EUR/USD

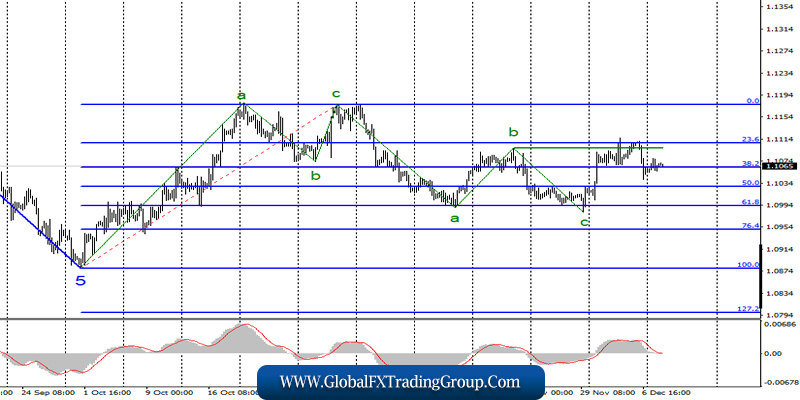

On December 9, EUR/USD ended with a rise of just a few basis points. Thus, the current wave marking has not changed at all over the past day and still assumes the construction of an upward trend section.

However, two unsuccessful attempts to break the Fibonacci level of 23.6% also speak in favor of a possible resumption of the construction of a downward trend.

The working option is still to build an upward set of waves, but for the pair’s purchases, I recommend waiting for the breakout of the mark of 1.1107.

Fundamental component:

There was no news background for the euro-dollar instrument on Monday. Today, the news calendar is also not full of economic reports, although something will still happen. ZEW Institute for business sentiment indices in Germany and ZEW economic sentiment index for the European Union.

These reports are unlikely to trigger more activity in the markets ahead of the ECB and Fed meetings. The currency market has already focused on these events. Therefore, we should pay more attention to these events. The outlook for the euro is something that traders have been discussing for a long time.

The EU economy continues to show signs of a slowdown. Even when inflation or business activity indices rise slightly, no one thinks that the recession is over. Inflation has grown, according to the latest data, to 1.0%, but this is a very low value. Business activity in the manufacturing sector improved slightly but remained behind the red line of 50.0.

Christine Lagarde, who will hold her first ECB meeting, has already hinted at the weakness of the EU economy. Consequently, markets may well expect it to act in the direction of easing monetary policy or expanding the quantitative easing program.

Or at least statements during a press conference about the intention to continue to stimulate the EU economy. In any case, this is bad news for the euro. From the Fed, nothing like this can be expected, most likely, Jerome Powell, on the contrary, noted the good state of the labor market and satisfactory growth rates.

General conclusions and recommendations:

The euro-dollar pair is expected to have completed the downward trend. Thus, I recommend buying a tool with targets located near the estimated mark of 1.1176, which equates to 0.0% Fibonacci. However, I also recommend waiting for a successful attempt to break the peak of wave b before this and the Fibonacci level of 23.6%.

GBP/USD

The GBP/USD pair gained several points on December 9, and the currency market activity was not much higher than the EUR/USD pair. Thus, as in the first case, no changes or additions to the current wave markup has not suffered.

The expected wave 3 or C continues to build with targets near the Fibonacci level of 161.8%. An unsuccessful attempt to break this mark can lead to the completion of the construction of wave 3 or C and even the entire upward section of the trend.

This event may coincide with another equally important event – the elections in the UK. If Boris Johnson’s party wins, the chances of breaking the level of 161.8% will increase significantly.

Fundamental component:

The news background for the GBP/USD instrument on Monday was quite weak. This is also indirectly indicated by the activity of the market. However, markets are now fully focused on the upcoming election and the latest performances of Boris Johnson and Jeremy Corbyn.

Today, the UK has already released reports on GDP for October (0.0%), as well as on industrial production in October (-1.3% y/y). As you can see, both reports showed negative dynamics and did not meet market expectations. But, as we can see, the pound did not begin to decline, and the markets did not start selling the British currency.

This only proves once again that the markets are now fully focused on the parliamentary elections and do not want to pay attention to other news, especially economic reports. In such a situation, we can only wait. Waiting for the election, waiting for the election results, the rest of the news background, including, by the way, the Fed meeting, all this may also not cause any response from the forex market.

General conclusions and recommendations:

The pound/dollar tool continues to build an upward trend. I recommend on the approach to the estimated mark of 1.3201, which equates to 161.8% Fibonacci, consider closing purchases. At the same time, a successful attempt to break this mark will continue to buy the British currency until December 12 and 13.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom