EUR/USD

On February 28, the EUR/USD pair added only 25 basis points, although the trading amplitude during the day was much stronger. Nevertheless, even this movement was enough to confirm the continuation of the upward wave, presumably 1 new upward trend. Today, the tool started without long swings and immediately rushed up, adding another 60 points. Thus, the instrument reached 1.1096, which corresponds to 100.0% of Fibonacci. A failed attempt to break this mark will indicate that the markets are ready to build a corrective wave 2.

Fundamental component:

At first glance, the news background for the EUR/USD instrument on February 28 was rather poor. However, all the economic reports of the day still did not attract the attention of the markets. More important events took place in the world, which became the drivers of the tool on Friday and seems to remain so now. Several key events occurred at the end of last week. This is the collapse of the stock market in the United States, which lost a total of a record 15%.

This is the continuation of the spread of coronavirus, which negatively affects not only the economies of the countries where it is found but also the economies of all countries of the world since they are all tightly tied to each other. Quarantine in several regions of Italy and China does not mean that business activity will fall only in these countries. In these countries, supplies of goods, raw materials, and energy are delayed and canceled, which affects other countries as well.

That’s what Jerome Powell said at the weekend. The Fed President believes that the coronavirus can have a strong impact on the American economy (and the world as well), so the Fed is ready to urgently intervene and lower the key rate. This will not happen before the Fed meeting, which is scheduled for this month. Nevertheless, the markets were very sensitive to information about the fall of the stock market in the United States and a possible rate cut.

The US dollar, which recently grew steadily in the pair with the euro, is now simply collapsing every day. Moreover, this does not apply to the GBP/USD instrument.

General conclusions and recommendations:

The euro/dollar pair is presumably continuing to build a new ascending section. Based on the current wave markup, I recommend waiting for the completion of waves 1 and 2, and using MACD signals to buy the euro within wave 3. The upward trend began quite abruptly, and the wave pattern may take a more complex and ambiguous form than it is now. The news background now has a very strong impact on the tool, and trading is turbulent.

GBP/USD

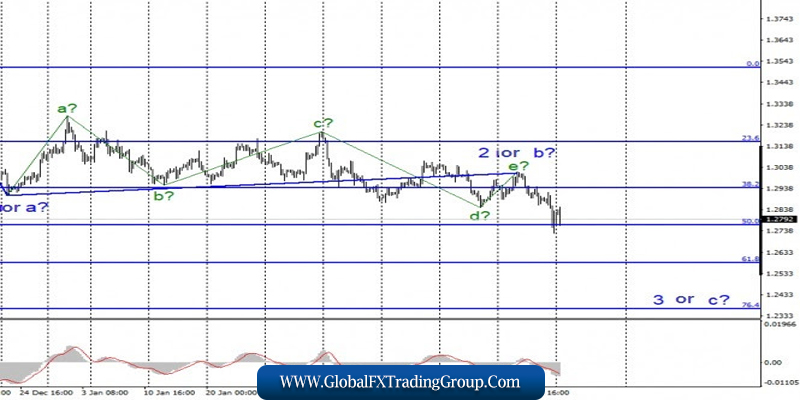

The GBP/USD pair lost about 70 basis points on February 28, thus moving in the opposite direction. Based on the current wave layout, the conclusion is that the intended wave 2 or b is complete and the tool has moved on to building wave 3 or C, which can be very long and complex.

If this is indeed the case, then the decline in quotes will continue with targets located near the 61.8% and 76.4% Fibonacci levels. A successful attempt to break the 50.0% level will indicate the readiness of the markets for further sales of the British.

Fundamental component:

The news background for the GBP/USD instrument on Friday was similar. Nevertheless, the US currency paired with the British continued to be in demand in the market. There may be several hypotheses for this discrepancy. First, wave markings suggest building different sections of the trend. Second, negotiations on a trade deal with the European Union will start in Britain this week.

And many experts and analysts fear that there will be no deal at all. For the British economy, this will be a strong shock, respectively, and the pound will be under attack. Perhaps, against this background, the British pound is now being sold, despite the fact that the US dollar is collapsing daily in pair with the euro.

General conclusions and recommendations:

The pound/dollar tool has complicated the current wave markup, which has now become much more extended. Thus, I recommend selling the instrument with targets located near the 1.2584 and 1.2369 marks, which corresponds to 61.8% and 76.4% for Fibonacci, after a successful attempt to break the level of 50.0%.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom