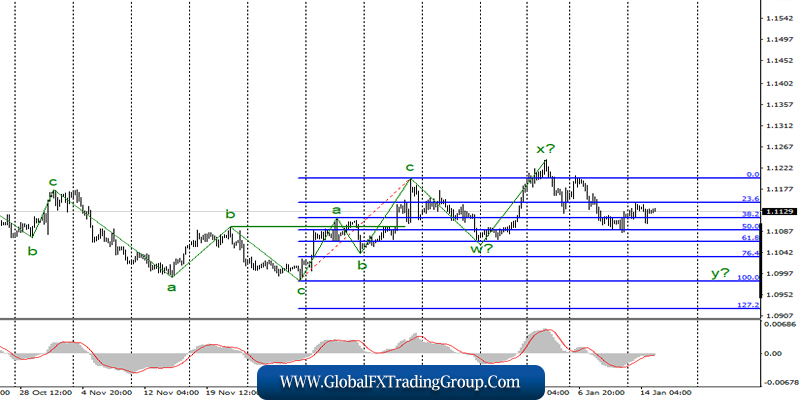

EUR / USD

On January 14, the EUR / USD pair lost only a few basis points, although it fell significantly below the opening levels during the day. However, the current wave marking remains to be developed as before, the construction of wave y with targets located around the 10th figure is still expected.

At the moment, the wave y takes a 5-wave form, and if this is true, then the decline in quotes of the instrument will resume today. On the contrary, an unsuccessful attempt to break through the 23.6% Fibonacci level indirectly indicates the readiness of the markets for new sales of the euro.

Fundamental component:

The news background for the euro-dollar instrument was not strong on Tuesday. There is only one report that came out – the US inflation report, and market expectations were fully justified. On an annualized basis, inflation rose to 2.3% in December, and on a monthly basis – by 0.2%.

These are the numbers that were expected by the markets. On the one hand, the news is positive, as the Fed and Jerome Powell have repeatedly stated that inflation is weak, which hinders stronger economic growth. Now, inflation has exceeded the target 2%, and now the main thing is to keep the consumer price index above this level.

If this can be done, then the US economy may continue to accelerate in 2020, which may even lead to an increase in key rates in the middle to the end of the year. Today’s news background for the euro / dollar instrument will be reduced to a November report on industrial production in the European Union.

Nevertheless, the markets do not expect any optimistic figures again and are preparing to reduce volumes by 1.1% y / y. But then, the indicator may grow by 0.3% compared to the previous month. However, whatever the final value, it is still far from the “normal” value, indicating a steady rate of production growth. Moreover, it is not surprising that the EU industry is in decline.

Business activity has been signaling this for more than six months, which is declining in all countries of the European Union. Separately, I would like to note that today the first phase of the trade agreement between China and America will be signed, which can be favorably received by markets, especially stock markets.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend resuming sales of the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci and on the MACD signal “down”, which indicates the readiness of markets for building a new downward wave of y.

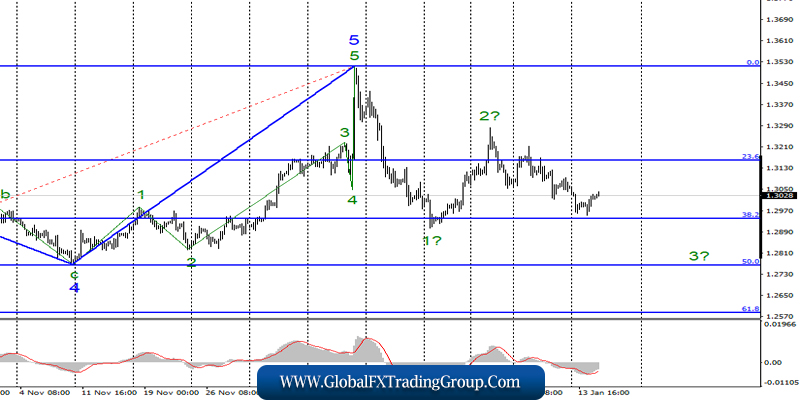

GBP / USD

On January 14, the GBP / USD pair added about 30 basis points and continues to build the alleged wave of 3 or C as part of a new downward trend. Even if the current downward wave is C, then the instrument should decline below the 38.2% Fibonacci level in any case. For today, I’m still inclined to see the instrument go down to 1.2763, which corresponds to 50.0% Fibonacci.

Fundamental component:

The news background for the GBP / USD instrument was the same as the EUR / USD instrument on Tuesday. However, if the euro fell down during the day, then the pound did not. On the way to the level of 38.2%, quotes began to move away from the lows reached.

There were no economic reports in the UK yesterday; today, inflation for December will come out, which will be called upon to answer an important question: will this indicator slow down or begin to show signs of recovery? If inflation continues to decline, then the demand for the pound will also continue to decline.

In the last year or two, it was inflation that gave the Bank of England hope for a positive outcome and saved it from deciding on a new reduction in the key rate. Inflation was more or less stable around 2%. Now, a value of 1.5% y / y has been observed for two consecutive months, and it may continue to decline. Thus, I believe that any value below 1.5% can return the instrument to 1.2939.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend selling the instrument again with targets located near the level of 1.2764, which corresponds to the Fibonacci level of 50.0%, with the new MACD signal “down”, as wave 3 does not yet look fully completed yet.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom