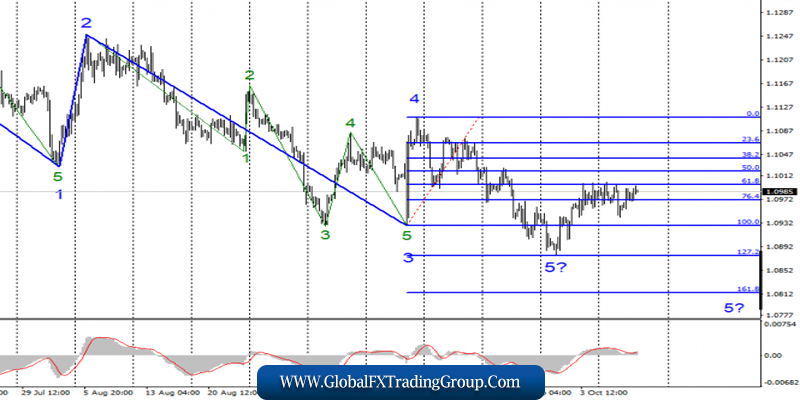

EUR / USD

Wednesday, October 9, ended for the EUR / USD pair with an increase of 15 basis points, and the instrument completed another Fibonacci level of 61.8% during the day.

Thus, today, the euro-dollar pair can make a new unsuccessful attempt to break through this level, which can still return the instrument to a downward channel. At the same time, a successful attempt to break through the 61.8% level will allow the instrument to continue building the first wave as part of a new upward trend section.

It is this option that remains working at the moment. The option with the complication of the downward trend section is the reserve one.

Fundamental component:

The news background for the euro / dollar pair still comes down only to the daily speeches of Fed President Jerome Powell. It’s better to say “it should have been reduced,” since the Fed Chairman has not reported anything important and useful to the markets through his 4 speeches.

There was only vague information regarding QE-4, as the Fed had already dubbed the desire to begin new purchases of securities on its balance sheet. However, Powell immediately explained that this was not a full-scale program of quantitative incentives, but only temporary measures.

Last night, nothing interesting came from Powell. Thus, the news background can be safely called neutral over the past 3 days, which explains the behavior of markets that continue to push around the levels of 61.8% and 76.4%.

Today, I recommend paying attention to the inflation report in America. According to forecasts, markets may see inflation accelerate to 1.8% in September, which may provide local support for the US currency.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair has allegedly completed the construction of a downward set of waves. At the same time, until a successful attempt to break through the Fibonacci level of 61.8%, certain chances remain to complicate wave 5 of the downward trend section with targets located around 1.0876 and 1.0814.

Therefore, with instrument purchases, I recommend being careful for now.

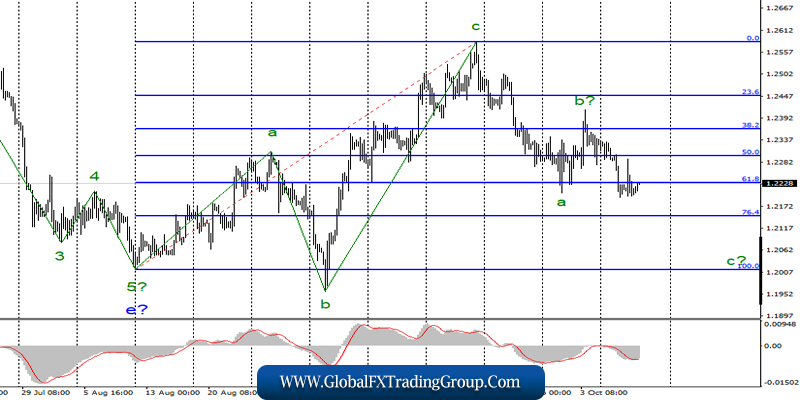

GBP / USD

On October 9, the GBP / USD pair lost 25 more base points and therefore, continued to build the wave c as part of the new bearish section of the trend, which is still interpreted as 3-wave.

If this is true, then the decline in quotations will continue with targets located much lower than 22 figures. At the same time, a successful attempt to break through the 61.8% Fibonacci level indirectly indicates the readiness of the market for further sales.

Fundamental component:

Today, It is proposed focusing on economic reports since no interesting events around Brexit are happening now. As I said, there will be a report on inflation in America today, and in the UK – reports on industrial production and GDP.

The GDP report is not quarterly, but monthly, for August. Thus, it should be understood whether there is any chance of an increase in the British currency today. Given the forecasts for the British reports – there are few chances.

GDP in August is expected to not increase, industrial production – with a decrease of almost 1% compared with August 2018. Thus, with a probability of 70-80%, the markets will again look downwards today. The general news background for the pound / dollar pair also suggests a further decrease, since the Brexit process is not moving forward.

The negotiations between the parties are in place and there is no consensus. There are also few prerequisites for the parties to come to an agreement in the coming days.

Sales goals:

1.2147 – 76.4% Fibonacci

1.2013 – 100.0% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly continues to build a new bearish trend section. Thus, now, I expect the continuation of the decline of the instrument in the direction of the levels 1.2147 and 1.2013, which corresponds to 76.4% and 100.0% Fibonacci in the construction of wave 3 or c.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom