EUR / USD

November 18 ended for the pair EUR / USD with an increase of 20 basis points. Thus, the instrument made a successful attempt to break through the 38.2% Fibonacci level and continues to build the estimated wave 2.

If the current wave marking is correct, then the decline in quotations will resume as part of the construction of the alleged wave 3 of the bearish trend section in the near future.

An unsuccessful attempt to break through the 23.6% Fibonacci level will indicate the readiness of the currency market to reduce the instrument.

Fundamental component:

There was no news background for the euro-dollar instrument on Monday.

After quite interesting and plentiful on various fundamental events of the past week, there are few interesting news this week, at least on the calendar.

Yesterday, we can only note the meeting of Donald Trump and Jerome Powell at the residence of the American president, which, as it seems, was not planned.

As both sides of the negotiation process stated, the meeting turned out to be “sincere,” despite the fact that it was preceded by a year-long criticism of Powell by the US president. It seemed that both sides were a little disingenuous, stating that the meeting was almost friendly.

Moreover, what was discussed at this meeting will also remain a mystery, covered in darkness. After all, this meeting is of interest to the market, primarily because of the possible actions of the Fed to change the key rate. It’s no secret that Trump wants the rate to be 0% or even lower.

Trump, along with the Fed, does not support Trump’s desire and is going to “respond to the economic situation in the United States.” However, as I said, no news specifically about the Fed’s key rate was followed. And today, the news background will be empty again, according to the calendar of economic events.

General conclusions and recommendations:

The euro-dollar pair continues to build the proposed wave 2. Thus, I now recommend to wait for the completion of wave 2 (its target is now about 1.1106, which is equivalent to 23.6% Fibonacci) and sell the instrument again with targets near the estimated levels of 1.0993 and 1.0951, which equates to 61.8% and 76.4 Fibonacci.

The MACD indicator signal “down” may indicate the readiness of markets for instrument sales.

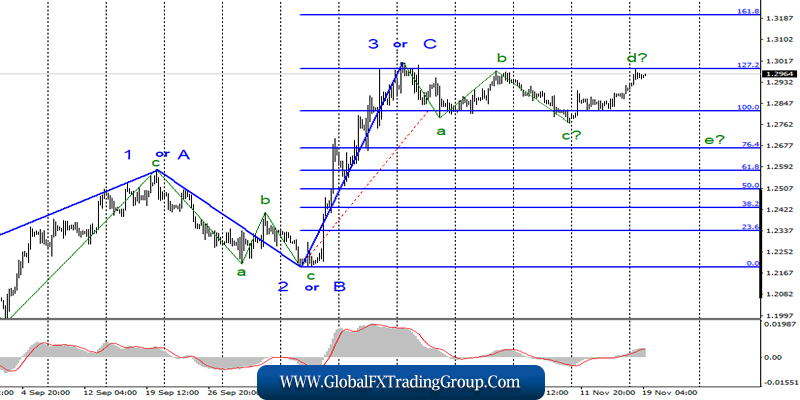

GBP / USD

On November 18, the GBP / USD pair gained about 45 basis points, which is still fully consistent with the current wave marking, and which involves the construction of wave d. The only thing is that the instrument has already exceeded the area that I designated as the target (1.2900 – 1.2950), but this way, perhaps, is even better.

A failed attempt to break through the Fibonacci level of 127.2% eloquently indicates the willingness of the markets to sell the pound / dollar instrument, and a successful attempt to break through indicates the willingness of the currency market to further purchase the instrument with additions to the current wave marking, since in this case the trend section, after November 8, will be identified as the 5th wave of the upward trend section.

Fundamental component:

There was no news background for the GBP / USD instrument on Monday. Although there are few posts regarding the Conservative Party’s growing ratings ahead of the parliamentary elections and that’s all. However, even such news (interviews with leaders of political parties in the UK, comments from Boris Johnson and leaders of the European Union) now do not particularly affect the mood of the currency market.

Greater importance is now given precisely to the wave pattern. The campaign statements and promises of the Labor, Conservatives, Brexiters, Scots and other political parties are certainly interesting, but not for the British pound, which is so interested in Brexit (for which there is no news right now) that it does not even pay any attention to the most important economic reports from the UK that overwhelmed the past week.

Thus, I will monitor the behavior of the pound-dollar instrument near the level of 127.2% Fibonacci and from this, I recommend to draw conclusions and further trading strategies. General conclusions and recommendations: The pound / dollar instrument supposedly completed the construction of the upward trend section.

Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of this area, its transformation into a 5-wave one and become the basis for new purchases of the instrument with targets located near the calculated level of of 1.3199, which equates to 161.8% Fibonacci.

At the same time, the trend section after October 21 takes a horizontal view, which allows us to expect a decrease in the instrument to area of the 27th figure.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom