EUR / USD

On February 6, the EUR/USD pair lost another 15 basis points and thus, continued the construction of the downward wave, which is still identified as b despite reaching a minimum of wave Y. However, an increase in instrument quotes is required today in order for the current wave marking to maintain its integrity.

Then, the trend section which started on January 29 can still be a corrective three-wave structure. If the increase in the euro / dollar instrument does not start today or a maximum on Monday, then the instrument will most likely complicate the downward part of the trend, originating on December 31.

Fundamental component:

The news background on Friday will be worthy of the attention again in the currency markets. The key report of the day is Nonfarm Payrolls in America, which will show the number of jobs created outside the agricultural sector in January. In this regard, market expectations come down to 160K, this report was 145K a month earlier.

Thus, the dynamics of the euro / dollar instrument and the trading amplitude on February 7 depend on whether the value of Nonfarm is higher or lower. This report is so important because it reflects the state of the labor market. And according to the Fed and Donald Trump, it is the labor market that will push the American economy forward.

In addition to Nonfarms, there will be reports on unemployment and wages today. There are no issues with unemployment. Its value is at its minimum for many years and decades for America. Thus, there is no reason to expect rising unemployment, which could lower the demand for the dollar. Information on the change in average hourly wages is more interesting.

Markets expect an increase of 3% in January yoy and 0.3% m / m. This is the second most important report today, but key attention will still be focused on Nonfarm. At the same time, the news background does not correlate well with wave marking. If the report on the labor market is strong, then the markets will have to increase demand for the dollar again, which will lead to an even greater drop in the instrument.

Thus, to build a C wave, you need either a weak report on Nonfarm or a huge desire of the markets to buy the euro currency today.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build a correctional set of waves. Thus, I still recommend buying the instrument using the MACD “up” signal with targets located near the calculated levels of 1.1115 and 1.1144, which equates to 50.0% and 61.8% Fibonacci. However, this recommendation will be relevant only if markets start buying euros in the coming days.

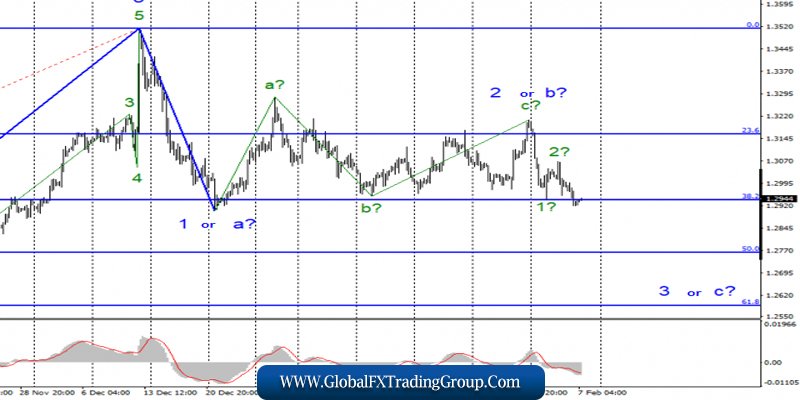

GBP / USD

On February 6, the GBP/USD pair lost about 75 basis points and made a seemingly successful, but uncertain attempt to break through the 38.2% Fibonacci level. Thus, the alleged wave 3 or c continues its construction, waves 1 and 2 are already clearly visible inside it.

However, in this case, the decline in quotes of the instrument today should continue within the framework of wave 3 to 3 or C. On the other hand, the expected wave 2 or b looks quite unconventional, but still complete.

Fundamental component:

There was no news background for the GBP / USD instrument on Thursday, and today, it will come down to reports from America, as markets from the UK do not expect any news this day. In turn, pound sterling will continue to decline with virtually no options based on the current wave counting. And only the news background can prevent it from doing this.

If the economic data from America starts to collapse and it improves from the UK, and Boris Johnson changes his tough position in negotiations with the EU to a softer one, then the demand for the Briton can grow significantly, which will lead to an increase in the instrument and disrupt the current wave marking.

However, there are still no prerequisites for performing at least one of these three theories. Today, everything will depend on reports on the US labor market and wages.

General conclusions and recommendations:

The pound / dollar instrument supposedly moved to the construction of a downward wave of 3 or c. Thus, I recommend selling the pound with targets near the level of 1.2764, which equates to 50.0% Fibonacci. At the moment, I recommend selling the instrument after a successful attempt to break the level of 1.2939, which corresponds to 38.2% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom