EUR / USD

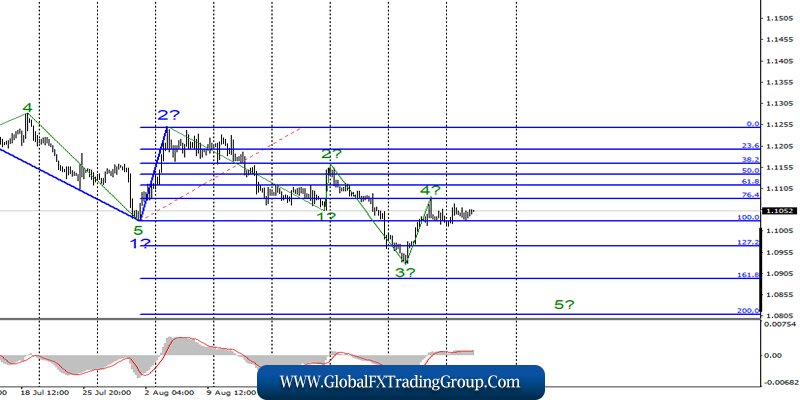

Tuesday, September 10, ended for the pair EUR / USD with a decrease of 5 basis points. Thus, the current wave marking has not undergone any changes and still involves the construction of a bearish wave of 5 to 3 with targets located under figure 9. A successful attempt to break through the maximum of the proposed wave 4, 3 will indicate the readiness of the markets for the purchase of the euro and will require adjustments to the current wave marking. Fundamental component:

The EUR / USD instrument is still calm. Markets are still waiting for the results of the meeting of the European Central Bank, but there are simply no other news and economic reports. Thus, there is nothing left to do but wait for tomorrow and guess what actions the ECB will take and what exactly Mario Draghi will say at the press conference.

Today, I also do not expect any interesting news in the USA and Europe. You can only depend on Donald Trump or any of the representatives of the European Parliament or the European Commission, if an unexpected speech or message is made that is significant for the foreign exchange market. However, the probability of this is no more than 5%.

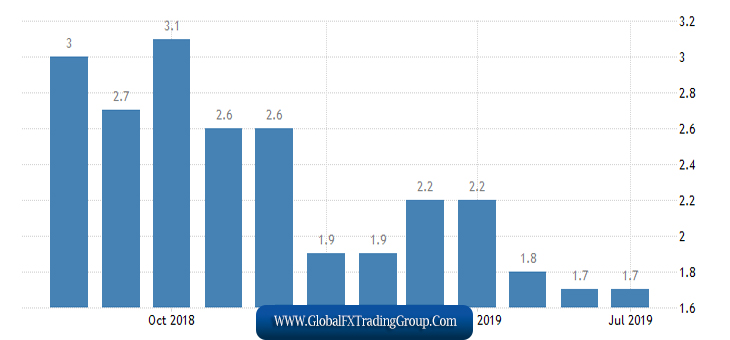

You can pay attention to the producer price index, which can tell what to expect from the US inflation report tomorrow, although the report itself is not of particular value to the markets.

The producer price trend is clearly visible, as seen in the chart, the price growth rate is declining. This is exactly what you can expect tomorrow from inflation in the USA: a slowdown or lack of change.

Purchase goals:

1.1248 – 0.0% Fibonacci

Sales goals:

1.0893 – 161.8% Fibonacci

1.0807 – 200.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build the bearish wave 3 and supposedly completed the construction of the internal correctional wave 4 near the level of 1.1081. I recommend selling a pair with targets near the calculated levels of 1.0893 and 1.0807, which corresponds to 161.8% and 200.0% Fibonacci, on the new MACD signal “down” in the calculation of the construction of wave 5, 3.

GBP / USD

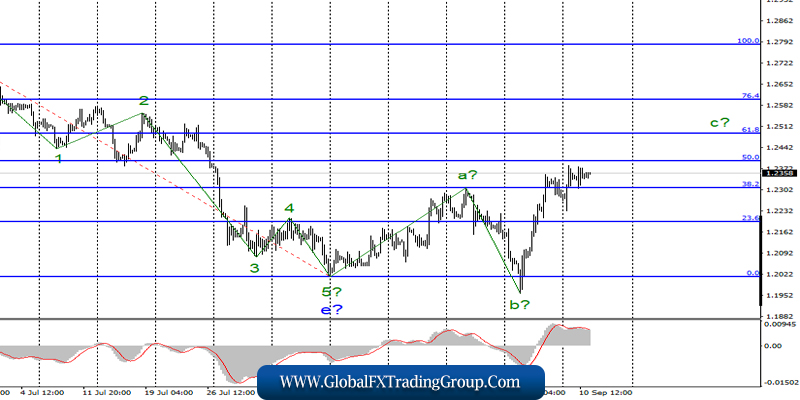

The pair GBP / USD did not lose or gain a single point on September 10. Thus, there is no reason to assume the completion of the construction of the upward wave, which is now interpreted as with the composition of the correctional wave set.

Moreover, the growth of the pound quotes may continue in the coming days, especially if tomorrow the inflation report in America turns out to be worse than the Forex market expected. Yesterday, the pound-dollar pair was in demand, as the level of wages in the UK increased by 4% instead of the expected markets of 3.7%, and the unemployment rate fell to 3.8%, which the markets did not expect.

An unsuccessful attempt to break through the 50.0% or 61.8% Fibonacci levels may lead to the completion of the upward wave. Fundamental component: For the pound, there are times when everything will depend on Boris Johnson. I remind you that the British Parliament was sent on forced leave yesterday, and although the deputies are unlikely to spend the next 5 weeks on vacation, nevertheless, working sessions will not be held, as well as the voting.

The resolution of all pressing issues has been postponed. However, Boris Johnson, who needs to solve a complex puzzle called “How to get around the law prohibiting Brexit”, will work in a sweat. Johnson already has several ways to implement this plan, but there are serious questions about how to implement it. After all, MPs will closely monitor Johnson’s actions or the absence thereof. If you have questions to him or if you suspect that the will of the parliament has not been fulfilled.

There is no doubt that all courts will be inundated with lawsuits against the prime minister. Thus, the actions of Boris Johnson will be under the microscope in the coming weeks.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2401 – 50.0% Fibonacci

1.2489 – 61.8% Fibonacci

General conclusions and recommendations:

The downward trend section is still considered completed. Thus, now, it is expected to continue the construction of the ascending wave with targets located near the calculated levels of 1.2401 and 1.2489, which corresponds to 50.0% and 61.8% Fibonacci. I recommend buying pounds in small lots, as the wave of c may be completed in the near future.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom