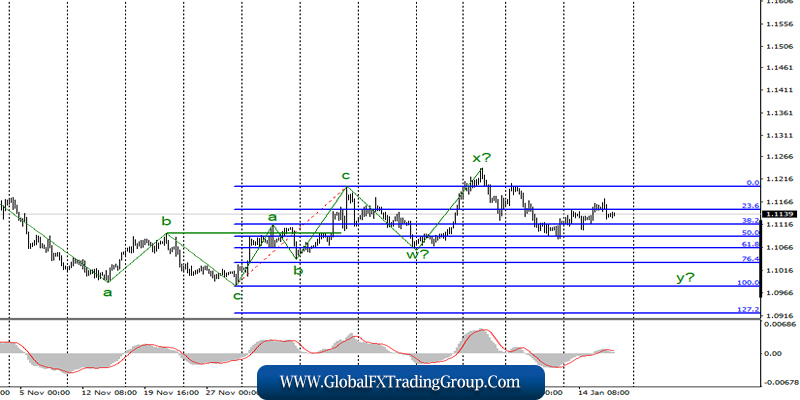

EUR / USD

On January 16, the EUR / USD pair lost about 10 basis points and already began to move away from the highs reached this time. The wave markings have not changed much over the past few days, given the very weak activity of the market.

I still expect the construction of a downward wave y, which should bring the instrument to the 10th figure and below. However, it should be recognized that the current wave marking is completely ambiguous and may require periodic changes and adjustments.

Fundamental component:

The news background for the instrument was a bit controversial on Thursday. I already wrote about inflation in Germany yesterday, which has not changed compared to November 2019 and amounted to 1.5%. But today, we have to find out what level of inflation will be recorded in the entire eurozone in December.

Markets expect to see 1.3% y / y, all forecasts of various analytical agencies indicate this. This value cannot be called high, so it is unlikely that demand for the euro will increase today after the release of the economic report on inflation.

However, statistics in America pleased sellers again. Although the main indicator of retail sales in December did not exceed the forecast of + 0.3% m / m, it turned out to be better than sales excluding automobiles + 0.7% m / m. The evening performance by Christine Lagarde was left unattended, since the chairman of the ECB very superficially hooked on the topic of monetary policy, without reporting anything specific.

Today, I recommend paying attention to the report on changes in industrial production in the USA, as well as the consumer confidence index there, in addition to inflation in the EU. Instrument sellers may be disappointed today if industrial production declines in America in December.

This will mean that not only the European Union is experiencing problems with the production sector, but America too. And the consumer confidence index will show in which direction the attitude and level of trust of ordinary consumers in the US economy has changed.

I would also like to note separately that China and the United States signed the first stage of the trade agreement, which could be the beginning of the end of the trade war.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend resuming sales of the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci, on the new MACD signal “down”, which is already present.

At the same time, a new successful attempt to break through the level of 23.6% will most likely indicate that markets are not ready for further sales of the instrument.

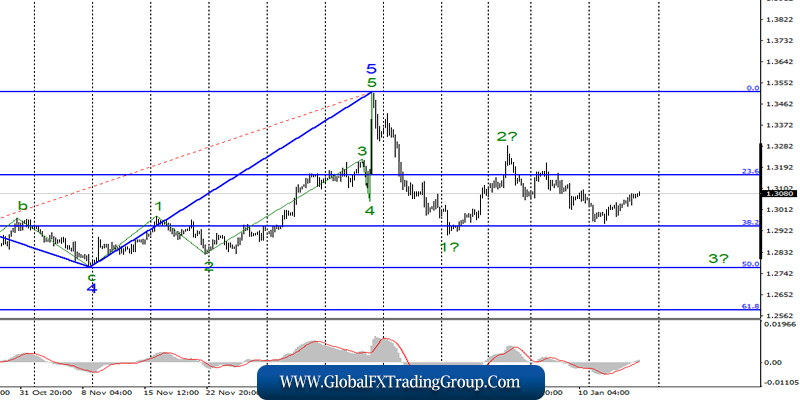

GBP / USD

On January 16, the GBP / USD pair increased by 40 basis points and continues to move away from previously reached lows near the level of 38.2% Fibonacci. Wave 3 also does not appear to be completed, so I expect its construction to resume with targets below the 38.2% Fibonacci level.

At the same time, the entire wave marking may require corrections given the too long construction of the internal correctional wave in structure 3, but so far I am counting on the option of building a new pulsed bearish wave.

Fundamental component:

The news background for the GBP / USD instrument was more or less neutral for the pound on Thursday. At the same time, buyers of the pound / dollar instrument should not relax, as the report on retail sales will be released today, which may fix a new discrepancy between market expectations and reality.

Let me remind you that earlier this week reports on GDP, inflation, as well as on industrial production in Britain failed miserably. Even if today retail sales show a good increase, this is unlikely to change the general picture of things. By the way, I must say that the pound has not really fallen and amid this disappointing statistics.

Demand for the British this week, on the contrary, increased, but not decreased. But at the same time, market activity dropped markedly. On the whole, this set of various factors results in a rise in the British so far, but I think…

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend selling the instrument again with targets located near the level of 1.2764, which corresponds to the Fibonacci level of 50.0%, with the new MACD signal “down”, as wave 3 does not yet appear to be fully equipped.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom