EUR / USD

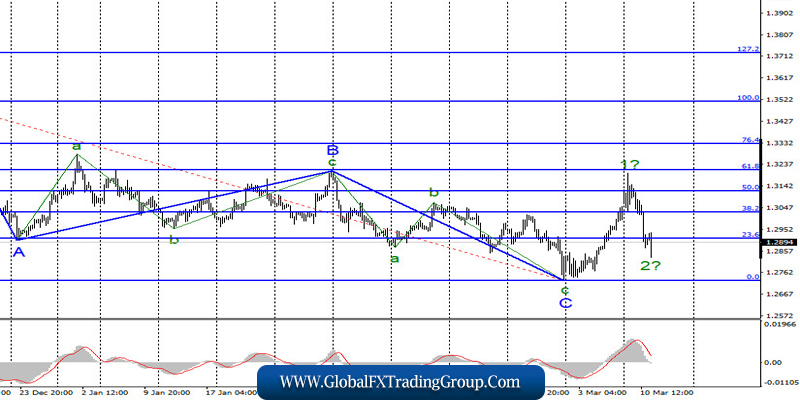

On March 10, the EUR / USD pair lost about 160 basis points. Thus, there are more and more reasons to assume the completion of the construction of the upward wave 1 and the transition of the instrument to the construction of the correctional wave 2. If this is true, then the decline in quotes will continue with targets located near the levels of 38.2% and 50.0% Fibonacci.

Meanwhile, the entire wave 2 can take a three-wave internal structure. However, its possible size is difficult to judge, as markets continue to be in a state of shock, which affects the amplitude of trading, growing day by day. Therefore, little depends on the news background nowadays.

Fundamental component:

The news background for the EUR/USD instrument on Tuesday had no effect on trading again. Markets continued to be in a state of shock due to the fall of quotes of “black gold”, collapses in the currency exchange market and other “charms”. During the day, the American currency managed to win back about 150 points, but this does not mean at all that the construction of the upward trend section has been completed.

The small demand for the US dollar was caused by the statements of US President Donald Trump yesterday regarding the possible tax breaks for all Americans. But a little later, representatives of both the Republican Party and the Democratic Party explained that for the most part, they support only those who have suffered one way or another from the coronavirus or from measures taken to combat the epidemic, and not to the entire US population.

The Senate also accused Trump of trying to raise his political ratings ahead of the presidential election this year. However, Trump is no stranger to being criticized. He has already outlined his personal desire to lower payroll taxes, knowing full well that the Senate and Congress are unlikely to approve such a move. Thus, he was put in front of voters in a good light, without taking any action. Also yesterday, a report on GDP in the eurozone was released, which showed a decrease from 1.3% in the third quarter to 1.0% in the fourth.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing the construction of the upward section. Based on the current wave marking, wave 1 has completed its construction. Thus, I still recommend waiting for the completion of the construction of wave 2 and buying the instrument only after the construction of wave 3 begins. At the same time, wave 3 is unlikely to turn out to be as strong as wave 1, and the entire trend section, taking its toll, which began last February 20, may take a three-wave form again.

GBP / USD

On March 10, GBP / USD lost about 210 basis points. Thus, there is reason to believe that the construction of the alleged wave 1 has been completed and, at the moment, the construction of wave 2 has probably been completed. It should also be noted that all wave marking is now quite arbitrary and may require changes and additions at any time.

For example, the emergency measures taken by the Bank of England became known today, and the pound fell down again. Its decline can now continue throughout the day, which will disrupt the current wave counting.

Fundamental component:

There was no news background for the GBP/USD instrument on Tuesday. But on Wednesday morning, an “information bomb” entered the markets. Following the Fed, the Bank of England lowered its key rate by 0.5% as part of the fight against the negative effects of the Chinese coronavirus. At the same time, asset buyback remains the same 435 billion pounds. Now, the word is for the European Central Bank, whose rates are already negative.

Nevertheless, some countries are very susceptible to infection in Europe, so stimulating the economy is clearly required in the EU. Today, there will be reports on inflation in America as well as reports on industrial production and GDP in the UK. Thus, the “fun day” for the pound is just beginning, since the instrument can be thrown repeatedly from side to side during the day.

General conclusions and recommendations:

The pound / dollar instrument has complicated the current wave count. Thus, I do not recommend trading now, as the situation in the markets is very unstable and frankly shocking. After the completion of wave 2 construction, it will be possible to consider the possibilities of buying the instrument using the MACD “up” signal with targets located around 1.3330 and 1.3513, which is equivalent to 76.4% and 100.0% Fibonacci, calculated to build wave 3.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom