EUR / USD

Tuesday, September 17, ended for the EUR / USD pair with an increase of 75 basis points. Thus, yesterday’s loss of the euro was completely won back by the market. The current wave marking suggests a continuation of the euro-dollar instrument increase, as the expected wave 2 or b as part of the future upward trend section has completed its construction near the 23.6% Fibonacci level.

Thus, today, I expect the construction of wave 3 or with targets located above the 11th figure. Fundamental component: The unsuccessful attempt to break through the 23.6% Fibonacci level proved to be an excellent tool for resuming the increase in the euro-dollar pair.

Although, the US currency did not help even a relatively favorable news background on Tuesday. Industrial production in August rose immediately by 0.6% mom, while markets expected growth not more than 0.2% mom. However, the focus of the markets remains the Fed meeting and the FOMC decision on the interest rate.

It is the expectations of “dovish” actions from the regulator that pushes the pair up, and the US dollar down on Wednesday, September 18. In addition to the evening meeting of the American regulator, an inflation report for August will be released today in the eurozone.

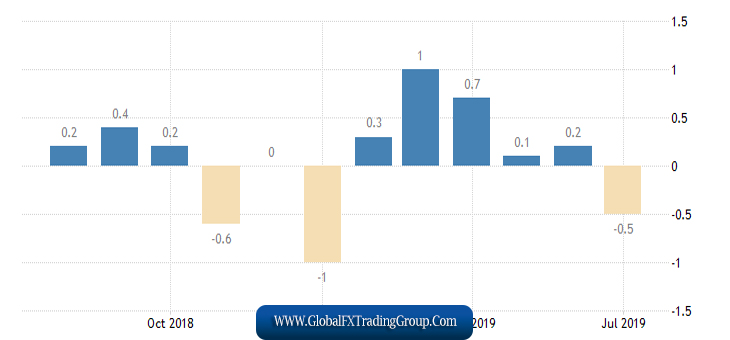

The latest inflation rates in the EU leave much to be desired – only 1% y / y, and the forecast for today’s report is the same – 1%.

On a monthly basis, everything is a little better. After a failed inflation in July, an increase of 0.2% is expected in August. However, the markets will pay more attention to annual indicators.

But since markets are waiting with great interest for evening events in the Fed, the reaction to inflation in the European Union may be weak.

Purchase goals:

1.1128 – 61.8% Fibonacci

1.1175 – 76.4% Fibonacci

Sales goals:

1.0927 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of a bearish wave 3 or C, as well as wave 2 or b as part of a new trend section, which originates on September 12 (presumably). If this is true, then the pair expects resumption of increase. I recommend buying a pair with targets near the calculated levels of 1.1128 and 1.1175. Today, I expect the construction of the third upward wave.

GBP / USD

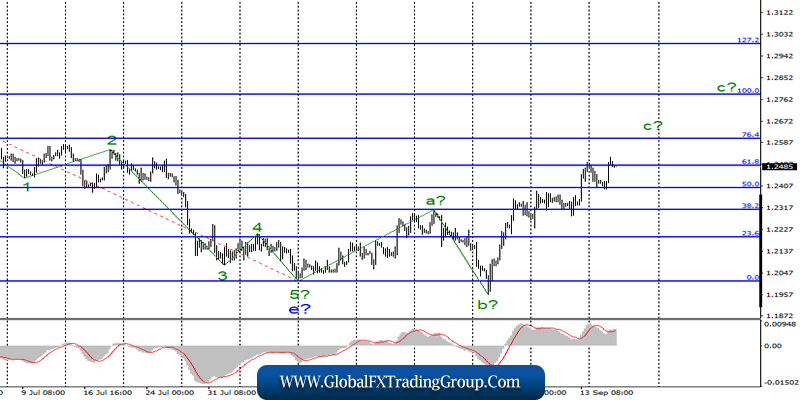

On September 17, the GBP / USD pair gained 70 base points and eliminated all losses of the past day. A successful attempt was also made to break through the previous local maximum, so the alleged wave c continues to build and becomes more complicated.

For the pound, which has long been out of favor with the foreign exchange market, this is great news. As for the news background for the pound-dollar, nothing happened in the UK yesterday. Proceedings are ongoing regarding the sending of Parliament on leave for 5 weeks, which was provoked by Prime Minister Johnson and approved by the Queen of Great Britain.

Deputies believe that Johnson did not act within the law. Thus, now, the Supreme Court has to resolve this disagreement, which still did not allow Johnson to implement his plan – and leave the EU without interference from Parliament.

Fundamental component:

On Wednesday, September 18, the GBP / USD pair may continue to build the bullish wave c, but this will depend on two factors.

The first is inflation in the UK, which threatens to slow down below 2.0%, which many central banks set as a target level for inflation. The second is the Fed meeting and a possible reduction in the key rate.

The first factor may not attract the attention of the markets, since a more important event – the Fed meeting – can simply overshadow it. In addition, inflation in Britain may not slow down as much as markets expect it to.

Although the second factor, of course, will affect the mood of the markets today and tomorrow, since the results of the Fed meeting will be known only late in the evening. The effect of it can last all night and all morning.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2489 – 61.8% Fibonacci

1.2602 – 76.4% Fibonacci

General conclusions and recommendations:

The upward trend section continues its construction. Thus, quotes are now expected to increase with targets located near the estimated levels of 1.2489 and 1.2602, which corresponds to 61.8% and 76.4% Fibonacci. Wave c can still complete its construction in the near future, even today, if the news background contributes to this.

Thus, I recommend buying a pair in case of a successful attempt to break through the 61.8% Fibonacci level, which is not yet available.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom