EUR / USD

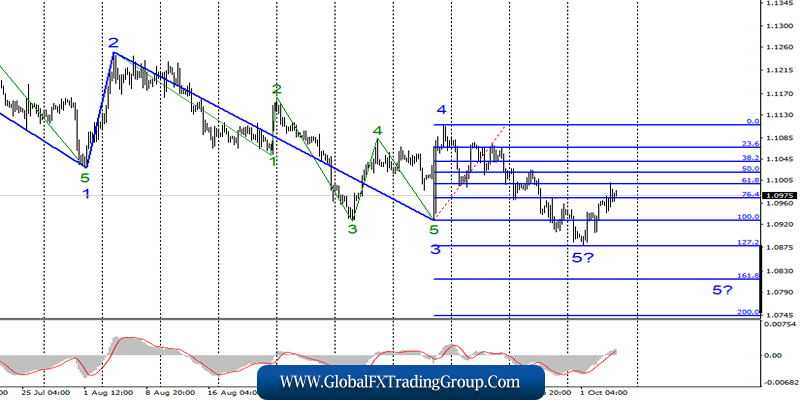

Thursday, October 3, ended for the pair EUR / USD with an increase of 5 basis points. The instrument also made a successful attempt to overcome the 76.4% Fibonacci level and an unsuccessful level of 61.8% Fibonacci.

Thus, the pair moves farther and farther away from the continuation of the construction of the bearish section of the trend, or rather its wave 5. A successful attempt to break through the 61.8% level will indicate the readiness of the markets to build an upward trend, although it is necessary that the news background also favors this scenario.

Fundamental component:

The Euro currency is in demand in the foreign exchange market in recent days, although the news background is far from always in its favor. Nevertheless, there is an increase in the EU currency and now, the question is about building a full-fledged upward trend section. On Friday, October 4, all the most interesting economic reports will come from America.

There will be Nonfarm Payrolls, a report on the change in average wages in September, and Fed Chairman Jerome Powell will speak late at night. I think that Powell’s performance is the most important. With economic reports, everything is more or less clear.

If their values are better than market expectations, the demand for the dollar will be high in the afternoon, if worse, then low and this will significantly increase the chances of building an upward wave, originating on October 1.

However, with Powell’s performance, it’s much more complicated as the economic performance of the United States continues to deteriorate, since Donald Trump continues to put pressure on the Fed so that the regulator lowers rates as soon as possible, and markets are increasingly convinced that in October (October 29-30) the Fed will lower its key rate again, in the third once in a row.

Thus, today, we will be waiting for hints from Powell about a possible Fed decision in October.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a downward set of waves. I still expect the pair to decline again with targets located near the calculated levels of 1.0876 and 1.0814, which equates to 127.2% and 161.8% Fibonacci, within the framework of wave 5 to 5.

I recommend selling the instrument according to the MACD signal “down”. However, a successful attempt to break through the level of 61.8% may change the current wave pattern.

GBP / USD

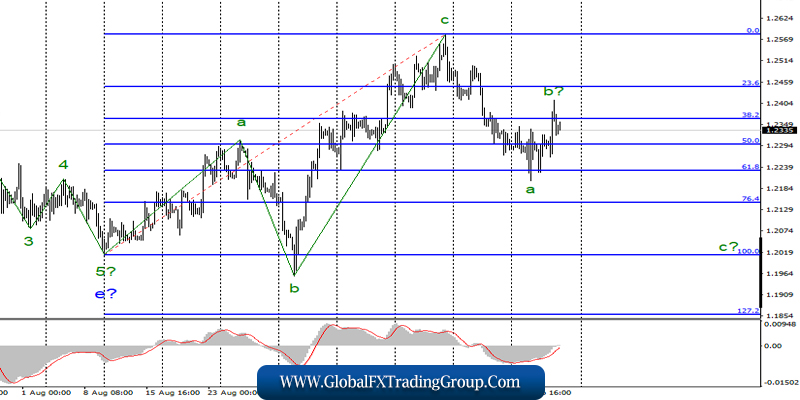

On October 3, the GBP / USD pair continued to build the proposed wave b as part of the new bearish trend section and gained about 30 base points. If the current wave count is correct, then the instrument should go to the construction of the descending wave with the goals, placed under 22 the figure today.

In order for this option to be executed, you need support for the news background, which in general, has recently been more neutral than negative for the pound-dollar pair. However, building a wave of c today requires economic reports from the United States to be weak, and Powell’s evening speech filled with hints of easing monetary policy at the next meeting.

Fundamental component:

Yesterday, the index of business activity in the UK services sector “went under water”, falling to 49.5. Thus, the news background specifically from the UK does not support the pound. Also, information was received that the EU government did not at all arrange Boris Johnson’s proposal for a deal on Brexit. It was rejected, but it seems that the European Union is still open to further negotiations.

Time is running out and, most likely, the parties will not have time to agree on an agreement. Thus, Brexit will either be rescheduled (a positive factor for the pound), or Britain will leave the EU in a tough scenario (negative factor). Today, economic reports from the USA will come first in importance.

Sales goals:

1.2229 – 61.8% Fibonacci

1.2147 – 76.4% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly continues to build a new bearish trend section. Thus, now, I expect the completion of the construction of the correctional wave b, which could have completed near the 38.2% Fibonacci level, and the continuation of the decline of the instrument in the direction of the levels of 61.8% and 76.4% Fibonacci as part of the construction of wave 3 or c.

The MACD signal “down”, in turn, may indicate the construction of a new bearish wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom