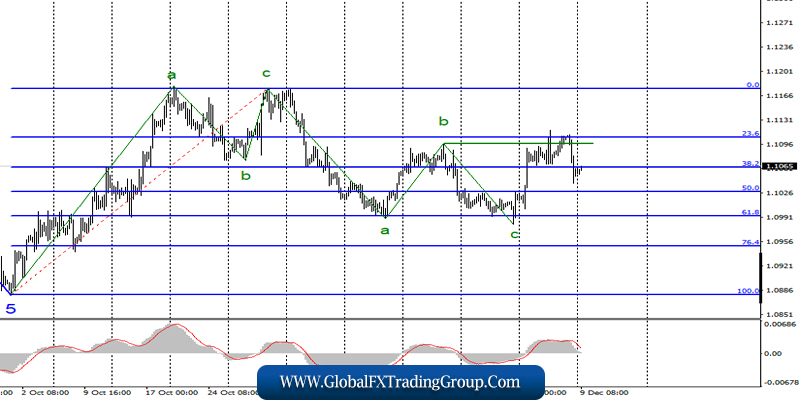

EUR / USD

On December 6, the EUR / USD pair completed lowering by 45 basis points. Thus, two attempts were immediately made to break through the maximum of wave b which ended successfully, while immediately two attempts to break through the 23.6% Fibonacci level ended in failure.

Thus, the instrument began to move quotes away from the highs reached and failures near the level of 1.1107, which allow us to expect the resumption of building a bearish trend section with a complicated internal wave structure. At the same time, the wave pattern can be seriously confused and require corrections and additions at any time.

Fundamental component:

On Friday, the news background for the euro-dollar instrument was quite extensive, although all the most important reports came out in only one country, the United States.

Most of all, markets were interested in the Nonfarm Payrolls report, which displays the number of jobs created outside the agricultural sector for the reporting period. It is this indicator that best reflects the state of the American labor market, which is very closely paid by the government and the Fed. So, the number of Nonfarms was as much as 266,000 in November.

This figure looks really impressive against the background of the previous value of 128,000 and the forecast of 180,000. Thus, the purchase of the US dollar in the second half of Friday is not surprising. In addition to the Nonfarm report, salary data was also released in November, which also exceeded market expectations (+ 3.1% y / y), and unemployment, which fell to a record 3.5% in November.

Thus, the entire package of news and reports on Friday was excellent support for the American currency and for sellers of the instrument. The perspectives of the instrument remain the same. In addition, the construction of an ascending set of waves remains a working option despite the instrument moving away from the reached highs.

However, I recommend waiting for a successful attempt to break through the 23.6% Fibonacci level to confirm the execution of this particular option. This week will be very busy in terms of economic reports and the news background. It will host meetings of the ECB and the Fed, as well as several very important reports from the United States and the European Union.

Thus, the activity of the currency market should be on top, although the euro-dollar instrument is unlikely to stand still.

General conclusions and recommendations:

The euro-dollar pair supposedly completed the downward trend. Thus, I recommend buying an instrument with targets near the calculated level of 1.1176, which equates to 0.0% Fibonacci. However, I also recommend waiting for a successful attempt to break through the peak of wave b before this and the level of 23.6% Fibonacci.

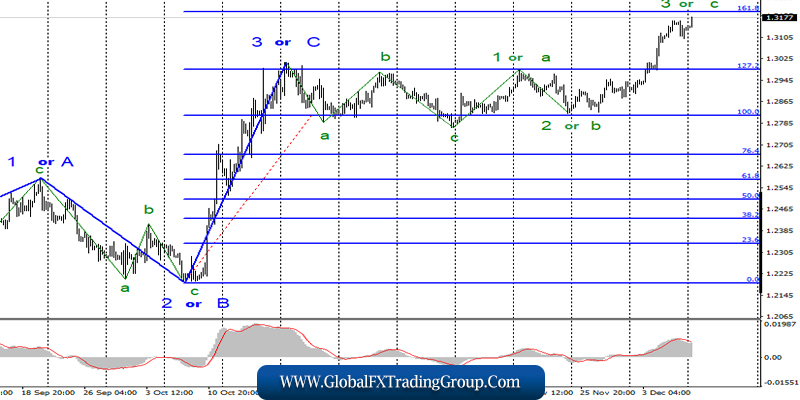

GBP / USD

On December 6, the GBP / USD pair lost several tens of points, which did not affect the current wave counting in any way. Thus, the construction of the expected wave 3 or C with the goals located near the estimated level of 1,3201, which corresponds to 161.8% Fibonacci, continues.

On the other hand, an unsuccessful attempt to break through this level may lead to a departure of quotes from the highs reached and the completion of wave 3 or C. In addition for the pound-dollar instrument, a lot of things that will occur this week will depend on the results of the parliamentary elections, which will be held on December 12, that is, this Thursday.

Fundamental component:

On Friday, the news background for the GBP / USD instrument was exactly the same as for the EUR / USD pair. However, if the markets won back all the economic information from America in the second case, then in the first case, they simply continued to buy the pound sterling, continuing to be optimistic about the future, or rather, the near future, which now comes down to the dates of December 12 and 13, when early elections will be held to Parliament and summarizing their results. For the pound, the time comes X.

If the Conservative Party gains the required number of votes and wins, the purchases of the pound that we have seen in recent weeks and months will not be in vain. However, if the advantage of the conservatives in the Parliament is ambiguous, it will cast doubt on Brexit again at the end of January and increase the chances of a second referendum and another postponement of Brexit’s date.

All of these are bearish factors for the pound, so in this case, the upward section of the trend can complete its construction, and the instrument can move to a long decline, since it is not difficult to predict the disappointment of the markets in this case.

General conclusions and recommendations:

The pound / dollar instrument continues to build an upward trend. Thus, I recommend to consider closing purchases, on the way to the estimated level of 1.3201, which is equivalent to 161.8% Fibonacci. At the same time, a successful attempt to break through this level will continue to allow buying British currency until December 12 and 13.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom