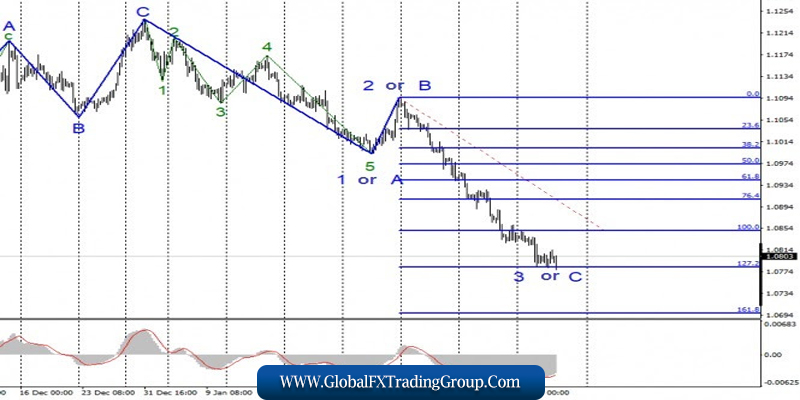

EUR/USD

On February 19, the EUR/USD pair gained about 15 basis points, however, it did not affect the current wave markup in any way. Thus, the pair remains within the framework of building the expected downward wave 3 or C. At the moment, the instrument has made several unsuccessful attempts to break the 127.2% Fibonacci level, so this may mean that the markets are not ready for further sales of the European currency. If the level of 127.2% can withstand the onslaught from above, the euro/dollar instrument can move to build a corrective upward wave or a set of waves.

Fundamental component:

The news background for the EUR/USD instrument was again absent in the eurozone and America on February 19. Only in the evening, the markets witnessed the minutes of the last Fed meeting. No important economic reports were released during the day. The Fed’s evening minutes also did not provide much new information to the markets.

The document reflected all the theses that have long been known to the markets, so the instrument’s amplitude and market activity remained unchanged. There was hope that the markets will still strengthen their positions this morning, as the Europeans did not have the opportunity to work out the protocol due to its late release.

However, at the European session, it became clear that the European market was not interested in the Fed’s protocol either. Today is full of economic reports but all of them are likely to have the same effect on yesterday’s protocol. Today, in Germany, the consumer confidence index for March and the producer price index for January have already been released.

The latter increased by 0.2% y/y and 0.8% m/m, which gives hopes for an acceleration of German inflation. A little later, ECB Vice President Luis de Guindos will give a speech, the ECB report from the last monetary policy meeting will be released and the Fed-Philadelphia’s manufacturing index and the change in the number of applications for unemployment benefits will be released. I can’t single out any of these events and say that they can increase or decrease the demand for a particular currency on February 20.

General conclusions and recommendations:

The euro/dollar pair continues to build a downward set of waves. Based on the current wave markup, I recommend waiting for a successful attempt to break the 127.2% Fibonacci level to allow new sales with targets located near the mark of 1.0699, which corresponds to 161.8% Fibonacci.

GBP/USD

On February 19, the GBP/USD pair lost about 80 basis points and resumed building a downward section of the trend within the expected wave 3 in 3 or C. If this assumption is correct, then wave 2 has completed its construction and the decline in the instrument’s quotes will continue with goals located near the level of 50.0% in Fibonacci and below. The entire wave 3 or C can be very long, which opens up good prospects for reducing the British in the future.

Fundamental component:

The news background for the GBP/USD instrument was strong on Wednesday but was expressed by only one report – inflation in Britain for January. It turned out that the consumer price index rose to 1.8% y/y, which was a surprise for the markets.

Such a surprise that instead of buying on the joys of the British currency, its sales began. In other words, the market reaction was directly opposite to the nature of the news background on Wednesday. On a monthly basis, inflation fell by 0.3%, which is also better than market expectations. The core consumer price index rose by 1.6% y/y, which is also higher than forecasts.

Why hasn’t the demand for the pound increased on this news? Most likely, because of the uncompromising nature of the current wave markup, which did not imply the continuation of the upward wave construction at all.

Today, the UK also released interesting news, namely the report on retail sales, which was better than the expectations of the foreign exchange market: +0.8% y/y and +0.9% m/m. However, the pound did not react to this report in any way. The demand for it did not increase after positive data on retail sales.

General conclusions and recommendations:

The pound/dollar instrument continues to build a downward wave 3 or C. Thus, I recommend selling the instrument with targets located near the mark of 1.2767, which corresponds to 50.0% of Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom