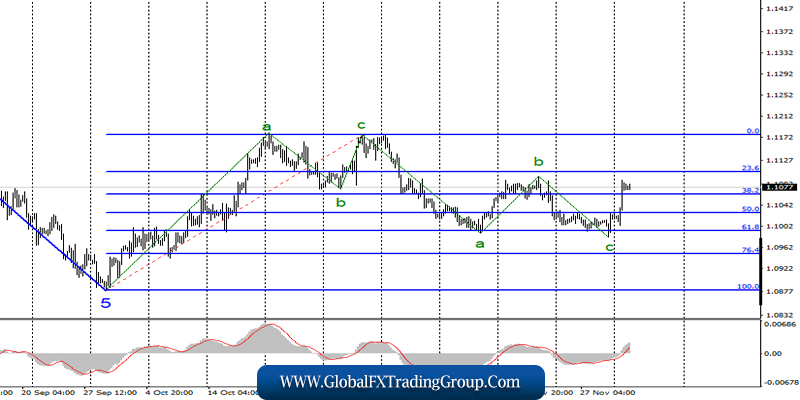

EUR / USD

On December 2, the EUR / USD pair completed an increase of 55 basis points. Thus, the wave marking of the instrument has undergone certain changes. An unsuccessful attempt to break through the 61.8% Fibonacci level indicated that the markets were not ready to further reduce the euro-dollar instrument.

Thus, the trend section, which began on October 31, has acquired a 3-wave form and is considered completed at the moment. If this assumption is true, then the increase in quotes will continue with targets located around the 12th figure within the framework of a new, at least three-wave, upward section of the trend.

Fundamental component:

On Monday, the news background for the euro-dollar instrument was strong enough. There was a speech by Christine Lagarde, and Trump’s new criticism of the Fed President Jerome Powell, and Trump’s introduction of new duties, and economic reports in the European Union and the United States.

Perhaps, most attention in the markets was caused precisely by the actions and statements of the US president. If the information about Jerome Powell’s criticism didn’t particularly affect the course of the trading (Donald Trump reiterated that rates should be cut as soon as possible and as much as possible), then the news of the introduction of trade duties on steel and aluminum imports from Brazil and Argentina had the effect of exploding bombs on the currency market.

Within a few hours, the euro (and other currencies except the pound) rose paired with the dollar by no less than 70-80 basis points. Thus, the American president continues to spoil relations with America’s trading partners, believing that absolutely everything is not fair to his country, and specially lower their monetary units in order to have a more positive trade balance with America.

On the other hand, the rest of the news of the day did not cause such a strong reaction, although they were in favor of the euro currency (this has not happened for a long time). Indices of business activity in the manufacturing sector of the European Union and France, Germany, Italy and Spain separately showed higher values than the markets expected to see, giving hope for the completion of the decline in this area in the Eurozone.

At the same time, the American index of business activity in the production of ISM was weaker than market expectations and amounted to only 48.1.

General conclusions and recommendations:

The euro-dollar pair supposedly completed the downward trend. Thus, now, I recommend buying the instrument with targets located near the calculated level of 1.1176, which equates to 0.0% Fibonacci. Moreover, I expect the construction of at least three waves up.

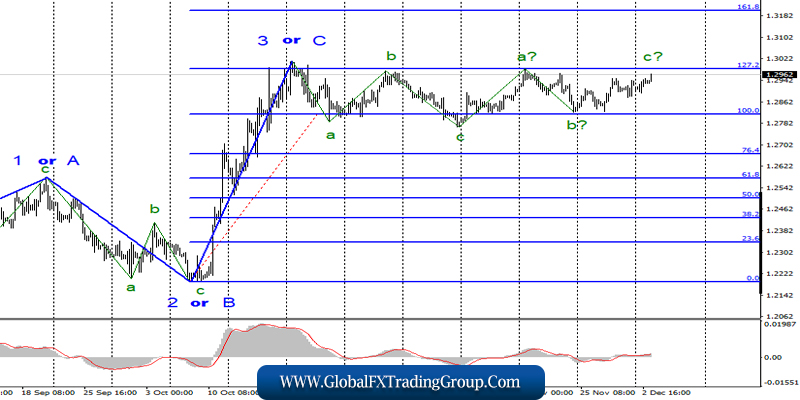

GBP / USD

On December 2, the GBP / USD pair gained about 30 basis points, and presumably remains within the framework of constructing the alleged wave c, three wave correction section of the trend.

The previous wave marking has undergone minor changes, as the option with building the e wave has disappeared due to too long as the instrument stay away from the Fibonacci level of 100.0%.

However, the current wave marking suggests an early completion of the upward wave, around the Fibonacci level of 127.2% again. An unsuccessful attempt to break through this level may lead to a departure of quotes from the reached highs and the construction of a new bearish section of the trend.

Fundamental component:

On Monday, the news background for the GBP / USD instrument was about the same as other instruments, as the American president was the main newsmaker of the day. However, the markets chose to stay away and not react to what was happening instead of working out information related to the introduction of new duties by the White House.

In the UK, an index of business activity in the manufacturing sector for November was released, which could also cause a more serious increase in the British currency than 30 points. The total value was 48.9, which is better and higher than the expectations of the market. Today, the only report will come is from Britain only which could cause interest in the currency exchange market.

We are talking about business activity in the construction sector, which may also improve slightly in November, but will still remain below 50.0. Thus, the main focus today is at the Fibonacci level of 127.2%, from which the instrument can rebound and complete the construction of three waves up. The news background continues to have only a weak effect on the markets and, as a result, the pound-dollar instrument.

General conclusions and recommendations:

The pound-dollar instrument continues to build the correctional part of the trend. Thus, now, I still expect the pair to decline to 1.2770 after the MACD signal “down” or after an unsuccessful attempt to break through the 127.2% Fibonacci level.

I recommend buying a pair no earlier than a successful attempt to break through the Fibonacci level of 127.2%, which will indicate the willingness of the markets to further increase quotes, but in this case, I recommend using Stop Loss below the level of 127.2%.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom