true, then the increase in the quotes of the instrument will continue with the goals located between 25th and 27th figures. The dollar, therefore, can start to fall synchronously in both instruments – EUR/USD and GBP/USD. And from my point of view, it would be logical if, after the simultaneous decline of the euro and the pound, both currencies will now grow.

Fundamental component:

The news economic background for the GBP/USD instrument on Monday was the same as for the euro. The UK and US governments continue to take all necessary measures to stop the spread of the COVID-2019 epidemic, as well as to mitigate its impact on the economy. Unfortunately, it is still not possible to stop the epidemic.

The number of cases of the virus in the US is already 46,000 and in Britain – almost 7,000. Today, the UK, the European Union and Germany have already released indices of business activity in the services and manufacturing sectors. Strangely enough, business activity in the manufacturing sectors of these countries was significantly higher than the forecasts and expectations of the markets. In the UK, it was 48, in Germany – 45.7, and in the eurozone – 44.8.

However, composite business activity indices and service sector indices collapsed miserably, turning out to be much worse than market expectations. For example, in the EU, business activity in the service sector fell from 52.6 to 28.4. The euro and pound are rising in the morning on Tuesday, and this is good.

General conclusions and recommendations:

The pound/dollar instrument also presumably completed the construction of the descending set of waves and the last wave E. Thus, now you can carefully buy the pound in the expectation of building a new ascending set of waves with targets located near the 25th figure and with stop-loss orders under the low of the wave E.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom