EUR / USD

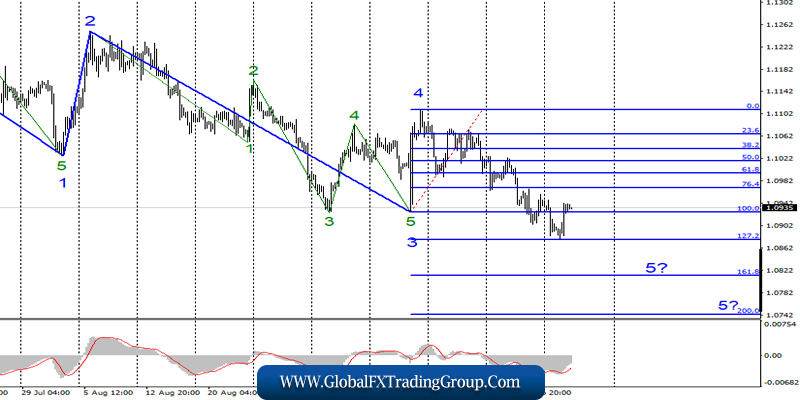

Tuesday, October 1, ended for the EUR / USD pair with an increase of 35 basis points. An unsuccessful attempt to break through the 127.2% Fibonacci level, as I expected yesterday, led the pair quotes to move away from the lows reached.

However, the current wave marking has not undergone any changes. It is still expected to build a bearish wave 5 as part of the downward trend section. If this assumption is correct, then the instrument will resume decline today or tomorrow.

Fundamental component:

A rather large number of interesting economic reports came out yesterday.

However, we will not dwell on each of them in detail, we list only the “bare” numbers. Indices of business activity in the manufacturing sectors of Germany and the European Union amounted to 41.7 and 45.7, respectively.

Inflation in the European Union declined to 0.9% in September, while business activity indices in US manufacturing were 51.1 and 47.8. With that, it was the latest index with a value of 47.8 (PMI ISM) that probably upset the markets the most. Otherwise, it is impossible to explain the rise of the euro and the pound in the afternoon.

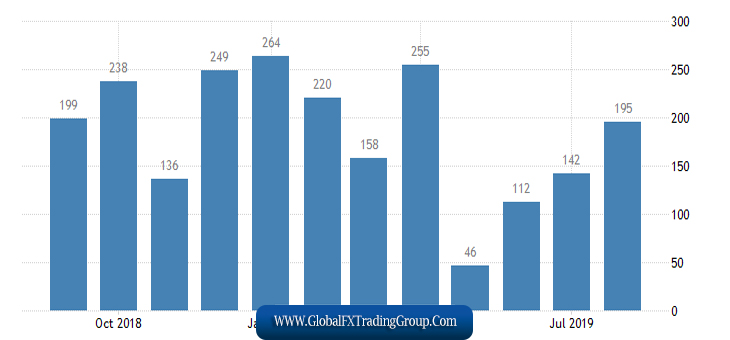

Today, in America, there will be a report from ADP on the change in the number of employees in the private sector, which involves the creation of 140,000 new jobs.

As you can see from the illustration, this value will be lower than the previous month, which will be very difficult to exceed. But in any case, the markets will be primarily interested in matching the real value and from their own expectations.

Thus, in order for the bears to actively sell the instrument again today, it is necessary for the ADP report to show more jobs than 140,000.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

Today, the euro-dollar pair continues to build a downward set of waves. I expect the continuation of the decline in the pair with targets located near the calculated levels of 1.0876 and 1.0814, which equates to 127.2% and 161.8% Fibonacci. In addition, I recommend selling the instrument by the MACD signal “down”.

GBP / USD

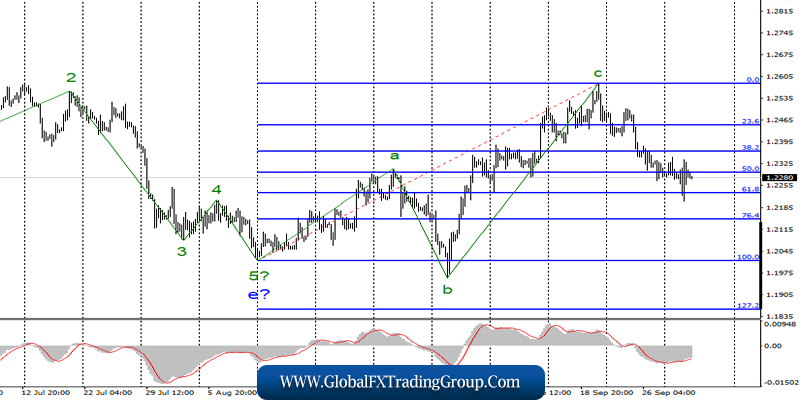

On October 1, the GBP / USD pair added a few more basic points, although it made impressive jumps both up and down during the day.

Meanwhile, the unsuccessful attempt to break through the 61.8% Fibonacci level, as well as weak economic data from America, led to the departure of quotes from the lows reached and the construction of an internal correctional wave as part of the proposed 1 new downward trend section.

If this assumption is true, then the forecast is the same as for the EUR / USD pair – continuation of decline. Fundamental component: Yesterday, the British PMI for manufacturing showed a positive trend, increasing from 47.7 to 48.3. However, this is still not enough to state an improvement in the state of the entire industry.

Today, I expect from Britain an index of business activity in the construction sector, which may be even more important than in the manufacturing sector. Despite that, the forecasts here are much lower – 45.0, which indicates an even more depressing state of this industry.

On Brexit’s topic, only one thing can be said now: It is tightly stuck at the “dead center”. Thus, Boris Johnson is trying to find an alternative to “backstop”, and MPs are thinking when it is better to pass a vote of no confidence in Johnson, while the European Union is waiting for proposals from London under the agreement on Brexit.

Sales goals:

1.2229 – 61.8% Fibonacci

1.2147 – 76.4% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly continues to build a bearish trend section. Thus, now, I expect the continuation of the decline of the instrument in the direction of the levels of 61.8% and 76.4% Fibonacci as part of the construction of the first wave. The MACD signal “down” may indicate the construction of a new bearish wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom