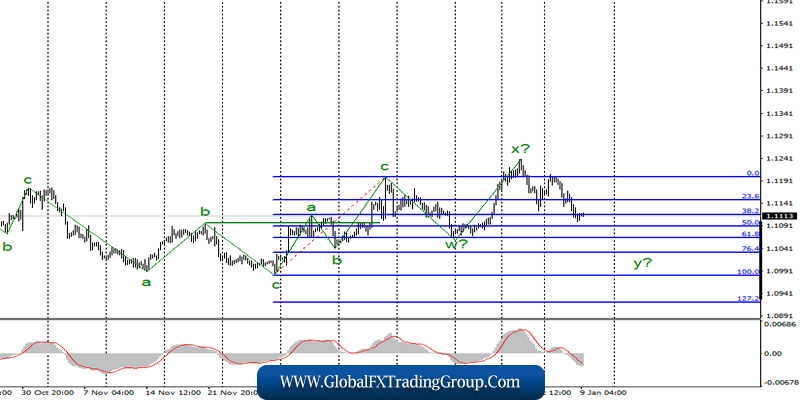

EUR / USD

On January 8, the EUR / USD pair lost about 45 basis points and thus, resumed the construction of the alleged wave y. If the current assumption is correct, then the quotes of the instrument will continue to decline with targets located near the 10th figure.

The internal wave structure of wave y takes on a 5-wave form and is still far from complete. At the moment, wave marking does not require any additions or corrections.

Fundamental component:

The news background for the euro-dollar instrument was interesting again on Wednesday. The most important economic report of the day caused new purchases of the American currency, as it turned out to be very strong, much higher than market expectations.

The number of new workers in the private sector ADP amounted to as much as 202 thousand, while the past value was revised from 67 thousand to 124. Thus, the market received a favorable signal that the Friday report would also be in order, in anticipation of the publication of Nonfarm.

Well, the American currency received additional demand thanks to this report and can now continue to build a bearish wave in accordance with the current wave markings.

However, Thursday January 9, will be less interesting. The news background today will come down to economic reports from Germany which do not have such an impact on the market, like news from the European Union or from America.

Nevertheless, the volumes of industrial production, import, export and trade balance for November have already reached today. The first indicator is the most important, since we all know that industry in Germany and throughout the European Union is now in a state of decline, which is indicated primarily by business activity indicators.

At the same time, reports have confirmed this hypothesis, showing a decrease of 2.6% y / y, which is still not bad, as markets expected to see a decrease of 3.8% y / y.

Moreover, the unemployment rate in the European Union today will be released, which also does not belong to the indicators that can move the market. In America, there will be a report on applications for unemployment benefits today.

There is no market reaction to reports from Germany, but the figures themselves are interesting. Although there is a slight excess of forecasts, the industry in Germany remains in decline.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend continuing to sell the instrument with targets located around the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci, since there is now a high probability of building a bearish wave.

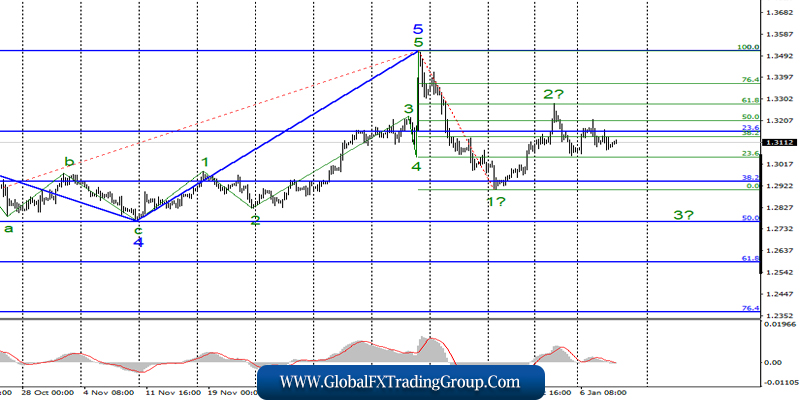

GBP / USD

On January 8, the GBP / USD pair only lost 20 basis points. Thus, the strengthening of the dollar paired with the pound was very modest.

Nevertheless, two unsuccessful attempts to break through the 61.8% and 50.0% green Fibonacci retracements indicate that the pound / dollar instrument is ready to continue to build a bearish wave, presumably 3. If the current wave marking is correct, then the decrease in quotes will resume with targets under 29th figure in the near future.

Fundamental component:

The news background for the pound-dollar instrument on Wednesday was also expressed only by the ADP report on US employment. The dollar received more modest support paired with the pound. It is difficult to say what caused this, since the wave marking of the pound / dollar instrument suggests a lowering even more strongly than the euro / dollar instrument.

One way or another, but the wave marking remains working until the instrument makes a successful attempt to break through the 50.0% level on the green Fibonacci sect, built to the size of the estimated wave 1 as part of a new bearish trend section.

In this case, wave marking will require additions and corrections, and the trend section may transform from a bearish to a horizontal or an upward one. From the important news of the past day, we can also mention Prime Minister Boris Johnson and European Commission President Ursula von der Leyen, who, we can say, began negotiations on a trade agreement between Britain and the EU after Brexit.

So far, the parties have not come to anything. Therefore, very difficult negotiations are expected throughout 2020.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend continuing to sell the instrument with targets near the level of 1.2764, which corresponds to the 50.0% Fibonacci level, as another unsuccessful attempt was made to break through the 50.0% level on the small Fibonacci grid.

The MACD “down” signal also indicates the readiness of markets for new sales of the pound. Thus, I recommend placing Stop Loss orders above 1.3206.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom