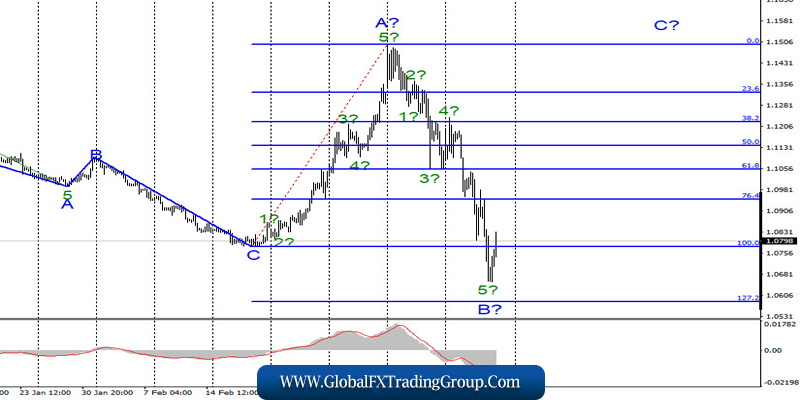

EUR / USD

On March 19, the EUR / USD pair lost another 250 basis points. Therefore, it continued to build a bearish wave, since the quotes of the instrument went beyond the minimum of the first wave of the proposed new trend section. Thus, as I warned earlier, the wave marking has undergone certain changes, and now, the entire trend section, starting on February 20, takes a horizontal view. If this assumption is correct, then the increase in quotes may continue today with goals located about the 15th figure.

Fundamental component:

There was no news background for the EUR / USD instrument on March 19. This refers to economic reports from the eurozone and the United States. Now, all attention of the market continues to be directed to the action of central banks, which have been doing everything possible to reduce the negative impact of the COVID-2019 virus epidemic on the economy for the last week.

First, all the world Central Banks announced record cuts in key rates, as well as expanding programs to quantitatively stimulate the economy, and then governments joined in, who also want to help citizens, businesses, and households cope with the effects of the crisis caused by the coronavirus epidemic. In fact, it does not matter at all how much money will be poured into the economies of the ECB and the Fed.

Both banks announced that they will do everything necessary, to prevent the economy from slipping into recession. However, according to many experts, the recession has already begun and in any case, will continue for at least most of 2020. Nevertheless, central banks and governments, through financial injections into the economy, are trying to prevent it from slowing down to 0%. For the currency market, the most important thing now is the recovery time.

Those terms during which investors will come to the conclusion that there is no need to panic anymore. We need to wait for the victory over the epidemic and the restoration of all markets (commodity and stock). Thus, it will be possible to expect a decrease in the trading amplitude for all instruments only after that.

General conclusions and recommendations:

The euro-dollar pair supposedly completed the construction of the downward wave B. The entire trend section, starting on February 20, turns out to be almost horizontal with very strong correction waves, which will be equated to almost 100% of the pulsed ones. So far, the main option for the development of events is the construction of an ascending wave C. It will be possible to buy the instrument cautiously using the MACD signal “up”. But it should be remembered that panic can again overwhelm the markets.

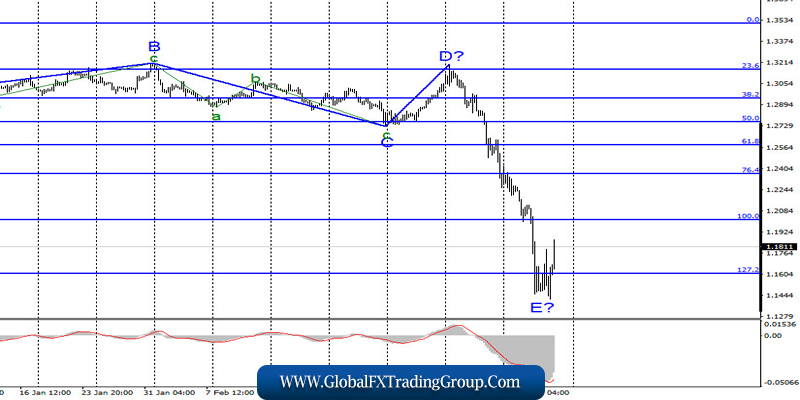

GBP / USD

On March 19, GBP / USD pair lost another 115 basis points. Nevertheless, it managed to gain almost 400 points only in the morning of March 20. The highest amplitude of the pound / dollar instrument is maintained, which still greatly complicates trading.

If the current wave marking is correct, then the downward part of the trend is completed and now, the instrument will go on to build at least a 3-wave upward wave structure. At the same time, the situation with the epidemic is not improving, which means that markets can continue to be in a panic state, which can lead to new strong movements and the need to make adjustments to the current wave markings.

Fundamental component:

There was no news background for the GBP / USD instrument on Thursday. All the same news on measures taken by the Bank of England to mitigate the effects of coronavirus on the economy, news about additional quarantine measures in the UK. Mostly, everyone is now interested in just two issues. 1) When will the epidemic be defeated? Here the forecasts are completely different, from a few months to 12-18 months.

The first trials of the coronavirus vaccine began in China, the USA and Italy, but the whole process takes a long time. 2) What will be the consequences for the global economy? It all depends on the answer to the first question. Thus, the relative recovery of markets on Friday, March 20, may simply just be an accident and markets are likely to remain in shock.

General conclusions and recommendations:

The pound / dollar instrument continues to complicate the current wave count. Thus, I still do not recommend trading, as the situation in the markets is very unstable. Perhaps wave E is completed, which indicates the willingness of the markets to buy the pound. However, when the instrument passes 400 points in one morning on Friday, I still think that any transactions are now very risky.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom