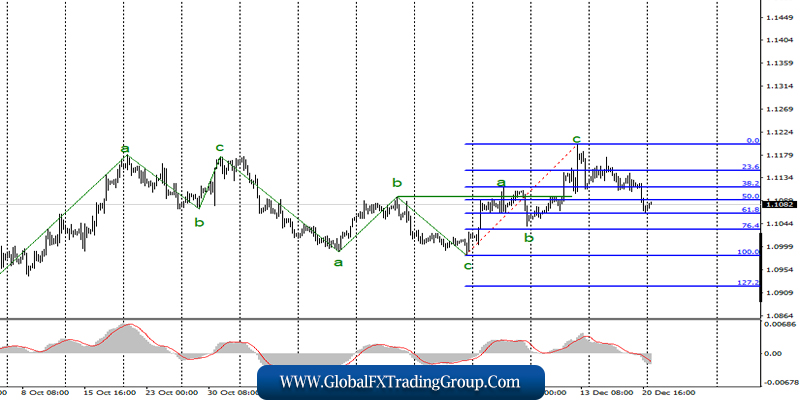

EUR / USD

On December 20, the EUR / USD pair completed with a decrease of 45 basis points, thus, it continued to build a bearish wave presumably at 1 or a, as part of a new downtrend.

If this is true, then the decline in the quotes will continue with targets located around 1.0981, which equates to 100.0% Fibonacci. At this stage, I expect to build another three-wave wave structure. If the news background is favorable to the dollar, then the entire wave markup can take on a more complex and extended look.

Fundamental component:

The news background for the Euro-Dollar instrument on Friday was very interesting. In America, a third-quarter GDP report was released, which indicated a 2.1% year-on-year increase in the main indicator. This is a very worthy value, which indicates the excellent condition of the economy at this time.

Other, less important reports also supported the American currency. For example, the personal expenses of the American population in November grew by 0.4% mom, which is higher than a month earlier, and personal income grew immediately by 0.5%, although a month earlier the growth was 0%.

In addition, the University of Michigan consumer confidence index was also higher than forecast at 99.3, reflecting increased consumer confidence in the economy and a desire to spend money rather than save it. Of course this has a positive effect on the general state of the US economy. Thus, the dollar’s rise on Friday was due to positive statistics.

There will be much less news this week, which in principle is not surprising, since Christmas week has begun, and then immediately after which the New Year will follow. Thus, a small amount of news and falling activity of the currency market are absolutely normal aspects for this period of the year.

Today in America there will be a report on orders for durable goods, which are distinguished by their high cost, and therefore have a strong impact on the country economy. Markets expect the main indicator to grow by 1.9% in November and if the forecast comes true, this will contribute to a further increase in the US currency as Christmas week begins and immediately after which New Year’s will follow.

Thus General conclusions and recommendations:

The Euro-Dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend selling the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci.

An unsuccessful attempt to break through the 61.8% level may lead to quotes moving away from the lows reached, after which I still expect a new fall of the instrument.

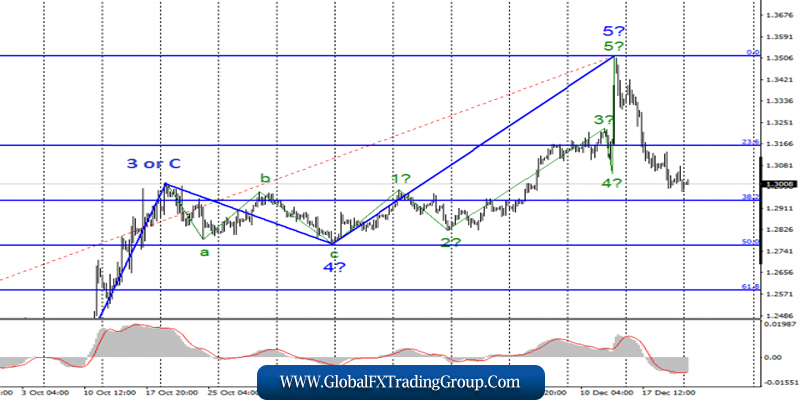

GBP / USD

The GBP / USD pair did not lose or gain a single base point on December 20. During the day, quotes of the pair went up 80 points, but by the end of the day returned to their original positions. Thus, the alleged first wave of a new bearish trend continues its construction.

An unsuccessful attempt to break the 1.2940 mark, which corresponds to 38.2% Fibonacci, will indicate the completion of this wave and the market’s readiness to build wave 2 or b . Based on the current wave markings, the prospects for the pound are only bearish.

Fundamental component:

The news background for the GBP / USD instrument on Friday was extremely important. By and large, only one event of the day attracted all the attention of the traders and this is a vote in the British Parliament on a deal between Boris Johnson and the European Union.

Earlier, on its previous composition, the Parliament rejected various versions of the agreement with the EU at least 6 times. In order to successfully carry out his own version of the agreement, Boris Johnson held early parliamentary elections and won a resounding victory, which allowed him to gain the required number of votes on December 20.

Parliament approved the deal with the EU, however by January 31, Britain will leave the EU while formally remaining for almost a year in the bloc. After January 31, a transitional period will begin, designed to reduce the negative impact on the economies of the EU and Britain from an immediate and instant gap.

General conclusions and recommendations:

The Pound / Dollar tool continues to build a new downtrend. I recommend continuing to sell the instrument with targets near 1.2943, which roughly corresponds to the 38.2% Fibonacci level. An unsuccessful attempt to break through the 38.2% level will lead to the construction of a correctional upward wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom