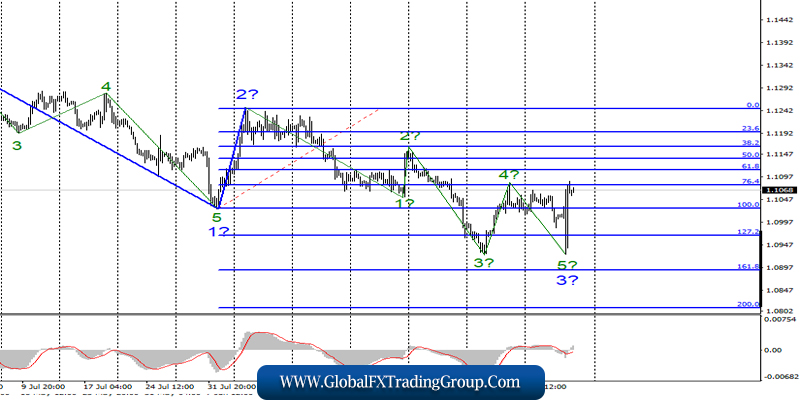

EUR / USD

Thursday, September 12, ended for the EUR / USD pair with an increase of 55 basis points, despite the fact that the quotes decreased to the minimum of the expected wave 3, 3. Thus, the wave 5 in 3 during the day, although it turned out to be somewhat shortened, but it can be considered complete, as well as the whole wave 3.

However, the questions remain: on a global level (waves 1-2-3) are part of the 5-wave structure, or is it another abc formation? In the second case, the construction of the bearish section of the trend is completed, and now, we are expected to build at least three waves up with the prospect of leaving much higher than the level of 1.1250.

Thus, the readiness of the euro-dollar pair to further decline can now be determined only by a successful attempt to break through the lows of waves 3 and 5. Fundamental component: On the EUR / USD instrument, all the most interesting news yesterday concerned the ECB meeting and the debriefing of this meeting.

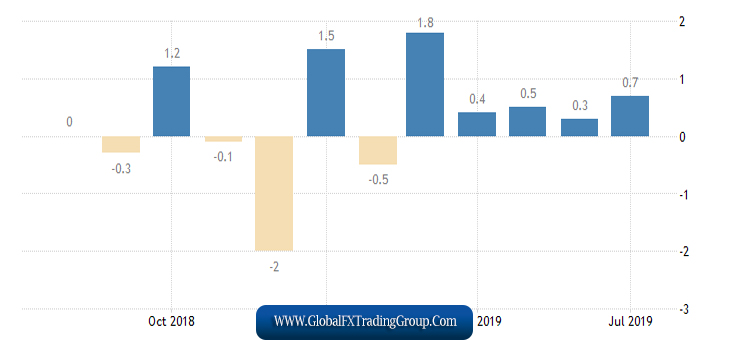

As markets expected, Mario Draghi lowered the deposit rate to -0.50% and announced the launch of a new asset repurchase program worth € 20 billion per month. This program will begin in November 2019. It seems to be nothing surprising and the markets began to get rid of the euro in accordance with the plan.

However, upon reaching the minimum of wave 3 in 3, there was a sharp upward turn and no less strong growth of the European currency. What could have caused this? Possibly, pending orders for the purchase of large volumes, for example, large players who were located near the level of 1.0926. Perhaps, traders in any case did not expect the pair to fall below this level and began to take profits around it.

Also, maybe inflation in the USA, which fell in August to 1.7% yoy, dramatically changed the mood of the foreign exchange market. And most likely, all three factors played simultaneously.

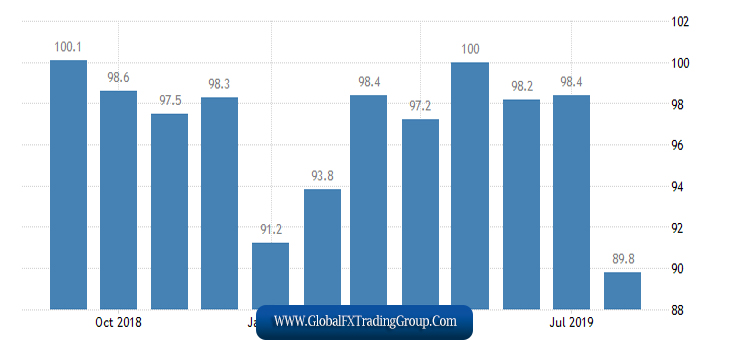

Today, I draw attention to only one economic report, which will be released in the afternoon in the USA.

And on one index, the University of Michigan Consumer Confidence Index.

Retail sales in America should grow by 0.3% in August, and the consumer confidence index may increase slightly after falling by almost 10 points and reach 90.9.

Purchase goals:

1.1248 – 0.0% Fibonacci

Sales goals:

1.0893 – 161.8% Fibonacci

1.0807 – 200.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair supposedly completed the construction of the bearish wave 3. If this is true, the pair expects the construction of an upward set of waves. I recommend buying a pair with targets located about 12 figures, but so far in small volumes.

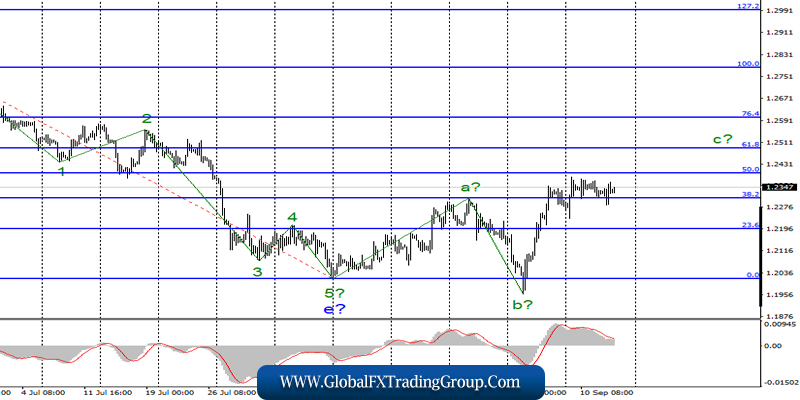

GBP / USD

On September 12, the pair GBP / USD gained just a few basic points, and the overall market activity tended to zero. It is not surprising, since all the main attention of the Forex market was paid to a couple of euro-dollars, which had a very strong news background yesterday.

The pound-dollar pair remains within the framework of constructing the proposed wave with the composition of the correction section of the trend. Wave c may already be completed, since it has gone beyond the maximum of wave a. However, it can also take a much more extended and complex form. Thus, everything will depend on the news background.

Fundamental component: On Friday, the news background for the GBP / USD pair will not be strong. Two US reports may force markets to trade the pair more actively, but if their values are neutral, then activity will remain at the same level. In addition, markets are clearly more interested in Brexit’s hot issue, rather than economic reports from America, although Brexit-related news is not much.

Boris Johnson defends Jeremy Corbyn from the opposition, but parliament is likely to regain its right to return to work through the courts. Moreover, the European Union is likely to provide a respite for Brexit. Thus, Johnson’s plans are crumbling one by one.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2401 – 50.0% Fibonacci

1.2489 – 61.8% Fibonacci

General conclusions and recommendations:

The downward trend section is still considered completed. Thus, now, it is expected to continue the construction of the rising wave with targets located near the calculated levels of 1.2401 and 1.2489, which corresponds to 50.0% and 61.8% Fibonacci. I recommend buying pounds in small lots, as the wave of c may be completed in the near future.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom