EUR / USD

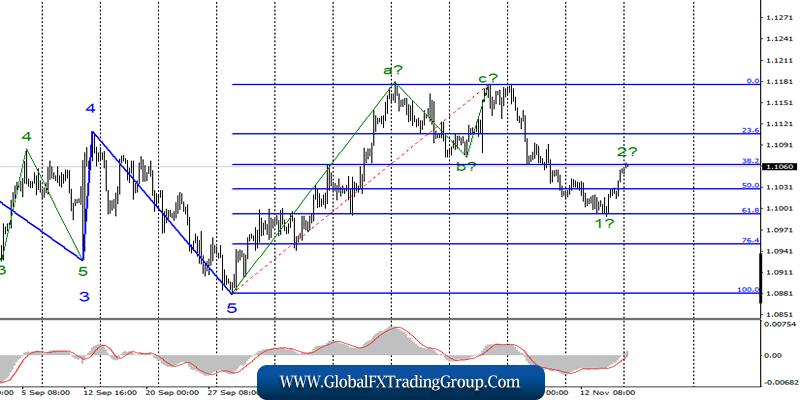

November 15 ended for the pair EUR / USD with an increase of 30 basis points. Thus, the instrument remains within the framework of constructing the alleged wave 2 with targets located just around the 38.2% Fibonacci level.

An unsuccessful attempt to break through the 38.2% level may lead to the completion of the construction of correctional wave 2 and the transition of the instrument to decrease within the framework of wave 3 of the bearish trend section. A successful attempt to break through the 38.2% level will complicate wave 2.

Fundamental component:

On Friday, the news background for the euro-dollar instrument was quite interesting. Firstly, we found out that inflation in the European Union remains at the same low and weak values that the European Central Bank does not allow to state the completion of the recession.

In October, the consumer price index was only 0.7% y / y and 0.1% m / m. The basic consumer price index, which does not take into account changes in energy prices for food products, amounted to 1.1% y / y. In America, reports on retail sales and industrial production came out and left a double impression.

Retail sales including auto sales in October grew by 0.3%, which is higher than expectations of the currency exchange market. However, industrial production in October declined immediately by 0.8%, which also indicates a recession. With such a news background, we could equally see how the increase, so the decline of the instrument.

But since the wave pattern suggested the construction of an upward wave, the markets decided to continue buying euro-currencies. At the same time, the news background will be absent on Monday which is a good time to turn down around the 38.2% Fibonacci level.

General conclusions and recommendations:

The euro-dollar pair has completed the construction of the first wave as part of a new downward trend and is nearing the completion of wave 2.

Thus, now, I recommend to wait for the completion of wave 2 (its target is about 1.1062, which equates to 38.2% Fibonacci, or slightly higher) and sell the instrument with targets near the calculated levels of 1.0993 and 1.0951 again, which equates to 61.8% and 76.4 Fibonacci.

The MACD indicator signal “down” may indicate the readiness of markets for instrument sales.

GBP / USD

On November 15, the GBP / USD pair gained only 20 basis points, which is still fully consistent with the current wave marking, which involves the construction of wave d with targets located between 1.2900 and 1.2950.

If the current wave marking is correct, then the construction of this wave will be completed soon, and the instrument will proceed to the construction of a bearish wave e.

A successful attempt to break through the 127.2% Fibonacci level will cast doubt on the execution of the working version with a horizontal trend section and indicate the readiness of the markets to build the rising wave 5, and the trend section, which starts on August 12, will take a 5-wave form.

Fundamental component:

On Friday, the news background for the GBP / USD instrument was rather weak. However, the report on industrial production in the US supported the pound, which continued to rise slowly. There is not much political news from Great Britain now, and according to Brexit, not one at all.

This is only due to the fact that the country is preparing for the fateful parliamentary elections, and all other issues and processes are now paused.

From time to time, information is received about the progress of the election race. For example, that the ratings of the Conservative Party, led by Boris Johnson, are growing, and the Labor Party is significantly behind them. However, it is unlikely that this information can somehow be used in trading pairs.

In addition, the markets did not pay due attention last week to a whole series of economic reports from the UK, although this factor does not affect the pound-dollar instrument now. Thus, now, I recommend paying more attention specifically to wave marking, since the news background has recently faded into the background.

Today, on Monday, the news background will be absent, which may lead to the completion of the rising wave. General conclusions and recommendations: The pound / dollar instrument supposedly completed the construction of the upward trend section.

Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of this area, its transformation into a 5-wave and become the basis for new purchases of the instrument. At the same time, the trend section after October 21 takes a horizontal view, which allows us to expect a decrease in the instrument to area of the 27th figure.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom