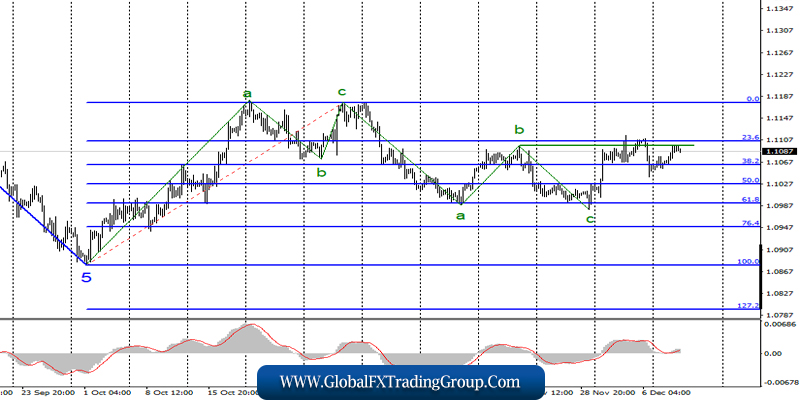

EUR / USD

On December 10, the EUR / USD pair completed with an increase of 30 basis points and returned to the maximum of wave b again, as well as to the level of 23.6% Fibonacci. Thus, the wave pattern remains not completely unambiguous and allows various options for further movement of the instrument.

A successful attempt to break the level of 1.1105 will indicate the willingness of traders to continue building the upward trend section. On the other hand, a new unsuccessful attempt to break the level of 1.1105 can transfer the instrument again to building a bearish trend section, which can significantly complicate its internal structure.

Fundamental component:

On Tuesday, there was no news background for the euro-dollar instrument. Today, markets will focus entirely on news from America. First, an important economic report on inflation will be released, and according to market expectations, the level may rise from 1.8% to 2.0%.

Thus, today, the markets can again begin to buy the dollar, since rising inflation is a very strong strengthening factor for the US currency in the current conditions. It is with weak inflation that the Fed’s main concerns about the country’s economic growth were associated.

Moreover, it is with weak inflation that the EU continues to struggle unsuccessfully. The next event of the day will be even more significant than the first due to the two-day Fed meeting. The results of which will be summed up tonight.

Therefore, the range of the target interest rate is expected to remain unchanged, from 1.5% to 1.75%. In addition, the synopsis of the economic forecast from FOMC is expected. The Fed’s President press conference is scheduled for 19:30 Universal time.

The significance of the current Fed meeting is characterized as moderate and the unchanged interest rate following the meeting has a probability of 99%. Thus, more attention will be paid to FOMC forecasts and Jerome Powell’s presentation.

At the same time, Powell’s statement can cover many topics related to the US economy. The only question is whether he will focus on weak indicators of industrial production, business activity in the manufacturing sector and the threats of protecting policies, global trade conflicts, or, conversely, will talk about the strength of the US economy, good GDP growth and low unemployment.

General conclusions and recommendations:

The euro-dollar pair supposedly completed the downward trend. Thus, I recommend buying an instrument with targets near the calculated level of 1.1176, which equates to 0.0% Fibonacci. However, I also recommend waiting for a successful attempt to break through the peak of wave b before this and the level of 23.6% Fibonacci.

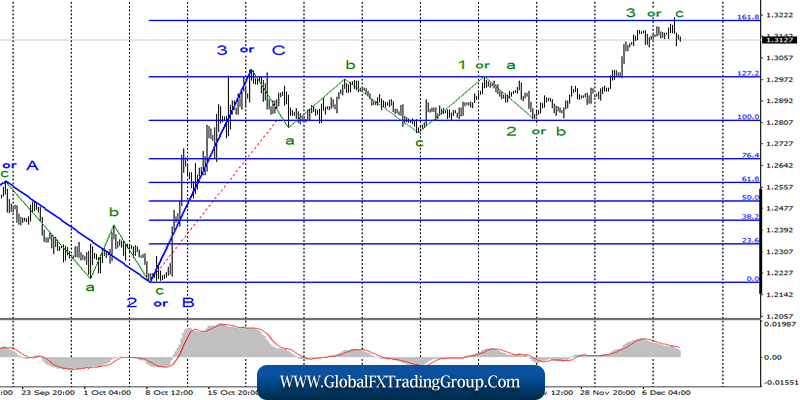

GBP / USD

On December 10, the GBP / USD pair scored several more points, made an unsuccessful attempt to break through the Fibonacci level of 161.8%, and began to move quotes away from the highs reached.

Based on the current wave markings, there is every reason to believe that wave 3 or c has completed its construction, and the future of the instrument will now entirely depend on the results of the UK elections, which will become known on Friday morning or during the day.

If the election results impress the markets, a new attempt will be made to break through the 161.8% Fibonacci level and, if successful, the construction of the upward trend section will continue.

Fundamental component:

On Tuesday, the news background for the GBP / USD instrument was noticeable. However, the markets are still only thinking about the upcoming elections. Moreover, economic reports in the UK have shown a deterioration in the country’s economic condition once again.

Thus, the political chaos and incompleteness of Brexit continue to be felt. GDP in October did not grow by ten points, although markets expected growth by at least 0.1% m / m. Compared to October 2018, industrial production decreased by 1.3% y / y, which is also worse than forecasted. The pound, of course, fell back from its highs, but rather the withdrawal did not occur due to weak statistics.

In turn, the markets entered the final stage of preparation for voting and vote counting, partially closed their purchases, since at least the Conservative Party is likely to win, but surprises are also possible. Thus, economic data continues to “pass” the markets. Now, everyone is waiting for the triumph of Boris Johnson.

There is a high degree of probability that the Prime Minister will be defeated in the elections which will lead to the completion of the construction of the upward trend section and the beginning of a new downward trend.

General conclusions and recommendations:

The pound/dollar instrument continues to build an upward trend. Thus, I recommend considering closing purchases around the calculated level of 1.3201, which is equivalent to 161.8% Fibonacci.

On the other hand, a successful attempt to break through this level will allow us to continue to buy the British currency with targets located at about 1.3437, which corresponds to 200.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom