EUR / USD

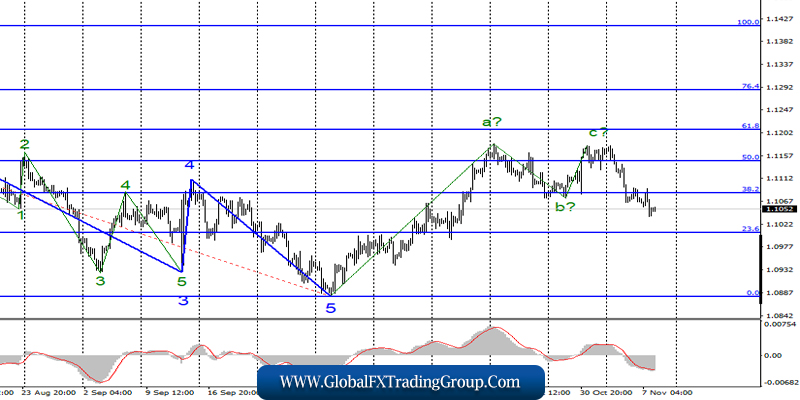

November 7 ended for the pair EUR / USD with a decrease of another 15 basis points. Thus, the alleged first wave of a new downward trend continues its construction.

A successful attempt to break through the minimum of the alleged wave b indicates the readiness of the markets for further sales of the euro.

Thus, if the current wave marking is correct, then the decrease in quotations will continue with targets located below the 10th figure.

Fundamental component:

On Thursday, the news background for the euro-dollar instrument remained extremely weak. All-day markets saw only the weakest report on industrial production in Germany (a decrease of 4.3% y / y) and the report on applications for unemployment benefits in the USA (211 thousand).

Both news had a very indirect effect on the movement of the euro-dollar pair. However, the downward momentum remained due to a strong decline in production in Germany, which almost automatically means that a similar European figure will decrease.

Also yesterday, the European Commission announced the lowering of a number of key forecasts for the European economy. The forecast for GDP for 2019 has been lowered to + 1.1% yoy, inflation is expected to reach + 1.2% yoy. In my opinion, these are very optimistic forecasts.

For example, the current inflation rate in the European Union is 0.7-0.8% y / y.

Purchase goals:

1.1208 – 61.8% Fibonacci

1.1286 – 76.4% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend correction section. Since the attempt to break through the minimum of wave b turned out to be successful,

I now recommend selling the instrument with targets under the 10th figure. The instrument probably moved on to building a bearish trend section.

GBP / USD

On November 7, the GBP / USD pair lost about 45 basis points, which is still fully consistent with the current wave marking, as well as implies a further decrease in the instrument within the framework of the expected wave c.

Moreover, wave marking after October 21 may transform into a downward trend section, and may take the form of 4 waves in the upward trend.

Given the weakness of lowering the instrument, so far there is reason to lean precisely toward the second option. If this is the case, then after the completion of wave c, the instrument will resume rising within the framework of impulse wave 5 with targets much higher than 30 of the figure.

Fundamental component:

The news background will provide assistance or hindrance in the implementation of the option with building wave 5 and increasing instrument quotes much higher than 30 figures.

Yesterday, for the first time in a long time, markets had the opportunity to study economic data from the UK. True, it was a meeting of the Bank of England, at which the key rate by majority vote remained unchanged – 0.75%.

However, if earlier all 9 committee members were in favor of maintaining the rate, that is, now there were only 7 of them, while two voted to lower the rate. For the pound, this is another alarm bell.

Although as we can see from yesterday’s trading, the markets still did not attach too much importance to such a vote on the members of the Bank of England board and are still waiting for the elections in Britain, their results and the end of the epic with Brexit.

Thus, while the pound has been granted a credit of confidence, which allows it not to fall down. But how long will the markets still lend and advance the pound currency markets?

If economic reports are weak, the demand for the pound will decline even more sooner or later. Then wave 4 may well transform into the first one as part of a new bearish section of the trend.

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, only a successful attempt to break the level of 1.2986 can be regarded as a complication of the upward trend section and become the basis for new purchases of the instrument.

Thus, now, I recommend looking towards the sales side after a successful attempt to break through the level of 1.2812 (100.0% Fibonacci) with targets located near the 76.4% Fibonacci level.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom