EUR / USD

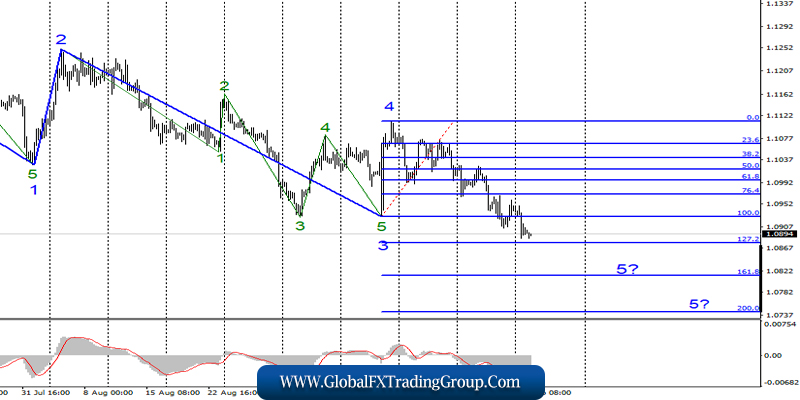

Monday, September 30, ended for the pair EUR / USD with a decrease of 40 basis points. Thus, the construction of the alleged wave 5 of the downward trend section continues with targets located near the 8th figure.

As before, the future of the pair depends on the news background, which has not changed at all in the last days and weeks. An unsuccessful attempt to break through the 127.2% level may lead to quotes moving away from the minimums reached.

Fundamental component:

Yesterday was another disappointment for the currency of the European Union. Economic reports from Germany and the EU have been largely disappointing. For example, retail sales and consumer price index in Germany were much lower than market expectations.

The unemployment rate in the European Union also declined to 7.4%, while in Germany, it remained at 5.0%. However, the first two reports were enough for the markets to start selling the instrument again. Today, new reports will be released in Germany, the European Union and America.

All of them will concern business activity in the manufacturing sector, and another report on inflation for September will be published in the EU.

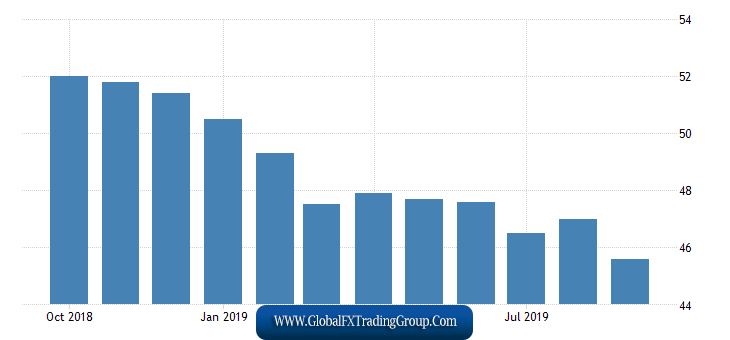

One of the most interesting reports is business activity in the EU manufacturing sector. Over the past 8 months, activity has been at very low levels, which does not add optimism to markets. It is hardly worth expecting that the situation will change for the better today.

The same goes for inflation in the European Union. The last two reports recorded 1.0% inflation. In September, according to various forecasts, inflation may range from 0.9% to 1.0%, that is, in the best case, remain unchanged, and in the worst – even lower.

Thus, I look forward to a new decline of the Euro currency today.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a downward set of waves. I expect the pair to continue to decline with targets located near the calculated levels of 1.0876 and 1.0814, which equates to 127.2% and 161.8% Fibonacci. Wave 5, in turn, can turn out to be both very long and shortened.

GBP / USD

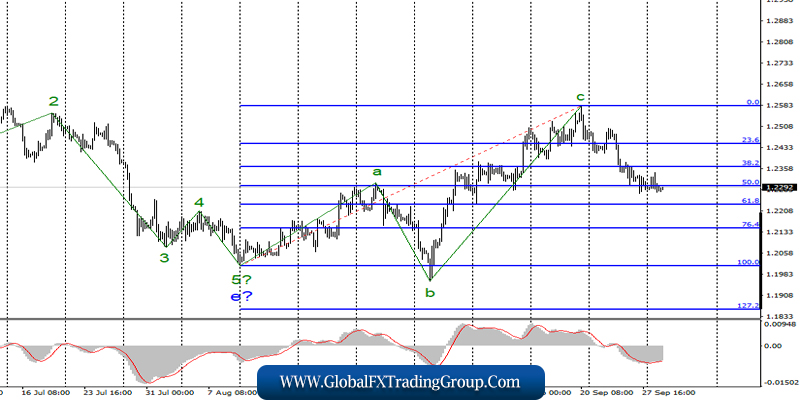

GBP / USD pair added several basic points on September 30, which does not affect the current wave counting, and which still involves the construction of a new bearish set of waves, after the completion of the 3-wave ascending structure.

Yesterday, the report on GDP for the second quarter of the UK saved the pound-dollar instrument from a new decline, but there is a suspicion that it will not be for long. Today, I expect a decline to around 1.2232.

Fundamental component:

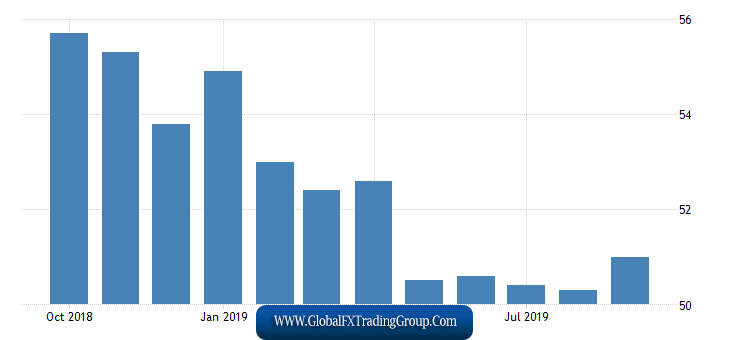

Today, In the UK, a report on business activity in the manufacturing sector will also be released.

It, as well as European and German indices, does not bode well. Over the past 4 months, business activity has been in the “under 50” area, which indicates a slowdown.

Today, markets are waiting for the index to fall to 46.5 – 47.0.

The last to come out is the business activity index in the USA with a forecast of 51.0, which in August showed its intention to move away from the dangerous area “below 50” and

ISM business activity index, which just fell below 50 in August. In the case of American business activity indices, things are not so clear, as the fluctuation of these indicators can send them above 50 and below 50, which will be very important from the point of view definitions, recession or growth which is now present in the US manufacturing sector.

Sales goals:

1.2229 – 61.8% Fibonacci

1.2147 – 76.4% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The upward trend section supposedly completed its construction. Thus, now, I expect a decline in the instrument in the direction of the levels of 61.8% and 76.4% Fibonacci as part of the construction of the first wave. The news background suggests a continued decline in the instrument. Questions are available only to reports from America.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom