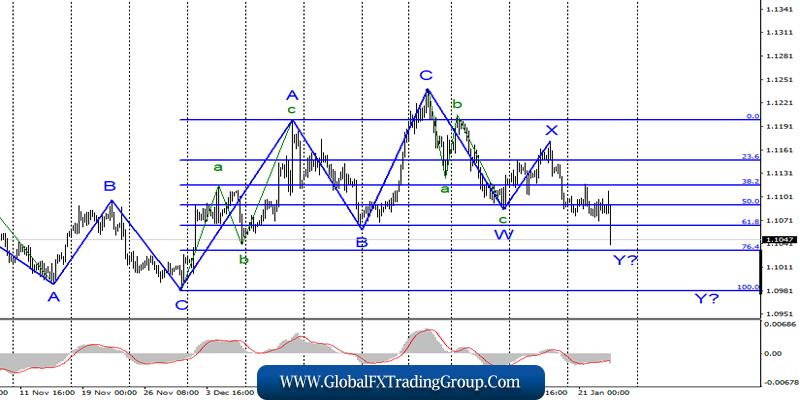

EUR/USD

The EUR/USD pair gained about ten base points on January 22, which did not particularly affect the current wave marking, which still implied a continued decline in the instrument. Today, January 23, when Christine Lagarde began her speech, the euro began to decline, which has already lost about 50 base points, and the day can end with even greater losses. Thus, the instrument continues to build a downward trend section and its expected wave Y.

Failure to break the 76.4% Fibonacci level may lead to quotes moving away from the lows reached, a break – to continue going down in the direction of the 100.0% Fibonacci level.

Fundamental component:

The news background for the instrument was very strong on Wednesday. By and large, only one event was expected by the markets today. Summing up the ECB meeting, the first in 2020. Expectations about changes in interest rates by the markets were negative, and it is unlikely that anyone would count on statements about changes in the volume of the quantitative stimulus program.

Therefore, all attention was paid to the speech of Christine Lagarde, and she did not disappoint. Indeed, she disappointed investors of the euro. At first, Lagarde’s speech did not portend disaster. The ECB president announced moderate growth in the EU economy, as well as certain signs of improving the economic situation and accelerating inflation.

However, after a few minutes, the markets heard the words that in general the risks for the EU economy remain downward, and industrial production and trade continue to slow down the eurozone economy. Thus, only that which was clear to the markets was confirmed.

The decline in industrial production in recent months, weak business activity, geopolitical conflicts, the recession of the global economy – all this has had and continues to have a negative impact on the economy of the eurozone. And since these problems have not yet been resolved, it is too early to expect improvement in the situation in Europe.

General conclusions and recommendations:

The euro-dollar pair, presumably, continues to build a downward set of waves. Thus, I would recommend continuing to sell the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci.

GBP/USD

The GBP/USD pair gained about 95 base points on January 22, but at the same time it continues to remain within the framework of the construction of the proposed wave 3 or c, which takes a very complex and extended form.

Now we can still assume that the decline could resume in the near future, although the internal wave structure of wave 3 or c already leaves some questions unanswered. A successful attempt to break through the 38.2% Fibonacci level will confirm the readiness of the markets for further sales of the pound sterling.

Fundamental component:

There was no news background for the GBP/USD instrument on Wednesday. The markets are now only watching the settlement of the last controversial issues between the House of Commons and Lords in the Parliament of Great Britain, but there is nothing special to note here.

The Queen of Great Britain will sign the Brexit bill in the near future, and ratification of the deal in the European Union is due on January 29. Although in fact all these issues have long been resolved. A small wave of optimism was present in the Forex currency market, the pound slightly rose, but due to what should it continue to rise?

The country will enter the so-called transitional period in a week, which will last 11 months. By and large, nothing will change in relations between the EU and Britain on February 1. Only negotiations will begin on agreements defining relations between the EU and Britain after December 31, 2020. There were no economic reports in the US and Britain today, so I’m waiting for a return to the 38.2% Fibonacci level.

General conclusions and recommendations:

The pound/dollar tool continues to build a new downward trend. I recommend selling the instrument again with targets near 1.2941 and 1.2764, which corresponds to 38.2% and 50.0%

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom