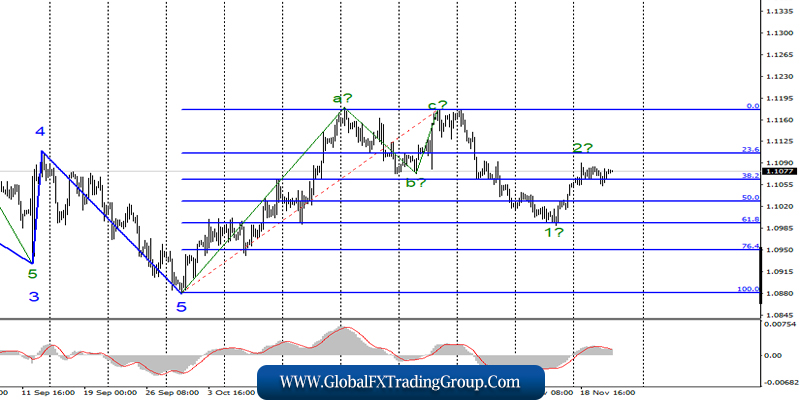

EUR / USD

November 20 ended for the pair EUR/USD with the loss of only a few basis points, and the activity of the currency market remains extremely low. Thus, I still assume the completion of the construction of the alleged wave 2 as part of the downward trend section.

If this is true, then the decline in quotations will resume today or tomorrow with targets located below the 10th figure in the framework of wave 3. In the future, the instrument may decline to the 9th figure, where the current trend section may end if it assumes a 3-waveform.

Fundamental component:

On Wednesday, the news background for the euro-dollar instrument came down only to the evening minutes of the last meeting of the Federal Reserve System.

However, from the very beginning, the markets did not assume that the content of the “minutes” would be very different from the announced results at the meeting itself and Jerome Powell’s rhetoric at the press conference of the last meeting and at all subsequent speeches. They were right.

Fed officials believe that further reduction of the key rate will not be required unless a significant deterioration in the economic situation in the United States occurs. According to Powell and other FOMC members, reducing the rate to 1.5% – 1.75% is enough to maintain a strong labor market and continue to keep inflation at around the 2.0% level.

Moreover, the Fed also notes the stability of economic forecasts, which are not reduced despite global geopolitical risks and recession risks. The document also notes that new signs of a slowdown in world economic growth make us fear for a rise in the United States.

The risks of lower investment in the business, industry and export may negatively affect the hiring of new employees. General conclusions and recommendations: The euro-dollar pair continues to build the proposed wave 2.

Thus, I now recommend to wait for its completion (its goals are now below 1.1106, which is equivalent to 23.6% Fibonacci) and sell the instrument again with targets near the calculated levels of 1.0993 and 1.0951, which is equivalent to 61.8% and 76.4 Fibonacci. Meanwhile, the MACD indicator signal “down” may indicate the readiness of markets for the sale of the instrument.

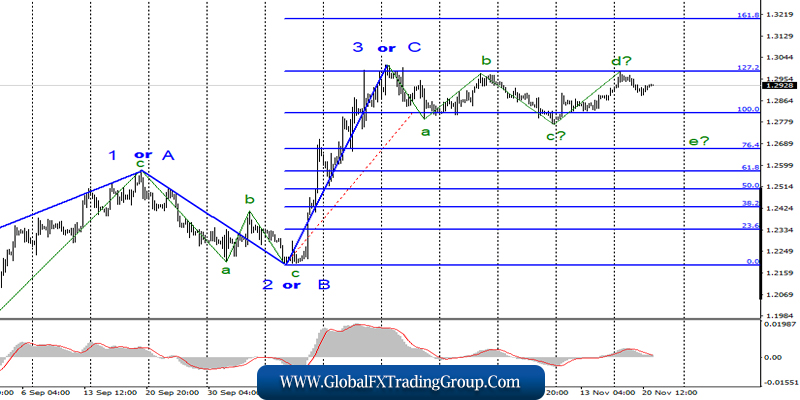

GBP / USD

On November 20, the pair GBP/USD did not add or lose a single basis point. Thus, an unsuccessful attempt to break through the 127.2% Fibonacci level may mean the completion of the construction of the alleged wave d and the transition of the pound-dollar instrument to the construction of wave e.

If this is true, then the decline in quotations will continue from current positions with targets located near the low of the wave from (1.2770) or slightly lower. Meanwhile, the breakdown of the level of 1.2987 marks the readiness of the market to complicate the upward trend of the trend, which is currently considered completed.

Fundamental component:

On Wednesday, the news background for the GBP/USD instrument was completely absent. From time to time, more or less interesting information is received about the course of the election campaign of a particular party, or Boris Johnson or Jeremy Coryin will make a speech.

However, that news flow concerning Brexit, Parliamentary meetings, adoption of important decisions in the Parliament, negotiations with The European Union regarding the agreement on Brexit, has dried up. And as a result, we have a situation this week in which there are no economic reports in either the UK or the United States.

In addition, news from politics does not have the necessary degree of importance for demand for the dollar or pound to increase, and wave marking involves the construction of a horizontal section of the trend. All three main factors speak in favor of the continuation of the movement in the range 1.2770 – 1.2980.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of the upward trend section.

Thus, only a successful attempt to break through the level of 1.2986 can complicate this part of the trend and become the basis for new purchases of the instrument with targets located near the calculated level of 1.3199, which equates to 161.8% Fibonacci. On the other hand, the development option provides for a decline to around 1.2770.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom