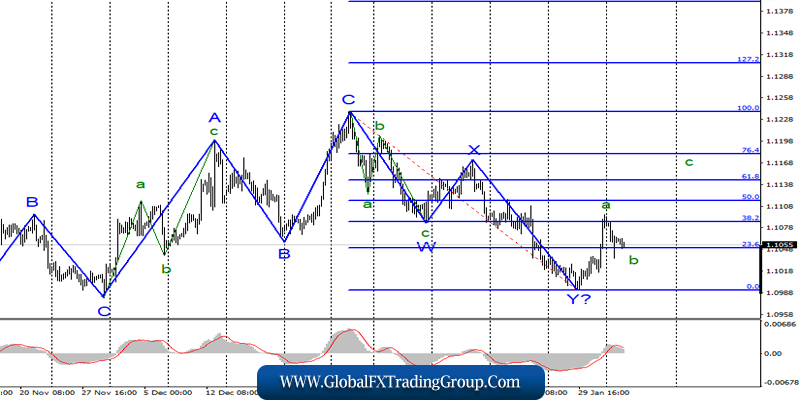

EUR / USD

On February 2, the EUR / USD pair fell by 35 basis points and thus began the construction of the proposed correctional wave as part of the future upward trend section. If this is indeed the case and the downward trend section is fully equipped, then in the near future the quotation of the instrument will resume resuming within the framework of the expected wave s. An unsuccessful attempt to break through the 23.6% Fibonacci level may just lead to the completion of the construction of the correctional wave b.

Fundamental component:

Monday’s news background was again interesting enough for the Euro-Dollar instrument. Almost the whole day was devoted to the release of data on business activity in the manufacturing sectors of the European Union, individual EU countries, as well as the United States. And I must say that these data did not disappoint the markets.

Both European and American indices turned out to be better than expected to see the markets, however, due to the fact that the US indices were higher, the US dollar received additional demand, which, by the way, completely coincided with the current wave marking of the instrument. But first things first.

The EU business activity index rose to 47.9, adding only 0.1 points. The same index in Germany also increased by 0.1 and amounted to 45.3, in the UK – by 0.2 and amounted to 50.0. Thus, the gains of all key indicators were minimal.

Moreover, European and German business activity remained below 50, indicating a continuing slowdown in industries. It is a completely different matter in America, where both business activity indexes have grown. If the Markit index grew by only 0.2 and amounted to 51.9, then the ISM index rose immediately by 3.7 points and amounted to 50.9.

Thus, American reports turned out to be corny stronger both in absolute terms and in relative terms. This is precisely what caused the increase in demand for the American currency. During Tuesday, the news background will be weaker.

By and large, there’s nothing to pay attention to, only the producer price index in the eurozone, which already came out and amounted to -0.7% in December, which led to a slight decrease in the European currency

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom