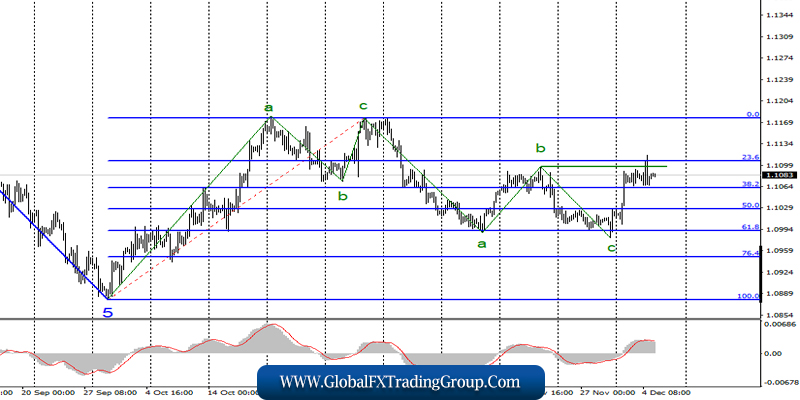

EUR / USD

On December 4, the EUR / USD pair ended with a decrease of 5 basis points, although the instrument increased by 40 points during the day. Thus, an attempt to break through the wave maximum b ended in failure, which casts doubt on the continuation of the euro-dollar instrument increases and the construction of a new upward trend section.

In addition, an attempt to break through the 23.6% Fibonacci level was unsuccessful. Thus, I believe that the probability of resuming the construction of a complicated downward trend section is increasing. More so, I do not recommend buying the instrument until a successful attempt to close above 23.6%.

Fundamental component:

On Wednesday, the news background for the euro-dollar instrument was quite interesting and strong. Basically, all economic data reflected the levels of business activity in the services sectors of the European Union, EU countries and America. As it turned out, business activity in Germany and Spain increased, while it decreased in France and Italy, but all indices remained above 50.0.

Thus, there is no cause for concern yet. However, there are reasons for concern regarding statistics from the United States. The ADP report on changes in the number of employees showed an increase of only 64K against market expectations of 140K.

This report turned out to be weak in itself and now gives reason to assume a weak report on Nonfarm Payrolls on Friday, which could trigger a much stronger reaction of the markets in the form of US dollar sales.

In addition, business activity in the service sector according to ISM decreased in America (54.7 – 53.9) in November, which also slightly upset the markets. Today, the euro will have another opportunity to begin to build an upward trend section, as reports on GDP and retail sales fall into the category of quite important, although the euro needs strong numbers.

If the values of the reports do not exceed market expectations (+ 1.2% y / y in GDP and + 2.2% y / y in sales), then you should not expect a rise in the European currency today.

General conclusions and recommendations:

The euro-dollar pair supposedly completed the downward trend. Thus, I now recommend to buy the instrument with targets located near the calculated level of 1.1176, which equates to 0.0% Fibonacci. However, I also recommend waiting for a successful attempt to break through the peak of wave b or the level of 23.6% Fibonacci, before this.

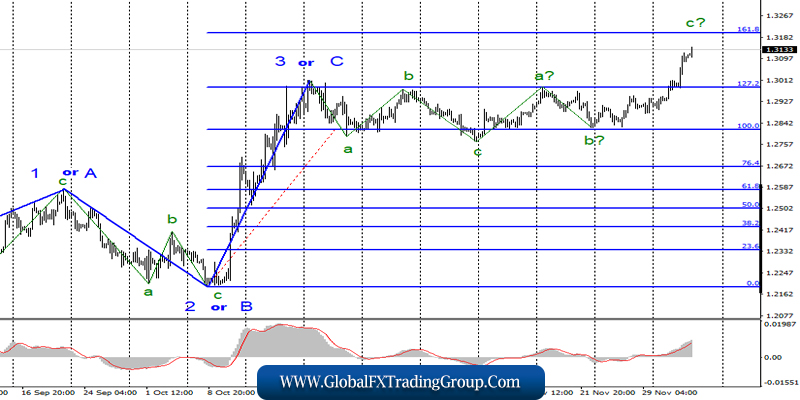

GBP / USD

On December 4, the GBP / USD pair gained about 110 basis points, and presumably remains within the framework of constructing the proposed wave c. Thus, the upward trend section, which may well now take the form of the 5th wave and is defined at the upper level as wave 5.

If the current wave marking is correct, then the construction of the proposed wave 3 or C can be completed near the Fibonacci level of 161.8%. On the other hand, an unsuccessful attempt to break through this level will indicate exactly that. At the same time, much will depend on the results of the December 12 parliamentary elections, which can radically change the mood of the currency exchange market. There is only 1 week before the election.

Fundamental component:

On Wednesday, the news background for the GBP / USD instrument was quite insufficient. In Britain, there was only one economic indicator – business activity in the service sector, which increased slightly in November and amounted to 49.3, which is below the level of 50.0, and leaves the entire region in a state of decline.

However, the Prime Minister Boris Johnson continues to make promises and agitate the country’s population for the Conservative Party. Boris Johnson’s latest promises relate to holding Brexit within 100 days after winning the election and tax cuts.

In addition, the conservative leader promises to increase government attention to immigration and security issues, as well as increase funding for educational institutions. He also said that it was time for the British population to make a choice “either the government of the working majority, or the next non-working Parliament.”

General conclusions and recommendations:

The pound / dollar instrument continues to build an upward trend. A successful attempt to break through the 127.2% Fibonacci level indicates the readiness of the instrument to continue to increase with targets located near the calculated level of 1.3201, which equates to 161.8% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom