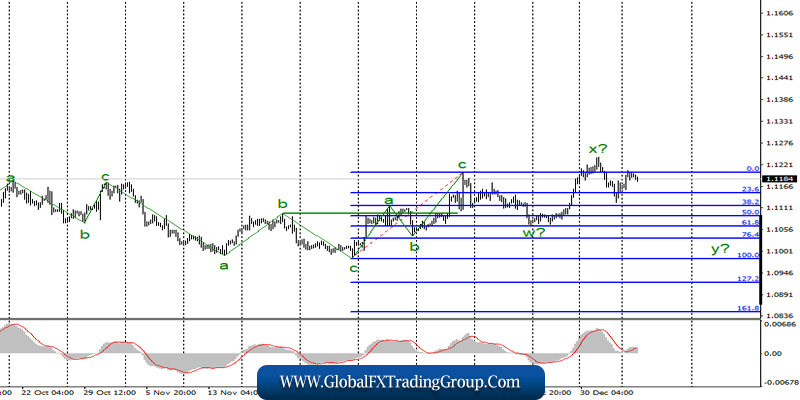

EUR / USD

On January 6, the EUR / USD pair gained about 35 basis points, which currently leads to a complication (assumed) of the bearish wave y. However, the current wave marking remains the same for the time being and does not require any additions or corrections.

The unsuccessful attempt to break through the 0.0% Fibonacci level indirectly indicates a second attempt by the markets to start selling Eurocurrencies. On the other hand, a successful attempt to break the level of 1.1202 will show the readiness of the currency market to continue buying euros, and the wave markings will require further clarification.

Fundamental component:

The news background for the euro-dollar instrument was favorable on Monday. To begin with, European business activity in the service sector was 52.8, and the composite PMI index was 50.9, which is higher than market expectations. Thus, the most important economic reports of the day for the euro were strong. Separately, there was also an increase in business activity indexes in the service sectors, as well as composite PMI indices in the largest countries of the European Union.

And only France was a little disappointing: no improvement was recorded for both indices. At the same time, America was also pleased with business activity, as the PMI for the service sector was 52.8 with market expectations of 52.2, and the composite PMI was 52.7 with expectations of 52.2. In general, I can call yesterday’s increase in the euro as a logical reaction of the market to economic reports.

Today, there will also be interesting data that will affect the movement of the instrument. The most significant is the December inflation report, which is expected to accelerate to 1.3% y / y. The core consumer price index may also be 1.3% y / y.

Considering that a month earlier, the markets saw figures of 1.0%, then 1.3% may contribute to a further increase in the euro. At the same time, the current wave marking suggests the opposite, and there will be local economic reports after lunch in America, in particular, the ISM index of business activity in the services sector with a high forecast of 54.5. Thus, economic data from America can also help the national currency.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend continuing to sell the instrument with targets located around the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci, since now a high probability of building a bearish wave.

The MACD signal down will indicate the completion of the construction of the correctional wave in the composition of y.

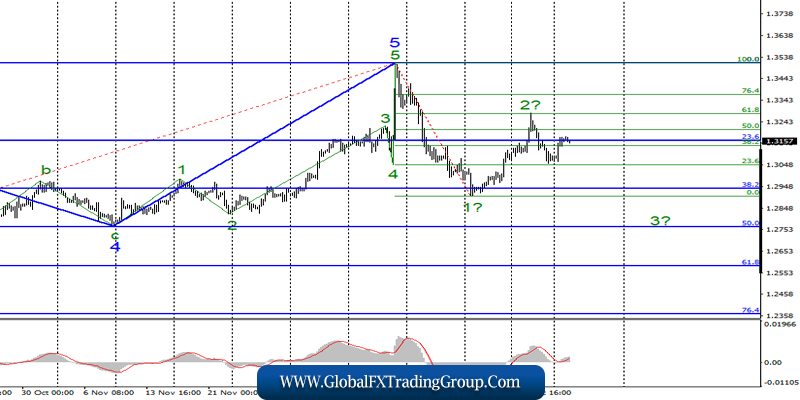

GBP / USD

On January 6, the GBP / USD pair added 85 basis points and began the construction of a correctional wave of 3 as part of the downward trend section, originating on December 13. If this assumption is true, then the instrument will resume to decline with targets located near the 28th figure and below, after a small departure of quotes from the reached lows.

However, an unsuccessful attempt to break through the level of 1.3158, which is equivalent to 23.6% Fibonacci, may cause the completion of the correctional wave today.

Fundamental component:

The news background for the GBP / USD instrument was also favorable on Monday. The levels of business activity in the service sector and composite PMI increased compared to the previous month and showed values of 50.0 and 49.3. Thus, the markets positively welcomed the improvement in the manufacturing and services sectors in the UK.

Now, the service sector is located exactly between the areas of decline and increase. At the same time, the Brexit and trade negotiations between London and Brussels remain important for the British pound. However, most politicians, including Boris Johnson, are on vacation since the Christmas and New Year holidays are ongoing and due to this, no news from the UK Parliament is coming.

It remains only to wait until the time of the holidays is over, and the British government will return to address issues regarding the future of the country, which very much affect the exchange rate of the national currency.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend continuing to sell the instrument with targets near 1.2764, which corresponds to the 50.0% Fibonacci level, as wave 2 or b is supposedly completed, as indicated by an unsuccessful attempt to break through the 61.8% Fibonacci level. Meanwhile, the MACD signal “down” will indicate the readiness of the markets for new sales of the pound.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom