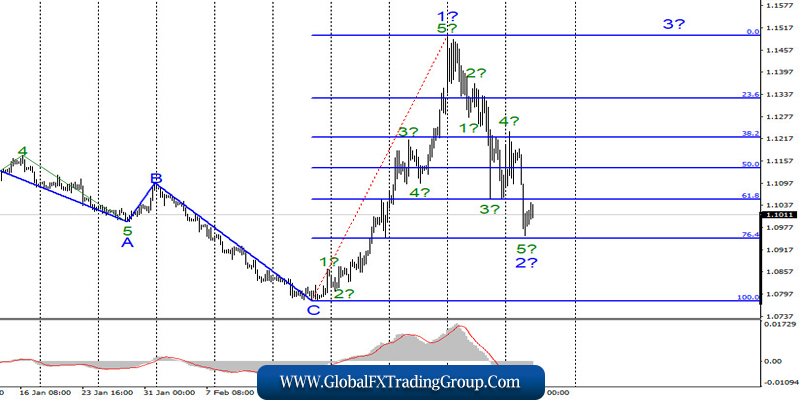

EUR / USD

On March 17, the EUR / USD pair lost 170 basis points and thus, continued to build a bearish wave, supposedly 2. If this assumption is true, then the entire trend section, starting on February 20, can be significantly more complicated. Wave 2 can also take a more extended and complex form, since 5 waves can now be traced inside it. However, this wave is corrective and cannot have more than 3 waves, given its “standard” nature. Thus, it will most likely take an even more complex form, and the quotes of the instrument may decrease down to the minimum of wave 1.

Fundamental component:

The news background for the EUR / USD instrument on March 17 was absent again. More precisely, there were economic reports in the European Union and America, but they did not interest anyone. The mood of investors in Germany and the eurozone, according to the ZEW Institute business sentiment index, has worsened. And not only has it worsened, it is close to depression now.

Nevertheless, data from America was slightly better. Industrial production grew in February by 0.6%, but the growth rate of retail sales decreased. Despite the fact that the US dollar continues to increase across the entire spectrum of the market, this does not mean that the US economy is in a wonderful mood. On the contrary, buying a dollar by the market is almost a necessary measure.

In fact, stock indices collapse daily in America, the Fed lowered the rate by one and a half percent and resumed the program of redemption of securities from the market in the amount of $ 700 billion, and the government is considering various options for helping businesses and residents. For example, Donald Trump suggests distributing checks for $ 1,000 to all US residents in order to mitigate the economic shock from the crisis caused by coronavirus. This step will very quickly fill the economy with hundreds of billions of dollars and support it.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing the construction of the upward section. However, this section of the trend can turn out not upward, but almost horizontal with very strong correctional waves, which will be equated to almost 100% of the impulsed ones. In addition, current wave marking may require adjustments and additions. While the construction of wave 2 continues, after completion of which I am still waiting for an increase in the framework of wave 3 with targets located about the 15th figure.

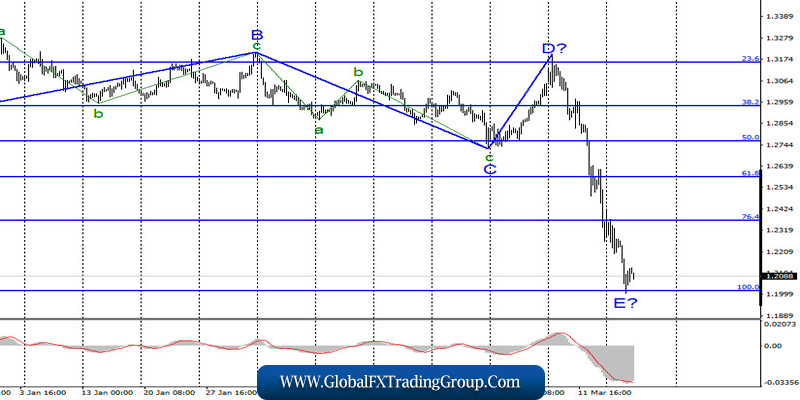

GBP / USD

On March 17, the GBP / USD pair lost more than 200 basis points, so the alleged downward wave E continues its construction and takes on a very long form. However, nothing can be done about it. Markets continue to remain in a state of panic. The British pound has been falling down for 6 full days in a row, and the total losses are already about 1000 base points. An unsuccessful attempt to break through the 100.0% level may lead not only to the quotes moving away from the lows reached, but also to the completion of building wave E and the entire downward trend section.

Fundamental component:

A news background for the GBP / USD instrument was present on Tuesday. However, the markets continued to sell the pound, not paying any attention to data on wages, unemployment in the UK. Thus, I am convinced once again that economic reports now have no effect on supply and demand in any currency. On Monday, March 17, there was a strong jump immediately by 26% in the number of people infected with coronavirus In the UK . The total number of cases of the virus has reached almost 2000. Therefore, Prime Minister Boris Johnson urges the population to stay at home and without any need to go out into the streets and public places.

General conclusions and recommendations:

The pound / dollar instrument continues to complicate the current wave count. Thus, I still do not recommend trading, as the situation in the markets is very unstable. After completing the construction of wave E, using the MACD signal “up”, it will be possible to consider the possibilities of buying the instrument, however, the main problem now is that it will be very difficult to determine the completion of both wave E and the entire downward trend section. A successful attempt to break through the 100.0% level will indicate the readiness of the markets for further sales of the pound.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom