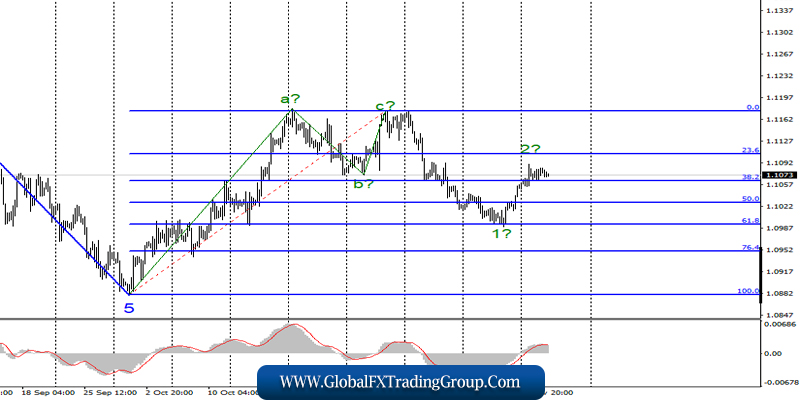

EUR / USD

November 19 ended for the pair EUR / USD with an increase of 5 basis points. Thus, the instrument still shows signs of readiness to complete the construction of the proposed wave 2 as part of the downward trend section.

If this assumption is correct, then the decline in quotations will resume today or tomorrow with goals located below 10th figures. In the future, the instrument may decline to the 9th figure, where the current trend section may end if it assumes a 3-waveform.

Fundamental component:

The news background for the euro-dollar instrument was absent on Tuesday as it was on Monday. However, markets continue to expect two key events this week, which may, however, be very disappointing. It is about the minutes of the Fed, which will be released late tonight, and the speech of the ECB chairman Christine Lagarde.

With the Fed’s minutes, everything is more or less clear, since this document will contain the final summing up of the last meeting. But with the speech of Christine Lagarde, everything is much more interesting. In the last months of the reign of Mario Draghi, many members of the Council began to experience dissatisfaction with the methods of work of the chairman.

The ECB has begun to split. Mario Draghi blamed the tendency to make decisions independently, not taking into account the opinions of many heads of central banks of the EU countries. It was Draghi’s latest decisions to lower the deposit rate and announce a monthly asset buyback of € 20 billion that caused the greatest resonance.

It was reported that more than a third of the members of the Governing Council were against such a move. Christine Lagarde, as many experts believe, will try to establish relations with the Board of Governors, and thus, monetary policy can begin to move in a different direction than it did under Mario Draghi.

Thus, the performance of Christine Lagarde will be very interesting. Monetary policy may begin to move in a different direction than it did under Mario Draghi. General conclusions and recommendations: The euro-dollar pair continues to build the proposed wave 2.

Thus, I now recommend to wait for the completion of wave 2 (its target is now about 1.1106, which is equivalent to 23.6% Fibonacci) and sell the instrument again with targets near the estimated levels of1.0993 and 1.0951, which equates to 61.8% and 76.4 Fibonacci. Meanwhile, the MACD indicator signal “down” may indicate the readiness of markets for instrument sales.

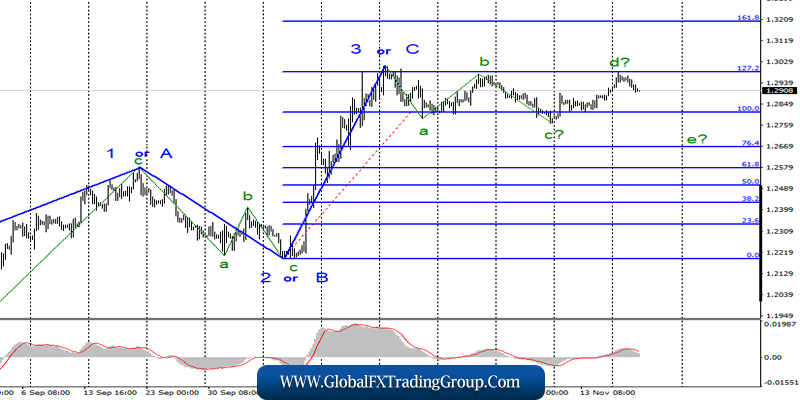

GBP / USD

On November 19, the GBP / USD pair lost about 25 basis points, which is still fully consistent with the current wave markings. Thus, an unsuccessful attempt to break through the 127.2% Fibonacci level may mean the completion of the construction of the alleged wave d and the transition of the pound-dollar instrument to the construction of wave e.

If this assumption is true, then the decline in quotations will continue with targets located near the low of the wave from (1.2770) or slightly lower. The breakdown of the level of 1.2987 will indicate the readiness of the market to complicate the upward trend of the trend, which is currently considered completed.

Fundamental component:

There was no news background for the GBP / USD instrument on Tuesday. Thus, the markets could just pay attention to just a few interesting messages that hit the media yesterday. The first of these concerns Donald Trump’s reminder to impose additional duties on imports from China, if the transaction is not concluded between the parties.

The second concerned the results of the debate between the leader of the Conservative Party Boris Johnson and the leader of the Labor Party, Jeremy Corbyn, who, according to many, did not reveal the winner. Thus, I believe that the pound fell yesterday more under the influence of wave markings, which suggested such a decrease, than under the influence, for example, of the results of the debate.

Now, the pound-dollar markets are waiting for the election and Brexit, all other news and economic reports are not of interest. General conclusions and recommendations: The pound / dollar instrument supposedly completed the construction of the upward trend section.

Thus, only a successful attempt to break through the level of 1.2986 can complicate this part of the trend and become the basis for new purchases of the instrument with targets located near the calculated level of 1.3199, which equates to 161.8% Fibonacci. The working option, in turn, provides for a decline to the level of 1.2770.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom