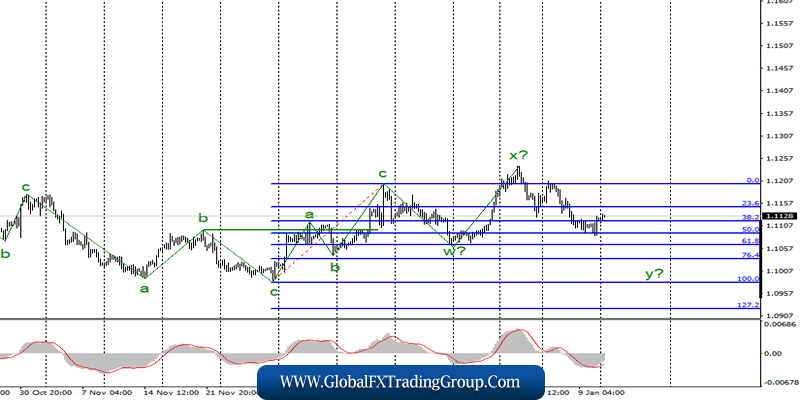

EUR / USD

On January 10, the EUR / USD pair gained about 15 basis points, but this increase did not in any way violate the current wave counting and the construction of the alleged wave y. Thus, I expect the continuation of lowering the quotes within the current bearish wave after a short break.

The general wave marking remains quite complicated, as the instrument moves in any direction mainly by 3-wave wave structures. In general, the trend section over the past few months is very similar to the horizontal one.

Fundamental component:

The news background for the euro-dollar instrument on Friday was very interesting. First of all, because of the extremely important report of Nonfarm Payrolls in America. This indicator reflects the number of jobs created outside the agricultural sector for the reporting period.

Thus, it reflects the state of the US labor market, and it is with this sector that the country’s government links its well-being and economic growth. The forecasts were fairly average, but the real value was worse than the expectations of traders – 164K vs 145K.

Nevertheless, I do not think that the value of Nonfarms is weak, but the fact that it is below forecasts has still caused a slight increase in the European currency. In addition, the report on the average wage in the USA was not the best, which showed an increase of 2.9% instead of 3.1%. It also caused a slight decline in the dollar.

The news calendar is empty today. Thus, quotes may continue to roll back from previously reached lows, after which I expect a resumption of decline. In this regard, news on the market will begin to arrive again tomorrow. Now, political factors play an extremely weak role in the exchange rate of the instrument.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend continuing to sell the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci, according to the MACD signal “down”, which indicates the readiness of markets for new instrument sales.

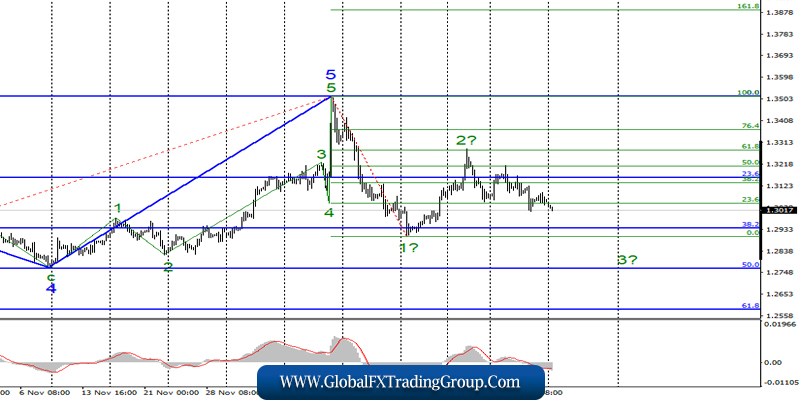

GBP / USD

On January 10, the GBP / USD pair literally lost several basis points and, in general, continues to build a downward wave 3 as part of a new bearish trend section.

Thus, I expect a decline in the pound-dollar instrument at least to the base of the alleged wave 1, although, most likely, the decline will continue to 28 and 27 figures, even if the entire trend section, starting on December 13, takes a 3-wave view.

Fundamental component:

The news background for the GBP / USD instrument on Friday also came down to economic reports from America. However, the pound did not lose a point even if the EUR/USD instrument deviated from the lows against the background of these reports, and on Monday morning, its decline resumed.

Thus, it can be noted that the British did not pay any attention to economic reports on Friday since the pound remains under the control of Brexit and its prospects. It should also be noted that these prospects are not completely bright.

Today, markets will closely monitor economic reports from Britain, which may confirm the worst fears of the markets that have formed over the past few months.

If the reports on GDP and industrial production turn out to be weak again and show a reduction in these indicators, then the pound may not be able to get even stronger, as this will mean a continued slowdown in the economy of the United Kingdom, which will officially begin the procedure of leaving the EU on January 31.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend continuing to sell the instrument with targets near the level of 1.2764, which corresponds to the Fibonacci level of 50.0%. Meanwhile, a new MACD signal “down” may indicate the next wave of sales of the instrument. Thus, I recommend placing Stop Loss orders above 1.3160.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom