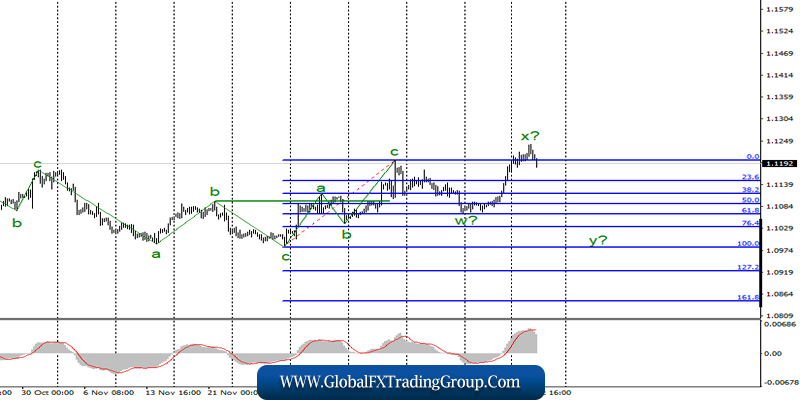

EUR/USD

On December 31, the EUR/USD pair increased by another 30 basis points, thus ending 2019 on a major note. However, the year 2020 begins with a decline, and the decline is highly anticipated. The current wave layout has been slightly transformed due to the last day of 2019, but it still assumes the construction of a downward wave.

If this assumption is correct, the tool has the potential to reduce under the low of wave w. At the same time, a new update for the peak of wave x is likely to lead to complications of the upward trend and the transformation of the entire wave pattern.

Fundamental component:

The news background for the euro-dollar instrument is surprisingly present. Immediately on the first day of the new year in the eurozone, business activity indices were released in the production areas of some of the largest countries. It is difficult to say how to interpret all the figures together since the pan-European index was 46.3, which is slightly higher than the value of November.

The German and Spanish indexes also rose slightly. But in Italy and the UK – they fell even further, to 46.2 and 47.5. Thus, it is impossible to say that the dynamics are positive. And in any case, the increase in comparison with November is minimal. This is probably why the euro currency did not feel the effect of these economic reports at all.

A little later, business activity will be known in America, where no major changes are expected at the end of December. Also, an important factor is the markets’ wagering of the new year’s rally, in which the euro added much more than the markets expected.

In general, we can say that the current values of business activity in the eurozone are not high enough for the euro to continue to increase. So I’m looking forward to building a downward wave, despite the importance of business activity in America’s manufacturing sector.

General conclusions and recommendations:

The euro-dollar pair have presumably completed the construction of an upward trend section. Thus, I would recommend selling the instrument with targets located near the marks of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% for Fibonacci. The signal from the MACD “down” indicates that the instrument is ready to build a new downward wave.

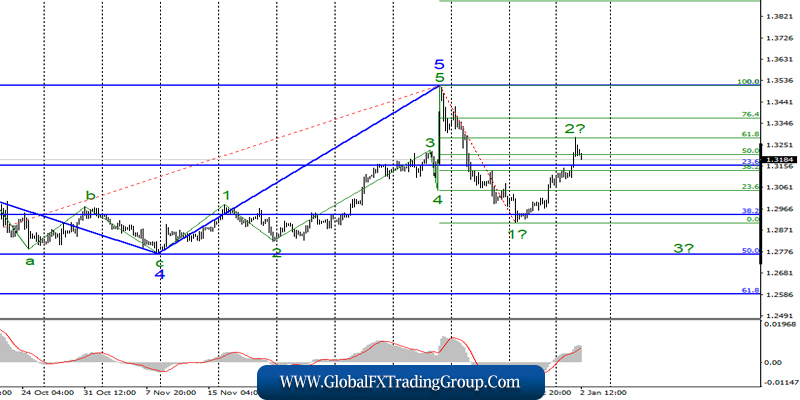

GBP/USD

The GBP/USD pair increased by 150 basis points on December 31. Thus, the correction from the expected first wave of the new downward trend was exactly 61.8%. An unsuccessful attempt to break this mark of 1.3280 indicates that the instrument is ready to build a wave 3 with targets located near the 29th figure and below.

A successful attempt to break the maximum of the expected wave 2 will indicate that the market is ready for further purchases and will lead to the need to make additional adjustments to the current wave markup.

Fundamental component:

The news background for the GBP/USD instrument on Thursday is weak but present. The index of business activity in the UK manufacturing sector was 47.5 in December, with slightly higher expectations of the currency market. I can’t say that it was this economic report that affected the low demand of the pound on January 2.

Rather, it is the wave pattern that “pushes” the instrument down, since the upward section of the trend is completed with a probability of 90%. Nevertheless, another nondescript report from Britain suggests that the economy continues to experience, if not problems, then certain difficulties.

Given this point, the pound has already “exceeded the plan” at the end of 2019. Thus, the decline of the “Briton” is justified now in terms of technology, and in terms of waves, and in terms of news and reports.

General conclusions and recommendations:

The pound-dollar instrument continues to build a new downward trend. I recommend resuming sales of the instrument with targets located near the mark of 1.2764, which corresponds to the Fibonacci level of 50.0% since wave 2 or b is presumably completed.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom